Guide to Creating a 1099 Pay Stub

And Why You Won't Use a 1099-MISC in 2020-----------------------------------------As a small business owner, it’s not uncommon to hire out work to a third pa...

Apr 17, 2020When it comes to payroll management, accuracy is paramount. However, even with meticulous attention to detail, errors can occur. One such issue is when an ‘employee paid correctly but pay stub shows incorrect pay period'.

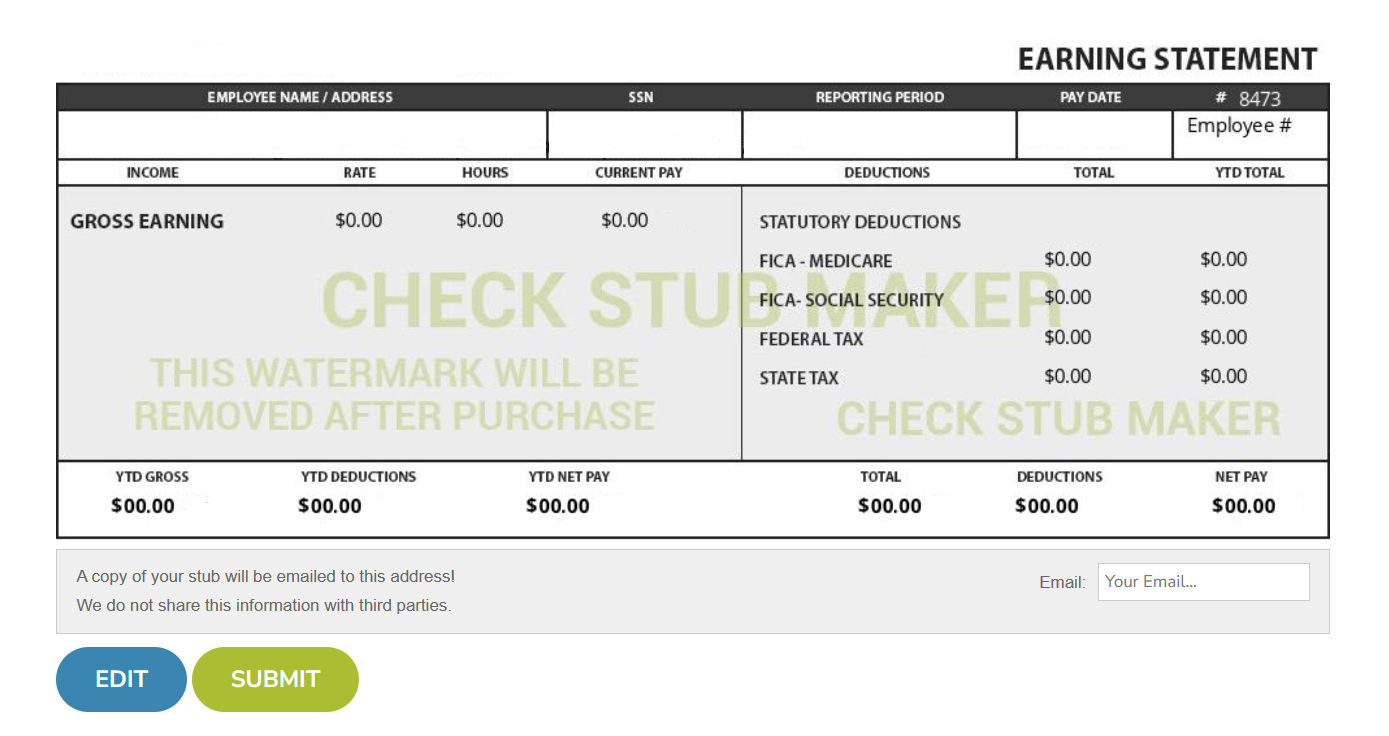

When it comes to payroll management, accuracy is paramount. However, even with meticulous attention to detail, errors can occur. One such issue is when an ‘employee paid correctly but pay stub shows incorrect pay period'. This article delves into the implications of such discrepancies when your pay stub is wrong and how they can be effectively addressed with our robust paystub generator at Check Stub Maker so you can avoid and rectify these errors. Let's dive in! What this article covers:

Here are 10 common errors that can occur on your pay stubs.

Incorrect personal information on a pay stub can lead to significant problems, including tax issues and complications with employment records. It's crucial to ensure that details like your name, address, and Social Security number are accurate. Any discrepancies should be promptly reported for correction.

For hourly employees, it's vital to verify that your pay stub accurately reflects the number of hours you worked. Our research indicates that these discrepancies can affect the final pay, potentially leading to significant wage losses over time.

Errors in calculating your base pay can occur, especially if there are changes to your wage or salary rate. Ensure the pay rate and your total earnings align with your work contract or agreement to avoid substantial financial loss. At Check Stub Maker, our pay stub generator is quick and easy to use. Our team discovered through using this product that it helps you calculate and review your pay stubs as often as you want to avoid clerical errors.

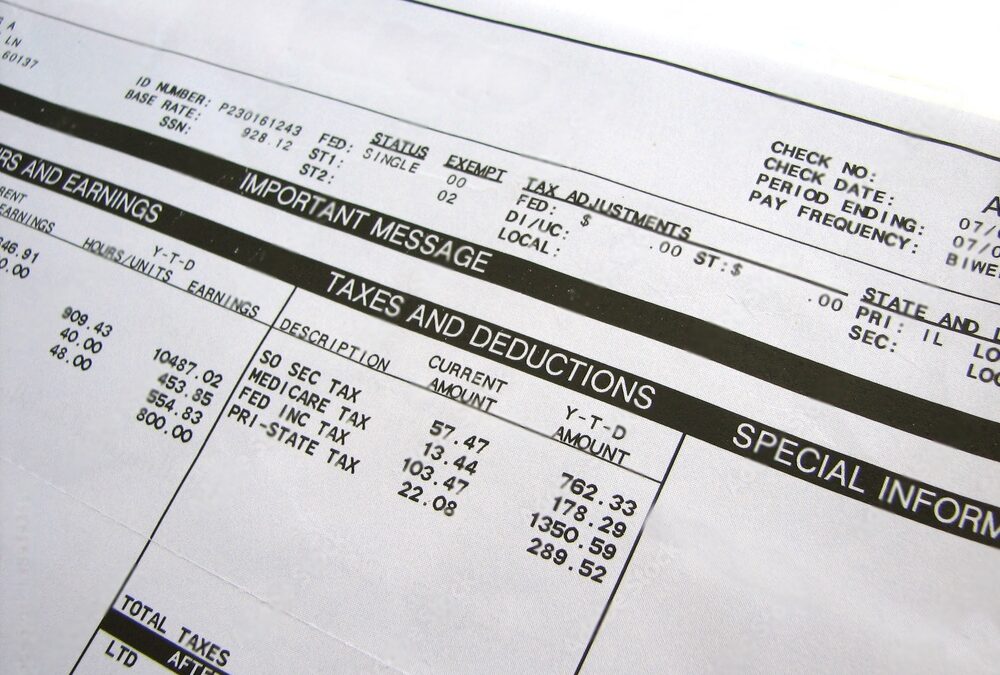

Deductions for taxes, retirement contributions, insurance premiums, and other employee benefits must be accurately reflected on the pay stub. Errors in deductions can significantly impact net pay and tax obligations.

For roles where income significantly comes from bonuses or commissions, it's essential to ensure these are correctly included on the pay stub. Omissions can lead to discrepancies between expected income and the amount received.

Non-exempt employees are entitled to overtime pay at a rate not less than one and a half times their regular pay rates for hours worked beyond 40 in a workweek. Our findings show that miscalculations or omissions in calculating overtime and how many weeks after work paystub pay can result in significant wage losses and legal issues.

Benefits or allowances, such as health insurance, retirement contributions, and travel allowances, must be accurately recorded and calculated. Errors can lead to discrepancies in your net pay and overall compensation.

The pay period dates must be consistent and accurately stated on the pay stub. Inconsistencies can cause confusion and potential errors in pay calculations.

YTD totals show cumulative earnings and deductions since the beginning of the calendar year. Inaccuracies in these totals can lead to tax complications and the misrepresentation of income.

Any unexplained discrepancies on a pay stub, such as sudden changes in net pay without corresponding shifts in gross pay or deductions, should be investigated promptly. These could signal calculation errors, system glitches, or even fraudulent activities where ‘ company won't give me pay stubs '. By being vigilant about these common errors and utilizing reliable tools like our pay stub creator at Check Stub Maker, you can maintain financial health and compliance in your payroll processes.

Missing or incorrect bonuses or commissions on pay stubs are common errors that can significantly impact an employee's total earnings. Based on our observations, these errors often stem from:

In roles where a substantial part of income comes from bonuses or commissions, any oversight in including these amounts can lead to significant discrepancies between the expected income and the amount received. At Check Stub Maker, we understand these complexities and have designed our paystub maker in a way which accurately reflects all forms of compensation received by you.

Based on our first hand experience, payroll errors, such as incorrect pay period dates, can have far-reaching effects on employees. They can lead to financial stress due to underpayment, affect the accuracy of tax calculations, and cause confusion regarding earnings and deductions. In severe cases, these errors can even lead to legal disputes or issues with employment benefits. We recommend that employers address these errors promptly to maintain trust and ensure financial stability for their employees.

If an employer refuses to immediately correct a payroll error, employees have several options:

It's important for employees to understand their rights and the appropriate channels for addressing payroll discrepancies.

There are a number of ways in which you can improve your payroll process by avoiding and reducing pay stub errors.

Creating and enforcing clear payroll policies is essential for minimizing errors. Through our practical knowledge of payroll processes, these policies should outline the process for:

Clear policies help ensure consistency and transparency in payroll processing.

Regularly assessing your payroll provider and processes is key to identifying potential issues. Evaluate whether your current system effectively meets your payroll needs, and consider upgrading or changing providers if necessary. That's why we offer a reliable and efficient pay stub generator that can streamline your payroll process.

Automation and integration of payroll processes can significantly reduce the likelihood of errors. We recommend using software that integrates:

After putting it to the test, our pay stub creator at Check Stub Maker is designed to automate and integrate seamlessly with your existing payroll systems, thereby simplifying the process and ensuring accuracy.

A detailed payroll calendar and checklist can help you stay organized and ensure all payroll tasks are completed on time. This includes setting reminders for pay periods, tax filings, and other important deadlines.

Our investigation demonstrated staying informed about the latest payroll regulations and employee pay stub laws is crucial for compliance. At Check Stub Maker, we regularly update our payroll practices to reflect any changes in labor laws, tax rates, and other relevant regulations to help you avoid legal issues and penalties, particularly during tax season.

Understanding what happens if an employee is paid correctly but the pay stub shows an incorrect pay period is crucial for both employers and employees. At Check Stub Maker, we help you avoid these and other payroll errors to gives you peace of mind in your payroll process every step of the way. So, what are you waiting for? Try our comprehensive paystub generator at Check Stub Maker now and experience the ease and reliability of managing your payroll quickly and efficiently. If you want to learn more, why not check out these articles below:

And Why You Won't Use a 1099-MISC in 2020-----------------------------------------As a small business owner, it’s not uncommon to hire out work to a third pa...

Apr 17, 2020

As more companies turn to digital solutions to streamline their processes, learning ‘how to create pay stubs for my business’ is extremely relevant in the fa...

Feb 23, 2023

How To Generate a Paystub in Minutes in Just 4 Easy Steps...

Dec 15, 2022