Facing the ‘how can employee correct the pay stub if the employer ran it wrong' conundrum can be a major headache. As a reliable and user-friendly payroll service, we at Check Stub Maker aim to provide clear guidance and solutions for both employers and employees facing these particular payroll inaccuracies with an incorrect pay stub . In this article, we'll explore effective ways to reverse digital transactions and adjust pertinent information in your payrolls that have already been processed using our user-friendly paystub generator . Let's jump in! What this article covers:

Adjusting a Payroll That You've Already Run

In this section, we'll discuss how to adjust your payroll process, even after already running it through your digital system.

Can I View Employee Or Contractor Pay Stubs?

Yes, if employees are not receiving pay stubs , employers can view and rectify employee pay stubs if errors are detected. In the case of contractors, they typically don't receive pay stubs from their employers, but they can create pay stubs and view them on platforms like ours at Check Stub Maker. This flexibility is crucial for employers, employees, and contractors to correct mistakes such as overpayment, underpayment, or incorrect deductions. Employers need to act promptly upon noticing an error to minimize any impact on the employee. It's equally important for employees to be vigilant and notify their employers as soon as possible about potential errors on their pay stubs.

Can I Change My Pay Date?

Changing the pay date can be a necessary step if a payroll error is identified, like when a pay stub pay period is not right. As per our payroll expertise, employers have the option to update the pay date on our check stubs , which can be particularly useful if the original date was set incorrectly. This adjustment ensures that employees receive their paychecks on the correct date, reflecting any changes or corrections made to the payroll process.

How Can I Stop An Upcoming Direct Deposit Paycheck?

In some cases, stopping an upcoming direct deposit is necessary to correct a payroll error. Based on our first-hand experience with pay stubs, employers can stop a direct deposit before it's processed. This action is essential when a significant error is identified after the payroll is run but before the funds are transferred into an employee's account. By halting the direct deposit, employers can prevent incorrect payments from reaching employees, allowing for the necessary adjustments to be made.

Can I Update My Taxpayer Address Or Business Phone Number In Check Stub Maker?

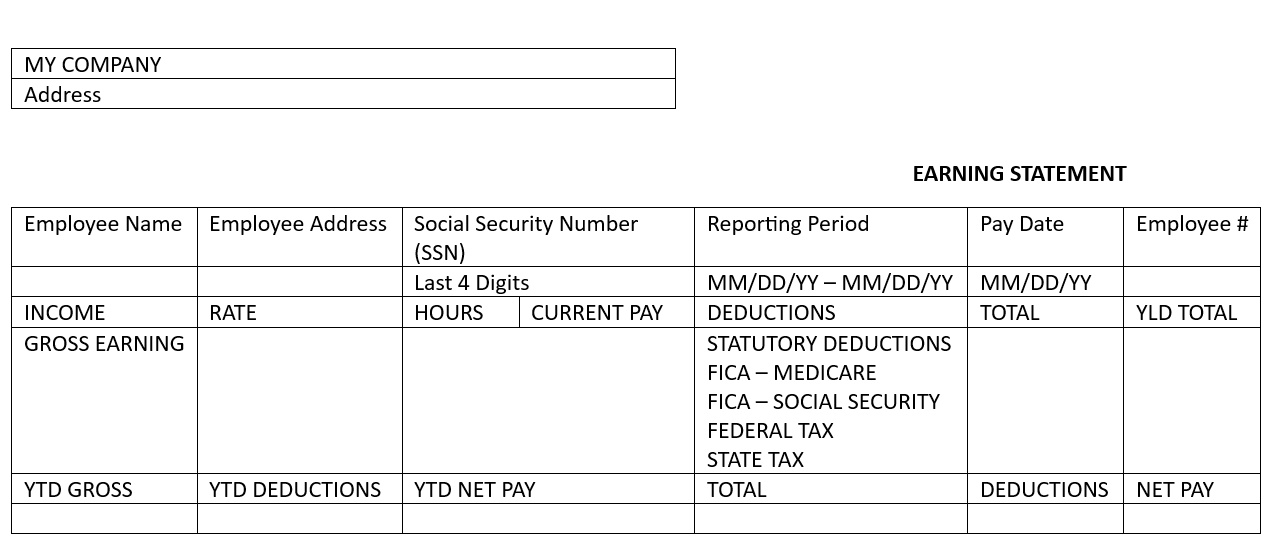

Updating your taxpayer address or business phone number can be easily done with Check Stub Maker's digital paystub maker , ensuring that all employee and contractor records are current and accurate. Here's how to do it:

- After you create paystub , click ‘Preview' at the bottom of your screen.

- Click ‘Edit' to update your taxpayer address or business phone number.

- Enter your email address and click ‘Submit' when you are happy with your updates.

- We will send you your updated pay stub with the correct payroll information for your personal recordkeeping purposes.

Our convenient approach to the updating process ensures that both employers and employees can manage payroll efficiently on a regular basis.

How to Avoid Common Payroll Errors

Now that you know how to run a payroll process again, here's how you can avoid common payroll errors in the long run.

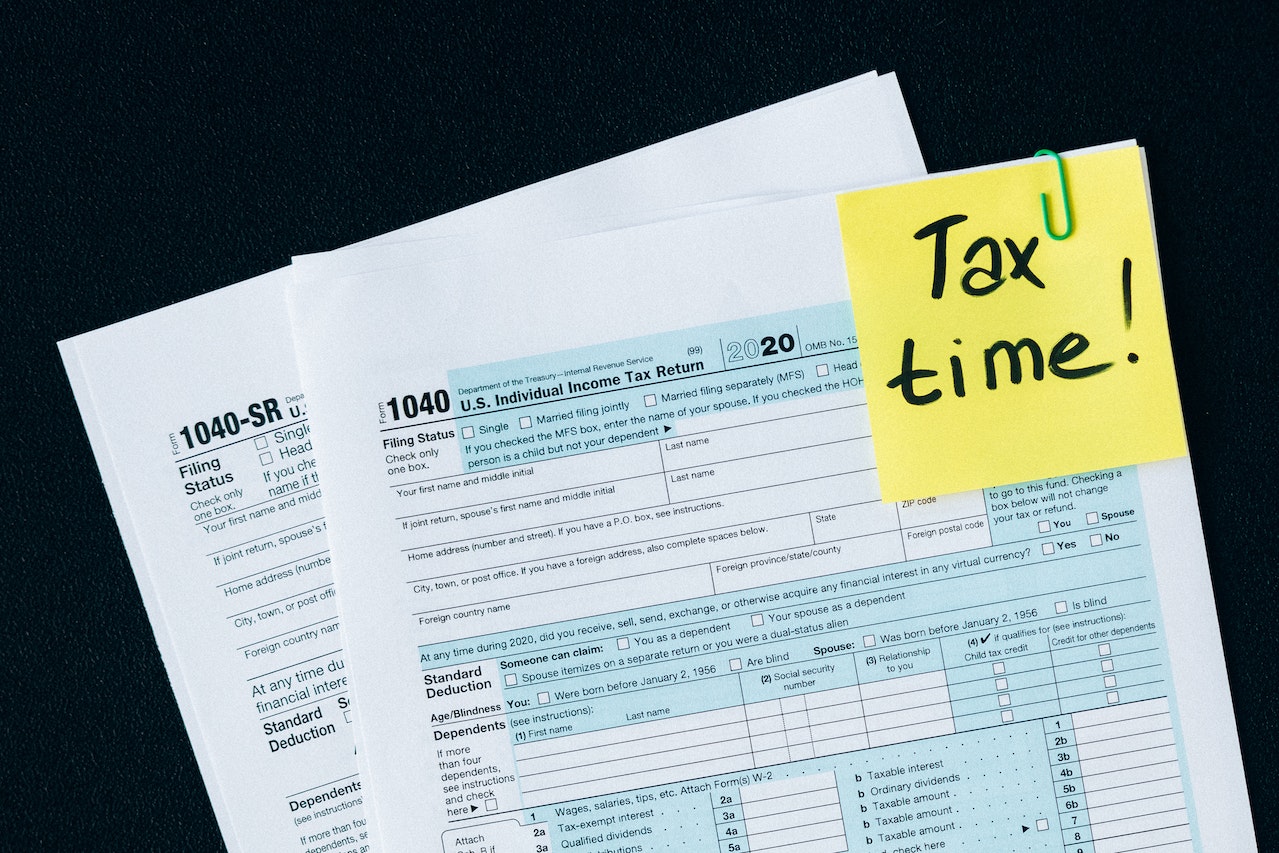

Understand Complex Tax Laws

One of the most challenging aspects of payroll management is navigating complex tax laws. Our research indicates that cases of misunderstanding or a lack of knowledge can lead to errors in tax calculations, resulting in penalties or employee dissatisfaction. It's crucial to stay informed about tax regulations, which often change. At Check Stub Maker, we offer guidance on handling specific payroll issues like overpayment corrections. That's why our pay stub generator is updated with the latest tax rates and regulations, providing peace of mind and accuracy in payroll processing.

Have Calculation Reminders

Calculation errors are common in payroll processing. To avoid these, it's beneficial to have reminders or checks in place. We suggest using reliable payroll software that automatically calculates pay based on hours worked, tax withholdings, and other deductions (like the platform we offer at Check Stub Maker). After putting it to the test, our paystub generator is an intuitive system that helps with accurate calculations to reduce the risk of errors significantly while you make paystubs .

Outsource Payroll

Outsourcing payroll can be a strategic move for many businesses. It not only saves time but also reduces the likelihood of errors. At Check Stub Maker, we specialize in payroll services, ensuring compliance and accuracy. Our services are designed to simplify the payroll process for you and your business, ensuring accuracy and compliance with tax laws. By outsourcing payroll to experts like us, businesses can focus on their core operations, leaving the complexities of payroll management in capable hands.

Conclusion

In this article, we've explored the question, ‘How can an employee correct the pay stub if their employer runs it wrong?' and discussed ways to adjust payrolls that have already been run. Understanding complex tax laws, having calculation reminders, and considering the outsourcing of payroll are effective strategies to avoid common payroll errors. At Check Stub Maker, our user-friendly paystub generator is designed to ensure accuracy and compliance, making payroll management hassle-free for you. So, visit us now at Check Stub Maker and experience the ease and reliability of our payroll solutions! If you want to learn more, why not check out these articles below: