How Long Does a Business Have to Keep Check Stubs?

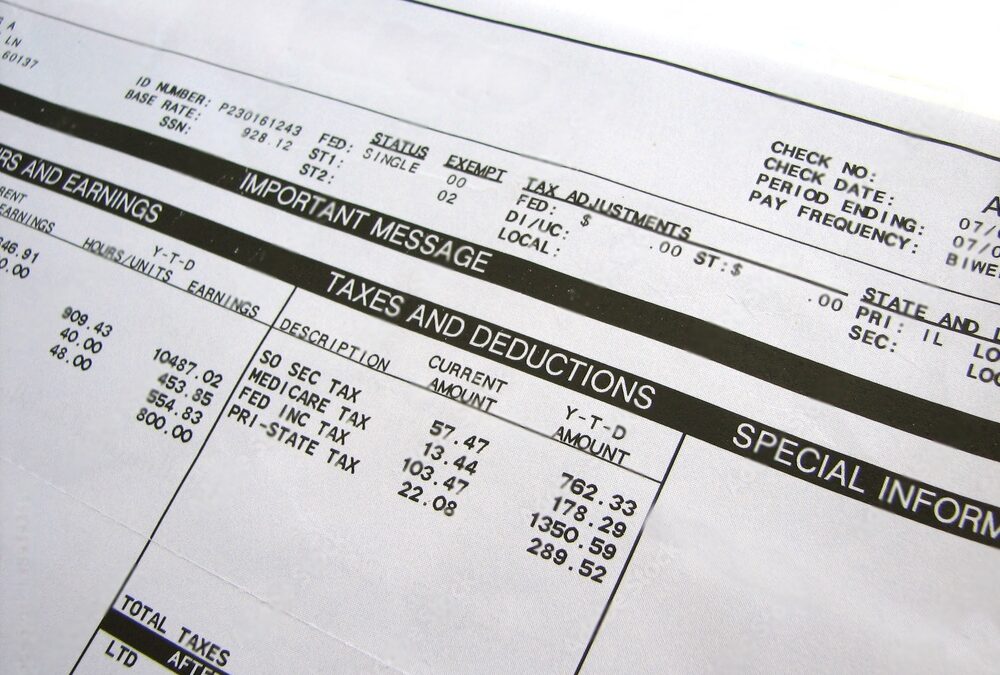

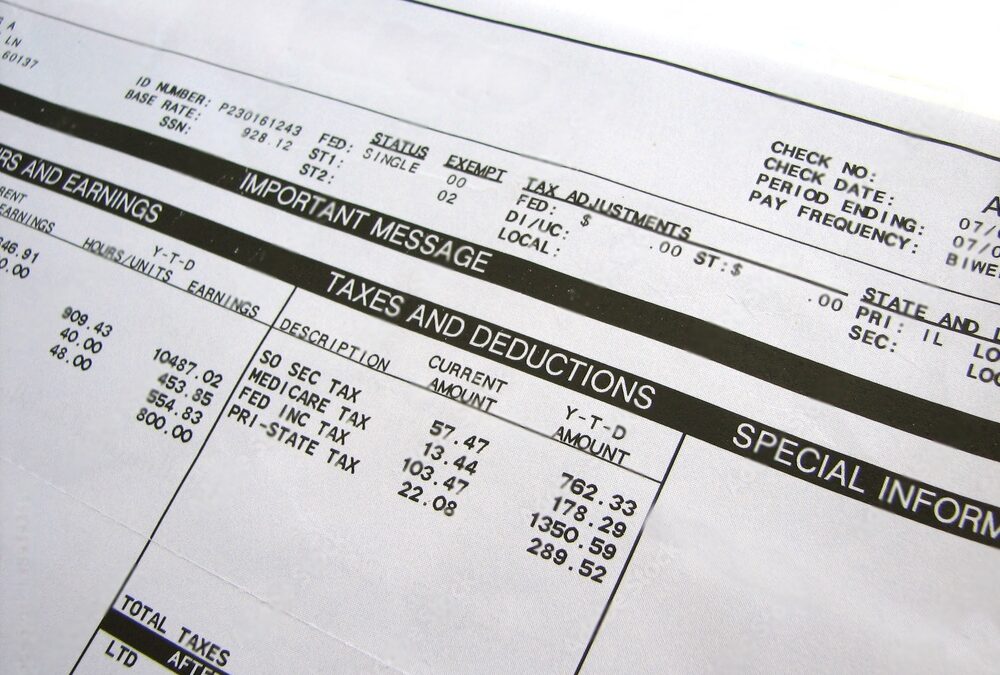

When it comes to managing payroll records, one of the most common questions businesses ask is, "How long does a business have to keep check stubs for?"

Jan 30, 2024When you see ‘TB Life' on your pay stub, it's natural to wonder “What is Life TB on pay stub?”.

When you see ‘TB Life' on your pay stub, it's natural to wonder “What is Life TB on pay stub?”. ‘TB Life' refers to a ‘Taxable Benefit'. This is often linked to a group life insurance policy provided by your employer, which is reflected alongside your basic wages as nml on pay stub . Employers typically offer this type of life insurance and tax fringe benefits within their benefits package, with the IRS considering this as part of your taxable income. At Check Stub Maker , we're here to help you navigate these nuanced terms so you consistently understand the details of your pay stub. We specialize in supplying an easy-friendly pay stub creator , making it easy for you to stay on top of your finances. In this blog post, we'll explain the meaning of ‘TB Life' on your pay stub, discuss related fringe benefits, and dive into what group term life insurance entails for you and your employer. What this article covers:

In this context, ‘TB' stands for a ‘Taxable Benefit', while ‘Life' pertains to a life insurance policy. Essentially, if your employer supplies you with life insurance, the premium they pay on your behalf is considered a taxable fringe benefit. This is why you might see ‘TB Life' on your paystubs —it reflects the amount of money that's considered taxable earnings due to the life insurance gains you've received.  In some cases, our research at Check Stub Maker indicates that ‘TB' could also apply to other taxable fringe benefits, but it's most commonly associated with group life insurance. This means that while your employer pays the GTL installments, the IRS mandates that the value of these gains be added to your gross income for tax purposes.

In some cases, our research at Check Stub Maker indicates that ‘TB' could also apply to other taxable fringe benefits, but it's most commonly associated with group life insurance. This means that while your employer pays the GTL installments, the IRS mandates that the value of these gains be added to your gross income for tax purposes.

Fringe benefits are additional compensation given to employees which go beyond their regular salary. These can include a wide range of perks, from healthcare to retirement plans. Drawing from our experience at Check Stub Maker, we've seen that fringe benefits can help employers attract and retain top talent, but they may also be tax-deferred. Knowing which gains are taxable and how they impact your paycheck is vital for effective financial planning.

Here are some common examples of taxable fringe benefits:

This is a common fringe benefit, where an employer offers life insurance coverage as part of the benefits package. The IRS stipulates that GTLs be excluded from taxes if the plan is valued at less than $50,000.

Often given by employers, health insurance isn't usually taxable, but it's still an important part of your total compensation.

Contributions made by your employer to a retirement annuity can be a great perk but may have tax implications. For example, your contributions won't be taxed by the IRS until you start making withdrawals when you retire, which are generally reflected on a check stub showing annuity .

These can be a lucrative advantage, but company stock options usually have nuanced tax rules that employees first need to understand before giving them to employees. For instance, most company stock options or Incentive Stock Options (ISOs) are tax-free until you sell them.

Group Term Life Insurance (GTL) is a type of life insurance supplied by employers as part of a benefits package, providing financial coverage to your family in the event of your death. Based on our first-hand experience at Check Stub Maker, GTL insurance is a popular perk because it offers peace of mind without significant out-of-pocket costs.

If the coverage of a GTL plan exceeds $50,000, the IRS requires that the value of the excess be included in your taxable salary, which is later reflected on your check stubs .

When you see ‘GTL' on your pay stub, it indicates that part of your group life insurance coverage is being treated as taxable income. This amount is then added to your gross wages, ultimately affecting your take-home pay.

In most cases, employees can't opt out of GTL insurance if it's offered by their employer. However, they may have options to increase or decrease the coverage level. Through our practical knowledge at Check Stub Maker, we've found that reviewing your life insurance options with a financial advisor can help you make the best decision for your situation.

In this article, we revealed that ‘TB Life' on a pay stub stands for a taxable benefit related to group life insurance offered by your employer. We discussed how GTLs affect your taxable income as well as exploring other fringe benefits which provide similar tax advantages. If you want to understand your pay stub better or need a reliable way to generate precise payroll documents for your small business, consider using our pay stub generator . It's a quick and easy tool to ensure all your money-related details are accurate, helping you stay on top of your finances without any hassles or confusion. By keeping things simple and clear, we at Check Stub Maker aim to help you navigate the complexities of your taxable perks with confidence. If you want to learn more, why not check out these articles below:

When it comes to managing payroll records, one of the most common questions businesses ask is, "How long does a business have to keep check stubs for?"

Jan 30, 2024

Whether you’re a small business owner or just curious to know what the IRS form 2553 is, you’re at the right place.What is form 2553? -------------------!Wha...

Apr 02, 2021

Are you ‘trying to get a loan but my paystubs are just to low’? Let us help!

Jun 06, 2024