Pay Stub for Cash Payment

Are you handling cash payments at your company and need an official record for your payroll?

Apr 24, 2024If you've ever looked at your pay stub and wondered “What is NML on paystub?”, you're not alone.

If you've ever looked at your pay stub and wondered “What is NML on paystub?”, you're not alone. Based on our first-hand experience, 'NML' is short for 'normal', which relates to your normal salary or basic wages. This is the amount you've been paid by your employer before any deductions have been made or you've received any additional company benefits. At Check Stub Maker , we're experts in the payroll process and can help you understand the ins and outs of your income with our user-friendly paystub maker . In this blog post, we'll explore what 'NML on pay stub' really means, how it works, and why it's important for both employees and employers. We'll also dive into how normal pay or basic wages is determined, what additions can be made to it, and what deductions usually come out of it. What this article covers:

When you see 'NML' on your pay stub, it stands for 'normal pay'. As per our expertise at Check Stub Maker, normal pay is the basic wages paid by an employer for a payroll period either at a regular hourly rate or in a predetermined fixed salaried amount. It's the amount you can expect to receive consistently for your regular work hours, before any additional compensation or deductions are applied. In essence, normal pay forms the foundation of your earnings.

Now that you know what ‘NML' means on a pay stub, let's dive into how it actually works. An ‘NML pay stub' is essentially a breakdown of your normal pay. It shows you exactly what you've earned for your regular work hours, and what is eventually displayed on your check stub .

Normal pay is typically determined based on your employment contract or agreement with your employer regulated by the Fair Standards Labor Act . For salaried employees, it's generally a fixed amount paid out each pay period. Conversely, normal pay is calculated by multiplying the number of regular hours worked with the hourly rate for hourly workers. Factors that influence normal pay include:

While normal pay forms the base of your earnings, there are often additional forms of compensation that can be added to it. Our investigation demonstrated that some common additions which significantly increase your total take-home pay include:

It's also worth noting that some companies may include TB Life on paystub , which generally refers to ‘taxable benefits' on group life insurance premiums that are added to your basic wages. These perks are typically listed separately when you create pay stubs with us at Check Stub Maker. They're usually subject to different tax treatments, which is why they're listed separately from your normal pay.

After additions are made to your normal pay, various deductions are typically applied. These deductions can be mandatory (required by law) or voluntary (chosen by the employee). Common deductions include:

Additionally, some pay stubs may also show an NCA offset on paystub . This could refer to a ‘Non-Cash Award' offset. This is a deduction related to an award, gift or certificate which employers can offer to their employees (without incurring any costs) as a reward for their work performance. In some instances, employers may deduct NCAs from your normal pay, which is noted and recorded correctly on your paystubs . Our research indicates that understanding these deductions is crucial for employees to fully comprehend their take-home pay and ensure that all their deductions are precise.

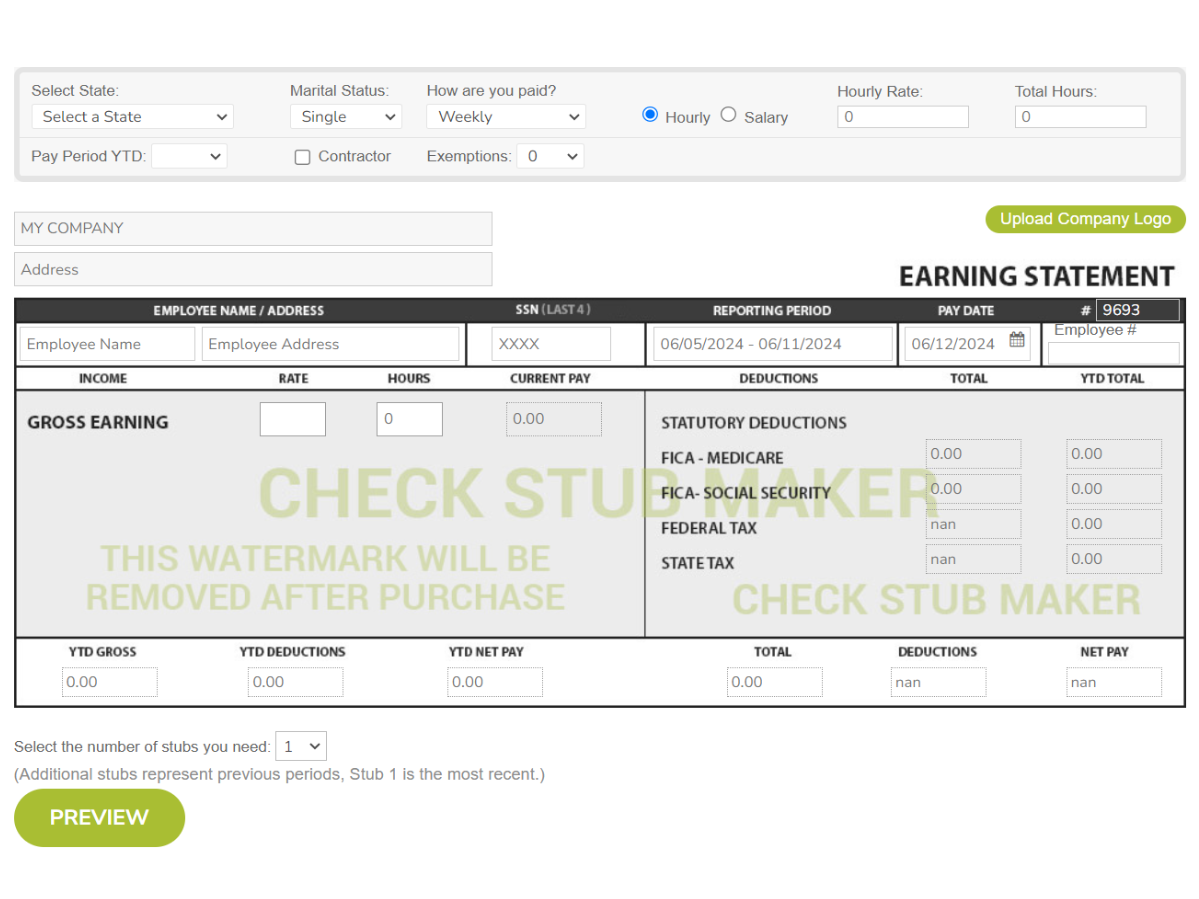

In this blog post, we discovered that 'what is NML on paystub' refers to your normal pay - the foundation of your earnings. At Check Stub Maker , we're committed to simplifying the payroll process for small and medium-sized businesses. So, why not use our easy-to-use pay stub generator ? It helps you create accurate, professional pay stubs that reflect your basic wages in minutes, ensuring clarity for both you and your employees. Give us a try today! If you want to learn more, why not check out these articles below:

Are you handling cash payments at your company and need an official record for your payroll?

Apr 24, 2024

Have you ever glanced at your pay stub and wondered, "What does PTO stand for on a pay stub?" Well, you're not alone!

Aug 28, 2024

When you start a new job, one of the most anticipated moments is receiving your first pay stub. But how long does it take for a job to send your pay stub?

Jan 30, 2024