New Employer Asking for Pay Stub

Are you currently in the middle of accepting a new job offer and puzzled by a ‘new employer asking for pay stub'?

Apr 24, 2024Learning how to calculate tax for missing w2 with no paycheck stub involves figuring out your gross income, then subtracting pre-tax deductions and nontaxable wages. This will help you to calculate what taxes you'll pay for the year.

Learning how to calculate tax for missing w2 with no paycheck stub involves figuring out your gross income, then subtracting pre-tax deductions and nontaxable wages. This will help you to calculate what taxes you'll pay for the year. At Check Stub Maker , we're experts in the payroll process who can help you navigate this scenario with our expert pay stub w2 calculator . In this blog post, we'll explore whether you can file taxes without a W-2, how to calculate W-2 wages from paystubs , when W-2s are typically sent out, and what to do if you haven't received yours. We'll also give you some tips on how to ensure you're prepared for future tax seasons, so you're not caught off guard again. What this article covers:

While it's possible to file taxes only using your last pay stub, the IRS still prefers you to use your W-2 form. This is because it contains the most comprehensive information about your earnings and taxes paid. However, if you're in a situation where you need to file without a W-2, you can use your last check stub as a reference. Whenever in doubt, we at Check Stub Maker recommend contacting the IRS directly if you have any issues with your W-2 and following their instructions for properly filing your taxes.

Our research indicates that calculating W-2 wages from a pay stub involves several steps.

Start by determining your total gross income for the year. This includes:

If you're using your last pay stub of the year, look for the "Year-to-Date" (YTD) gross earnings figure. If you're using an earlier pay stub, you'll need to estimate your total annual salary based on the information at your disposal. For example, if your check stub shows a YTD gross income of $45,000 and it's from the end of the third quarter, you might estimate your annual gross wages to be around $60,000. This is also dependent on whether you received consistent earnings throughout the year.

Identify all pre-tax deductions such as health insurance premiums, retirement contributions, and Flexible Spending Account (FSAs) contributions. On your pay stub, look for categories like "Pre-tax deductions" or specific line items for health insurance, 401(k) contributions, and the like. From there, you'll sum up all these deductions for the year. If you're using a mid-year pay stub, you'll need to estimate the total annual deductions.

Subtract any non-taxable income, such as certain disability payments or life insurance proceeds. These amounts might be included in your gross wages but aren't subject to income tax. This step can be tricky if you're not familiar with what constitutes a non-taxable salary. When in doubt, it's best to consult with a tax professional, refer to IRS guidelines, or contact us at Check Stub Maker for more information.

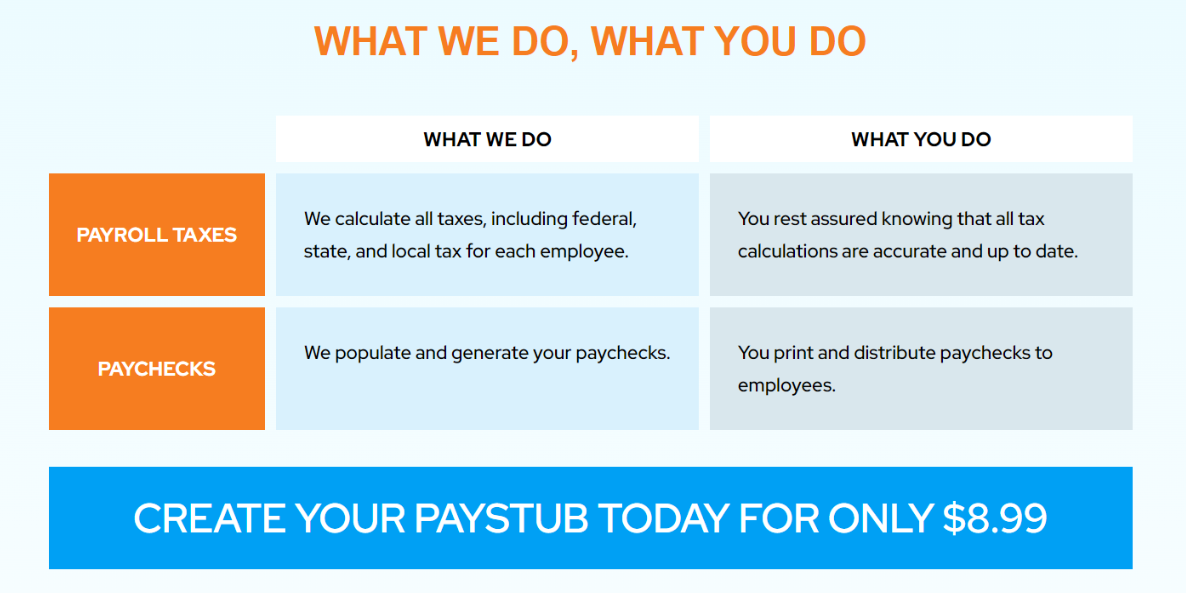

Estimate your annual federal, state, and local taxes based on your taxable income with the built-in calculator in our user-friendly paystub maker . Remember, this is an estimate and may not be exact, especially if you have complex tax situations or multiple sources of wages. With that said, our platform is still an excellent tool which gives you a reasonable approximation of how much is taxes on w2 or pay stub per year.

Sum up all your taxable wages and withholdings to get an estimate of your total W-2 earnings. This figure should represent your total taxable income for the year after accounting for all deductions and non-taxable earnings. Through our practical knowledge at Check Stub Maker, we've found that this step-by-step process can help you calculate your total W-2 salary and other key figures needed for your tax return. However, it's important to note that this method should only be used as a rough estimate and last resort when you don't have access to your official W-2.

Employers are required to send out W-2 forms by January 31st of the following year. This deadline ensures that employees have ample time to prepare and file their tax returns by the typical April 15th deadline. If you haven't received your W-2 by early February, it's time to take action and contact the IRS. Don't wait until the last minute to address this issue, as it could delay your tax filing and potentially lead to penalties if you miss the filing deadline.

After putting it to the test, we at Check Stub Maker have found several effective steps to take if you're missing your W-2:

Many employers now offer electronic W-2s, which may be available earlier than paper forms. If your employer provides this option, you might be able to access your W-2 information as soon as it's ready, potentially before the January 31st deadline. In this context, you can usually download your W-2 directly from these platforms. If you're unsure how to access this information, reach out to your HR department for guidance.

If you can't find your W-2 online, contact your employer's HR or payroll department to request your W-2. It may just be that they've sent it to an old address or there might have been an issue with the initial distribution. In this instance, most employers are happy to supply you with a duplicate W-2 upon request.

If your employer is unresponsive, contact the IRS after February 14th for assistance. They can reach out to your employer on your behalf to request your W-2. To start this process, you'll need to provide the IRS with your name, address, Social Security number, and any pertinent information you have about your employer.

You can request a filing extension if you're still waiting for your W-2. This will give you an additional four to six months to file your return. However, remember that an extension to file doesn't give you an extension to pay your taxes. If you expect to owe taxes, you should still estimate and pay your tax liability by the original deadline to avoid penalties and interest incurred from the IRS.

Form 4852 serves as a substitute for the W-2 if you can't obtain it in time for filing. You'll need to estimate your salary and tax withholding as precisely as possible. Be prepared to explain your efforts to obtain the W-2 to the IRS and how you calculated the numbers on the form.

The IRS can provide you with a transcript of your reported income and withheld taxes . This can be a useful tool if you don't have your W-2 and are having trouble estimating your salary for the year. You can request this transcript online through the IRS website or by mail using Form 4506-T.

If you receive your W-2 after filing and the information differs from your estimates, you can file an amended return using Form 1040-X . Based on our first-hand experience at Check Stub Maker, this ensures that your tax return correctly reflects your salary and taxes paid for the year.

In this blog post, we discovered that calculating taxes without a W-2 or pay stub can be a nuanced process, but isn't impossible to do. We explored methods to estimate your W-2 wages, and what steps to take if your W-2 is missing. Remember, accuracy is crucial when filing your taxes, and it's always best to use official documents whenever possible. To ensure precision in your payroll calculations, consider using our pay stub generator . It's a reliable tool that can help you approximate federal withholding from paystub and more. So, what are you waiting for? Make tax season a breeze for your small business with our help at Check Stub Maker ! If you want to learn more, why not check out these articles below:

Are you currently in the middle of accepting a new job offer and puzzled by a ‘new employer asking for pay stub'?

Apr 24, 2024

Have you ever wondered, "What does SERS stand for on a pay stub?" while checking contributions and deductions related to your retirement annuity?

Aug 28, 2024

Are you wondering, “What does AC mean on a pay stub?” If so, you're not alone. Many small business owners and employees find pay stub terminology confusing. ...

Aug 14, 2023