Letter From Employer Verifying No Pay Stub for Work Week

In an era where documentation is the backbone of many professional transactions, you might have come across the term ‘letter from employer verifying no pay stub for work week'.

Oct 31, 2023Learning how to make a W2 from paystub involves calculating your gross income and identifying all your deductions.

Learning how to make a W2 from paystub involves calculating your gross income and identifying all your deductions. From there, you'll calculate your yearly taxes and non-taxable salary to arrive at your total earnings, which will eventually be reflected on your IRS W-2 form. At Check Stub Maker , we're experts in the payroll process and can guide you through the nuances of creating W-2 forms using our pay stub generator . In this comprehensive guide, we'll walk you through the process of calculating W-2 wages from a pay stub and explain everything you need to know about W-2 forms and how they affect your finances. Let's dive in! What this article covers:

Here's a detailed process from us at Check Stub Maker to help you determine your W-2 wages using your paystubs :

Your gross income is the total amount you've earned before any deductions are taken out. This includes your:

To calculate your annual gross income, multiply your gross pay per pay period by the number of pay periods in a year. For example, if you're paid bi-weekly (26 pay periods per year) and your gross pay is $2,000 per paycheck, your annual gross salary would be $52,000.

$2,000 (gross pay) x 26 (number of pay periods) = $52,000 (total annual gross income)### 2. Identify Other Deductions

Next, you'll need to identify and sum up all the deductions taken from your paycheck. These may include:

It's important to add up all these items to get your total annual deductions.

Common examples of types of income not subject to federal income tax include:

It's critical to identify these non-taxable items on your check stub and subtract them from your gross income to determine your taxable salary.

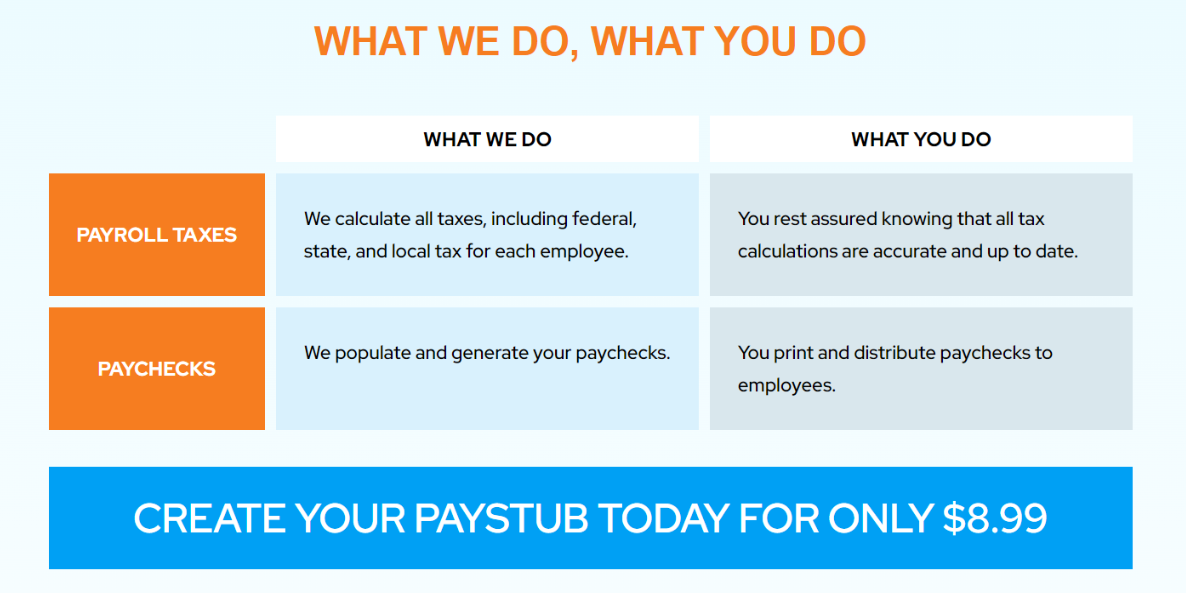

To calculate your yearly taxes, you'll need to add up all the federal, state, and local taxes withheld from your paychecks throughout the year. Based on our first-hand experience at Check Stub Maker, this information should be available on your final pay stub of the year. It's crucial to keep track of this information as it will be later reflected on your W-2 form.

Your total W-2 earnings are typically your gross wages minus any pre-tax deductions. This figure represents your taxable salary for the year and should match the amount reported in Box 1 of your W-2 form. Understanding this calculation is critical for ensuring the accuracy of your tax reporting.

Let's explore some key aspects of the W-2 form:

Our research at Check Stub Maker indicates that a W-2 form contains several critical pieces of information, such as your:

The W-2 form serves several important purposes. It reports your annual wages and the amount of taxes withheld from your paycheck. This form is essential for filing your federal and state tax returns. It helps determine if you're owed a tax refund or if you owe additional taxes. Finally, it supplies a record of your earnings for Social Security and Medicare purposes.

Drawing from our experience at Check Stub Maker, we know that employers are required to provide W-2 forms to their employees by January 31st of the following year. This means that W-2 forms for the 2024 tax year should be supplied by January 31, 2025. You'll need this form when you file your annual tax return, which is usually due by April 15th, 2025. It's vital that you keep track of this timeline to ensure you have all necessary documents for timely filing during the tax season.

Your employer will typically provide you with your W-2 form either electronically or by mail. If you haven't received your W-2 by early February, it's advisable to contact your employer's HR or payroll department as soon as possible. In cases where you're unable to obtain your W-2 from your employer, you can contact the IRS for assistance. They have procedures in place to help employees who haven't received their W-2 forms.

Our findings at Check Stub Maker show that there are several steps you can take if you've misplaced your W-2:

A W-2 isn't the same as a pay stub. While both contain information about your earnings and taxes, they ultimately serve different purposes. A W-2 is an annual summary of your total earnings and taxes withheld for the entire year. It offers a comprehensive overview of your annual income and tax situation. As per our expertise, a pay stub is a record of a single pay period's earnings and deductions. It gives you a detailed snapshot of your salary and deductions for that specific period. It's easy to make paystubs with us at Check Stub Maker. Simply use our computer check stub fillable system which calculates your total taxable earnings automatically and precisely from start to finish.

It's common for your W-2 to show different numbers than your final pay stub of the year. This can happen for several reasons:

If you notice significant discrepancies between your W-2 and check stubs , it's best to contact your employer's payroll department right away for clarification.

The W-2 is used for filing your tax return, while the W-4 is used to determine your tax withholdings throughout the year. A W-4 form is completed when you start a new job or want to adjust your tax withholdings, informing your employer on how much tax to withhold from each paycheck. You can update your W-4 at any time if your financial situation changes. A W-2 form, on the other hand, is given to you by your employer at the end of the year, summarizing your total earnings and taxes withheld on an annual basis.

In this guide, we uncovered that learning how to make a W2 from paystub involves properly calculating and identifying your gross income, deductions, annual taxes and non-taxable wages. From here, you'll be able to figure out how much you've earned in a year and what you'll eventually be taxed by the IRS. If you're running a small to medium-sized business and need help with your payroll system or learning how to generate self employment check stub as an entrepreneur, why not give us at Check Stub Maker a try? Use our pay stub creator now to streamline your financial tasks seamlessly and accurately! Did our blog meet your needs? You might also find our other guides helpful:

In an era where documentation is the backbone of many professional transactions, you might have come across the term ‘letter from employer verifying no pay stub for work week'.

Oct 31, 2023

Online Paycheck StubsWhile employees are expected to fulfill their responsibilities to the companies that they work for, so in turn do employers meet the nee...

Feb 13, 2015

!What Taxes Are Taken out of My Paycheck?https://checkstubmaker.com/wp-content/uploads/2019/06/Paycheck-Taxes-Taken-Out-300x200.jpg Receiving your paycheck c...

Jun 06, 2019