Check Stub Maker Makes the Season Bright

!Check Stub Maker Makes the Season Brighthttps://checkstubmaker.com/wp-content/uploads/2016/12/checkstub-maker-holiday-season-300x200.jpg Amid the lights and...

Dec 16, 2016Ever wondered, "If you work salary, can your company change your pay stub hours?" The answer is a bit more nuanced than a simple yes or no.

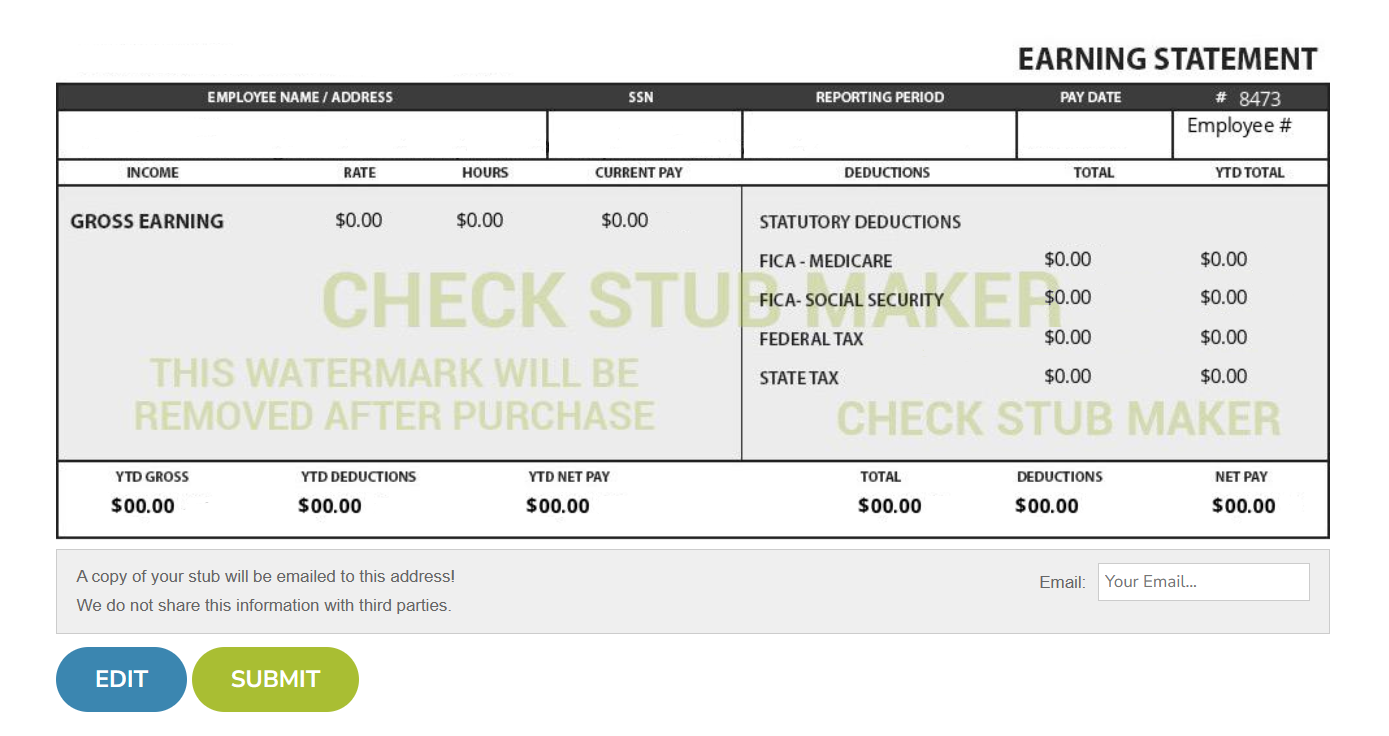

Ever wondered, "If you work salary, can your company change your pay stub hours?" The answer is a bit more nuanced than a simple yes or no. While your salary remains a fixed amount, factors like overtime, unpaid leaves, or company-wide shutdowns can sometimes lead to variations in your pay stub hours. This often leads to you working overtime but not seeing it reflected in your pay or taking a half-day and not understanding how it impacts your earnings. As experts in the payroll process, we at Check Stub Maker are here to shed light on these complexities. Our dynamic pay stub generator can help you make accurate calculations, so you can keep track of your earnings seamlessly. Dive in with us to unravel the intricacies of your salary and pay stub hours! What this article covers:

As per our expertise, a salary is a fixed, regular payment made by an employer to an employee, which typically occurs on a monthly or biweekly basis. This payment is stipulated in an employment contract and doesn't doesn't fluctuate based on the number of hours worked. This contrasts with hourly wages, where earnings are directly tied to the number of hours clocked in. Understanding your letter pay stub is crucial. Whether you're an employer streamlining your payroll process with a paystub generator or an employee calculating your earnings, it's imperative to grasp any potential changes that can occur in a salaried pay stub.

Direct deposit pay stub law for salaried employers differs across various states. For instance, the Wage and Hour Act outlines the rights and protections for salaried employees in Montana , which covers areas like:

Employees fall into two broad categories: exempt and non-exempt. Certain salaried employees are exempt from wage and hour laws, such as minimum wage or overtime. On the other hand, non-exempt employees are subject to these laws. Factors determining salaried status include job responsibilities, employment contracts, and specific state regulations.

The myth surrounding salaried positions is that salaried employees can work for endless hours during overtime without additional pay. In reality, while salaried workers do have a set pay, certain legal and company-imposed limits determine work hours, which are reflected on your check stubs . For instance, Wisconsin has overtime requirements that even apply to salaried employees and not just hourly workers.

Unless expressly stated in their contract or employee paystub review , or subject to specific state laws, any work that exceeds the required 45-hour workweek for a salaried position doesn't necessarily mean that an employer owes their employee more money for overtime work. For instance, in Wisconsin, executives and those in administrative roles are generally exempt from claiming additional pay for overtime unless it's otherwise stipulated in their employment agreement. However, if you're a ‘non-exemption salaried employer' not occupying an executive or administrative role, you're entitled to overtime pay so long as overtime pay requirements are stipulated in the work contract you have with your employer.

Based on our observations, for non-exempt salaried employees, overtime is typically paid at one and a half times their regular hourly rate. This rate is derived by dividing your weekly salary by the standard workweek hours, which are usually 40 hours. So, if you work beyond this, then you're compensated extra, ensuring fair pay for your additional efforts.

Technically, employers can't do this. If salaried exempt employees are available to work, then employers can't deduct pay from their salaries for partial-day absences that they (the employee) initiate. However, if an employee is away from their desk for a full-day absence, whether for personal reasons or sickness, this might warrant deductions on the part of their employer. As an employer, always use a reliable tool like Check Stub Maker to guarantee that any pay reductions you make in your paystubs align with a legitimate sick leave policy or employment agreement at your company to practice fairness and compliance.

Yes, it's possible for an employer to do so. If an employer has a sick leave policy in place, deductions can occur for full-day absences if an employee hasn't qualified for the leave or has already used up their allotted days. It's essential for both parties to understand the terms to ensure clarity and fairness in such situations.

Our investigation demonstrated that salary proration (a division or assessment of salaries) is allowed if a business shuts down for a partial workweek and the employee lacks PTO. However, if an employee takes a full week off without producing any work, then no salary is due for that time. But what about other reasons for proration, such as when you're dismissed from your job and need to know how to view online check stubs when laid off , or when you reduce your working hours? When an employee is let go mid-week from a company, employers are obligated to prorate the days worked during that week to provide fair compensation despite the termination. Additionally, if an employee's work hours are reduced from 40 to 30 hours weekly, then employers can prorate their salary. Whenever an employer needs to prorate an employee's salary, this adjustment should be reflected when you make paystubs and discussed with transparency between both parties to promote fair compensation in the workplace.

Employers can make salary deductions for full-day absences from work due to jury duty, witness roles, or military leave. For instance, Texas state laws require employees to make use of either their PTO or vacation leave to perform jury duty, witness roles, or military leave. This particular law doesn't conflict with federal legislation either. We always recommend verifying local regulations to ensure compliance on your part as an employee, should you need to take time off from work to perform these civic duties.

While the [Fair Labor Standards Act (FLSA) doesn't require holiday pay](https://www.dol.gov/general/topic/wages/holiday%23:~:text%3DThe%2520Fair%2520Labor%2520Standards%2520Act,(or%2520the%2520employee's%2520representative) .) , employers may offer it based on company policy or individual agreements. If some employees receive holiday pay, it doesn't guarantee that all employees will receive similar compensation.

Employers can direct employees to use vacation or leave time for absences, whether full or partial days. However, it's essential that such stipulations are outlined transparently in company policies or an employee's work contract.

Through our trial and error, we discovered that employers can switch between hourly and salaried compensation methods. However, such changes must adhere to labor regulations, uphold any existing contractual terms, and be transparently communicated to the employee well in advance, and reflect accurately when you create paystubs with a platform like Check Stub Maker.

Employers must diligently record salaried employees' details, hours, wages, and any deductions. This means adhering to both state and federal record-keeping laws for the purposes of compliance and protecting both parties' interests.

Our investigation demonstrated that understanding these nuances can help in ensuring compliance, fairness, and transparency with a verifiable pay stub and employment for both employers and employees. Let's look at some frequently asked questions surrounding general wages and working hours for employees, salaried or otherwise.

Pay requirements vary from state to state, but some commonalities persist. For instance, the Fair Labor Standards Act (FLSA) outlines the federal standards for minimum wage, overtime, and other pay practices. At Check Stub Maker , we provide a digital solution that accounts for these requirements, ensuring that the pay stubs generated are in line with prevailing regulations at the state and federal levels.

The minimum wage is the lowest amount employers can legally pay their workers per hour. While the federal government sets a baseline, many states have their own minimum wage laws. While salaried employees earn a fixed amount, they should still earn an amount that's equivalent to or more than the minimum wage when broken down hourly.

Overtime pay happens when an employee works more than a standard workweek, which is typically 40 hours in the U.S. Through our practical knowledge, the rate of overtime pay is usually one and a half times the regular hourly rate. While some salaried employees might be exempt from receiving overtime, others, especially non-exempt employees, are entitled to it.

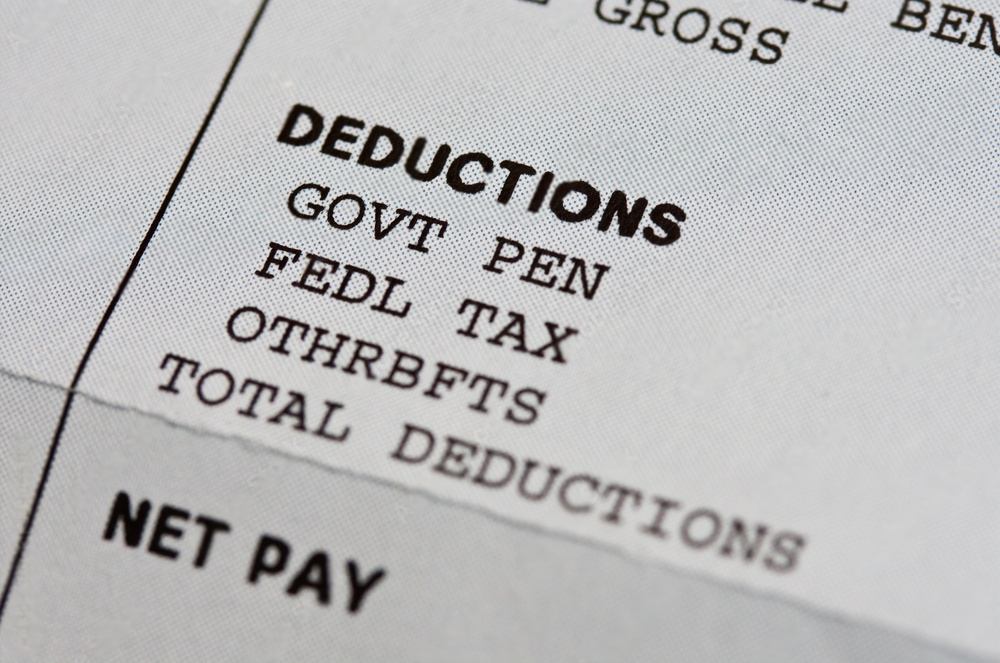

Payroll deductions are amounts taken out of an employee's paycheck for various reasons, including:

It's crucial for employees, especially those using digital solutions like our paystub generator , to understand and verify these deductions on their pay stub with ssn .

As indicated by our tests, holiday, vacation and leave, and severance pay are additional compensations and benefits that employees might receive outside of their regular salaries. Many employers offer these benefits as part of the employment contract or company policy, even though the FLSA doesn't mandate them.

Termination of employment refers to the end of an employee's tenure with a company. It can be voluntary (resignation) or involuntary (dismissal). Rights and responsibilities at the time of termination can vary, but employers often have to provide final paychecks, including accrued benefits like unused vacation days, within a specific period. For instance, Arkansas employers are required to give employees their final paychecks on the next regular payday, while California employers are mandated to give employees their final paychecks within 72 hours or right away.

On average, full-time employees in the U.S. work around 34.4 hours a week. However, salaried employees might occasionally work longer hours without additional pay, which must still be in line with employment contracts and state laws.

In this guide, we've demystified a burning question: "If you work salary, can your company change your pay stub hours?". From overtime quirks to leave policies, employers have various reasons to adjust your pay stub hours. With these fluctuations, you need Check Stub Maker as your tried and tested ally in the payroll process. With our user-friendly pay stub creator , you can easily keep track of your earnings and hours throughout your financial journey. So, next time you're wondering how to get recent pay stubs , remember, we're just a click away! Happy tracking! If you want to learn more, why not check out these articles below:

!Check Stub Maker Makes the Season Brighthttps://checkstubmaker.com/wp-content/uploads/2016/12/checkstub-maker-holiday-season-300x200.jpg Amid the lights and...

Dec 16, 2016

Curious about "What is an online pay stub?" You're not alone!

Oct 04, 2023

Understanding paycheck processes can sometimes feel nuanced, especially when terms like “NCA offset” appear. So, ‘What is NCA offset on paystub'?

Aug 28, 2024