Revolutionize Your Small Business with an Online Paystub Generator

As a small business owner, efficiency and cost savings are likely at the top of your priority list. Managing your day-to-day operations while trying to innov...

Apr 06, 2023When faced with the dilemma of what to do when employer doesn't give W2 or access to paystubs, it's crucial to know the right steps to take.

When faced with the dilemma of what to do when employer doesn't give W2 or access to paystubs, it's crucial to know the right steps to take. At Check Stub Maker , our goal is to provide you with practical solutions and peace of mind during tax season when your employer not giving pay stubs . This article aims to guide you through what a W-2 tax form is, outline the steps you should take to obtain your W-2 form, and discuss how our digital paystub generator can assist in these circumstances. Let's dive in! What this article covers:

There are a few things you can do if you haven't received your W-2 tax form yet from your employer.

The first step is to verify the date. Based on our first-hand experience, employers are legally required to send out W-2 forms by January 31st. If it's only a few days past this date, it may be worth waiting a little longer, especially if there are postal delays. However, if it's well into February and you still haven't received your W-2, it's time to take action.

In today's digital age, many employers opt to send W-2 forms electronically. Check your email, including the spam and junk folders, for any communications from your employer regarding your W-2. Based on our observations, electronic delivery can often be overlooked if you're not actively looking for it.

If you've checked the calendar and your email and still don't have your W-2, the next step is to contact your employer directly. Reach out to your company's payroll or human resources department because they can often provide you with a copy or reissue the form. It's important to confirm they have your correct mailing address.

If your employer is unresponsive or unable to provide you with a W-2, the IRS can help. We recommend contacting them at 800-829-1040 if you haven't received your W-2 by January 31st. Ideally, the IRS should receive your W-2 before this date so they have ample time to spot errors on employee returns and properly distribute refunds. Be prepared to provide your personal information, as well as your employer's details and an estimate of your earnings and withholding. The IRS will then contact your employer on your behalf.

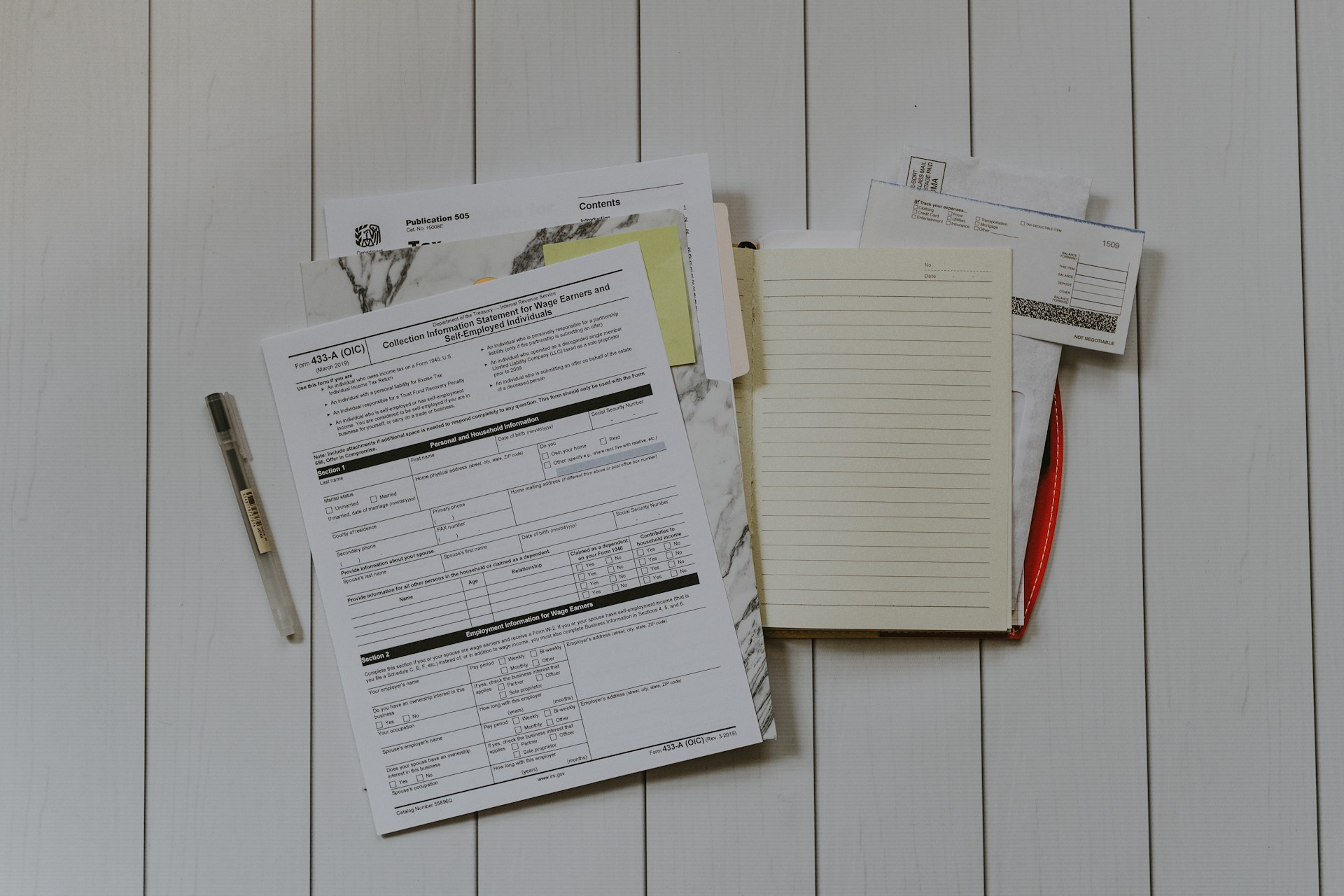

In cases where you still can't obtain your W-2, you may need to file your taxes without it. The IRS allows you to use Form 4852 as a substitute for the W-2. Our research indicates that this form requires you to estimate your income and withholdings as accurately as possible. Our pay stub creator at Check Stub Maker can guide you through this process. After trying out this product, we found it can accurately generate your relevant tax-related information to help you avoid errors and potential IRS inquiries.

If you're unable to file your taxes on time due to missing W-2 forms, you can request an extension by filing Form 4868 with the IRS. Our investigation demonstrated that you can submit Form 4688 electronically or on paper, which grants you an additional six months to file your tax return. Keep in mind, though, that an extension to file isn't an extension to pay any taxes you owe the government. You'll still need to estimate and pay any taxes owed by the original filing deadline to avoid interest and penalties. Not receiving your W-2 or access to paystubs can be a stressful experience, even in situations where you're offered a job but they wanted w2's or pay stubs . At Check Stub Maker, we're here to help you make paystubs to seamlessly overcome these payroll and tax-related difficulties.

In this section, we'll answer some frequently asked questions to clarify issues related to W-2 tax forms and paystubs and guide you through the process with our expert insights at Check Stub Maker.

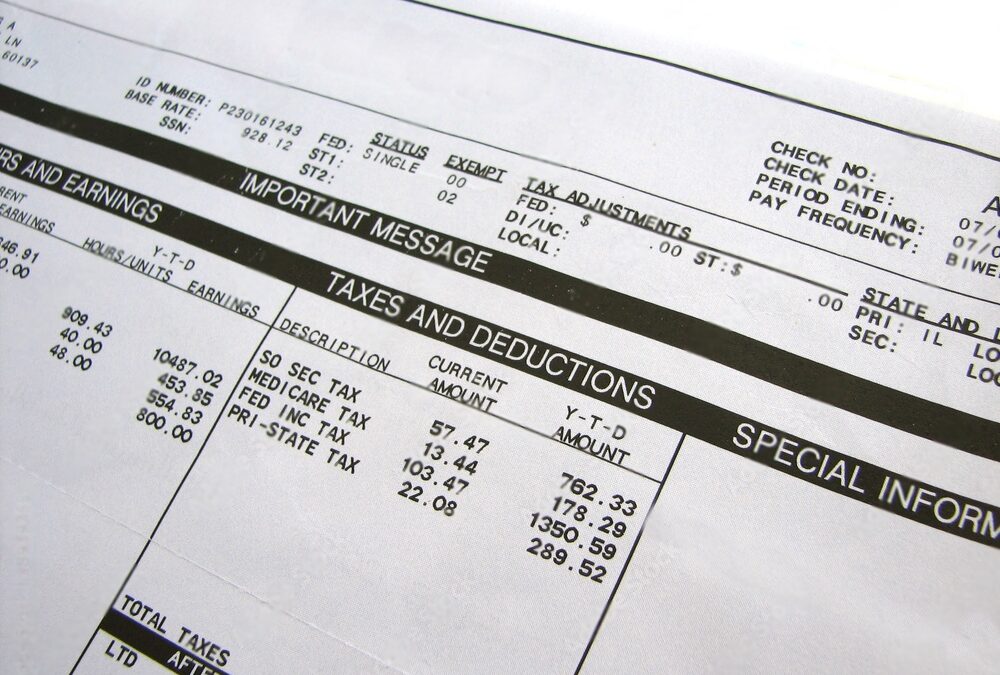

A Form W-2 is a wage and tax statement that employers are required to send to their employees and the IRS. Drawing from our payroll experience, it reports your annual wages and the amount of tax withheld from your paycheck. It's an essential document for filing your taxes because it provides the information needed to determine your tax liability or refund.

Obtaining a W-2 from your previous employer is crucial because it contains accurate data about your earnings and taxes paid throughout the year. This information is necessary for filing an accurate tax return. Without it, you risk underreporting your income or overpaying taxes and ending up with a typo pay stub . The W-2 ensures that you, the IRS, and your employer are on the same page regarding your annual earnings and tax obligations.

In this article, we've explored the vital steps for what to do when an employer doesn't give W2 or access to paystubs. From checking your email to contacting the IRS, these strategies are designed to help you navigate this challenging situation if ‘ a job is refusing to give me pay stub information '. Remember, if you need assistance in creating accurate and professional paystubs, Check Stub Maker is here to assist. So why not try our stellar services today? Visit Check Stub Maker now and experience the ease and efficiency of our paystub maker that helps you track your payroll in minutes! If you want to learn more, why not check out these articles below:

As a small business owner, efficiency and cost savings are likely at the top of your priority list. Managing your day-to-day operations while trying to innov...

Apr 06, 2023

!Not to discredit the hard work you already accomplish, but ask yourself, “can I work a little harder?” If the answer is anywhere near the area of yes, then ...

Feb 16, 2023

At Check Stub Maker, we're delving into the intriguing query: "Would a pay stub be considered a form of secondary ID?"

Apr 24, 2024