How to Get Paystubs From a Job If You Get Paper Checks

Wondering how to get paystubs from a job if you get paper checks?

Aug 28, 2024Ever glanced at your pay stub and wondered about the significance of that social security number printed on it? Well, a pay stub with social security number isn't just a piece of paper; it's a testament to your financial journey.

Ever glanced at your pay stub and wondered about the significance of that social security number printed on it? Well, a pay stub with social security number isn't just a piece of paper; it's a testament to your financial journey. For employees, it's a record of their hard work, earnings, and deductions. For employers, it's a document of their transparency and compliance. At Check Stub Maker, we understand the importance of a ssn on paystub. Whether you're a small business owner or someone who needs proof of income, a detailed and accurate pay stub is essential for your financial endeavors. In this guide, we'll explore the intricacies of crafting that perfect pay stub with social security number. Dive in with us, and let's make payroll a cinch together! What this article covers:

In the upcoming section, we'll delve deep into the essentials of printing full Social Security numbers on pay stubs. From the foundational general information to understanding gross pay, tax withholdings, and various deductions, we'll provide a comprehensive guide. Additionally, we'll demystify some commonly used deduction acronyms, ensuring clarity in every aspect of your pay stub. Whether you're an employer or an employee, this guide aims to simplify and clarify the pay stub process for you.

Our research indicates that the general information section typically includes:

This section serves as the foundation of the pay stub, ensuring that the employee's identity is verifiable. A verifiable pay stub and employment records are crucial for various financial transactions. Let's delve deeper into some of these essential elements and others on your paystub.

This represents the total earnings before any deductions. It's the starting point of every pay stub that we make at Check Stub Maker. The gross pay reflects your earnings before any taxes or other deductions come into play.

Different regions have different tax rates. It's essential to understand the tax implications in your specific region, as a pay stub rate changed without notice can lead to discrepancies and potential legal issues.

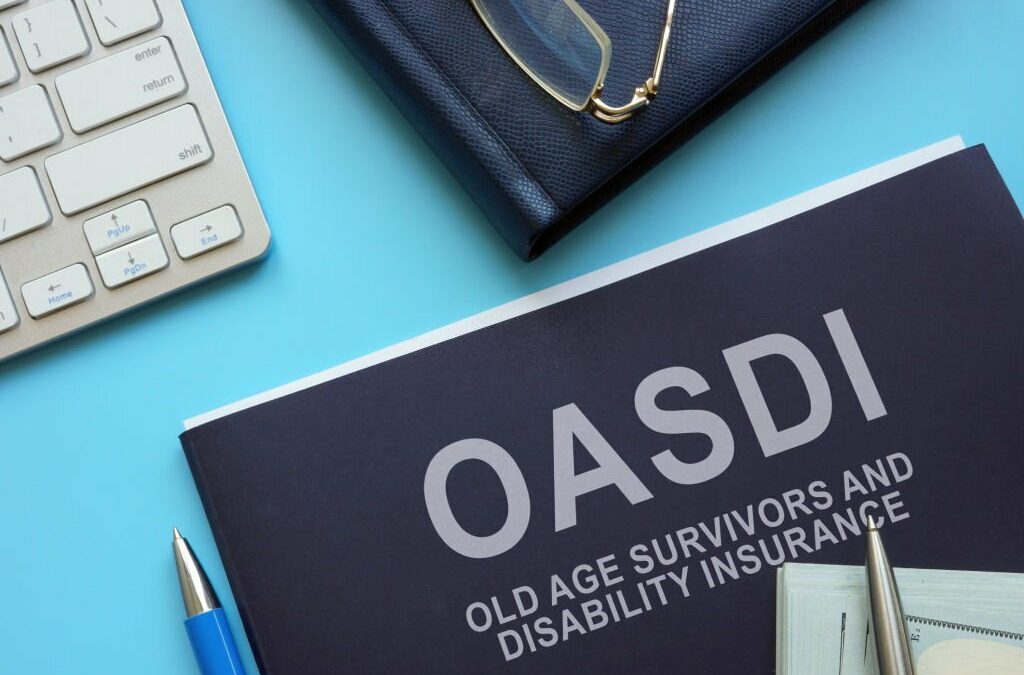

Standing for the Federal Insurance Contributions Act, FICA taxes are non-negotiable deductions that every wage earner in the U.S. sees on their pay stub. These deductions are split between Social Security and Medicare, two foundational pillars of our country's social security system. By ensuring that every working individual contributes, FICA taxes aim to provide support when it's most needed, be it due to age or health challenges.

As you age, healthcare often becomes a more pressing concern. Medicare, funded by a specific portion of FICA taxes, is designed to provide healthcare coverage for seniors, typically those aged 65 and over. This system underscores our nation's commitment to ensuring that the elderly have access to necessary medical services without the burden of exorbitant costs.

Beyond healthcare, financial stability during the golden years is a concern for many. The Social Security component of FICA addresses this by offering financial support during retirement. Every paycheck deduction made under this category is an investment in your future, ensuring you have a safety net when you decide to retire.

Unlike FICA taxes, wage garnishments are specific to individuals and arise when an employee owes money, perhaps due to unpaid debts, child support, or other obligations. These deductions are court-ordered, and it's crucial for both employers and employees to handle them with transparency and accuracy.

Some states have instituted mandatory disability insurance deductions to provide financial benefits during times when an employee cannot work due to health reasons. This insurance acts as a buffer, ensuring that individuals have some form of income even when facing health crises.

Beyond the standard salary, employees often earn additional income through bonuses, overtime, commissions, or other incentives. Our investigation demonstrated that it's essential to list these separately on the pay stub to provide a clear breakdown of all earnings sources.

Net pay is the amount an employee takes home, and understandably, it's often the figure that garners the most attention. This final figure is what employees use to manage their budgets, pay bills, and plan their financial futures.

Many employers offer health, dental, or other types of insurance as part of their benefits packages. Premiums for these insurances are typically deducted from the paycheck. Given the significance of insurance in safeguarding your health and well-being, detailing these deductions is paramount.

Balancing work and parenting can be a juggling act. That's why some employers offer sponsored childcare services for working parents. In essence, your pay stub is a comprehensive record of your financial relationship with your employer. Understanding each component ensures transparency, trust, and informed financial planning.

From retirement contributions to union dues, this section covers it all. It's a comprehensive look at all the various deductions an employee might encounter on their pay stub.

Next, we'll explain five commonly used acronyms that you may see while you make paystubs .

Through our practical knowledge, understanding these acronyms can help you better grasp the details of your pay stub and ensure they're fully informed about their earnings and deductions.

In the ever-evolving landscape of payroll, understanding the 2023 pay stub requirements by state is crucial for both employers and employees. This section delves into the specific state mandates regarding pay stub access and distribution, from states that prioritize electronic formats to those that offer more traditional approaches. We'll explore which states require employers to provide access, which mandate printing capabilities, and the nuances of opt-in and opt-out electronic pay stub provisions while utilizing Check Stub Maker.

The following states require employers to provide access to pay stubs but not necessarily hand out physical copies:

In these states, employers must allow employees to access and print their pay stubs:

Electronic pay stubs are the norm unless an employee opts out in these states:

In these states, employees must opt-in to receive electronic pay stubs. Currently, Hawaii is the only state with this requirement. Based on our observations, understanding the intricacies of pay stubs, especially those with Social Security numbers, is crucial for both employers and employees. Whether it's understanding the various sections of check stubs , the importance of FICA taxes, or the requirements by state, staying informed of your paystub rights and obligations ensures compliance and clarity.

Navigating the intricacies of pay stubs can sometimes feel overwhelming. With a myriad of components, legal stipulations, and best practices to keep in mind, it's paramount to stay informed. In this segment, we'll tackle some of the most pressing questions surrounding pay stubs, leveraging our comprehensive research and expertise at Check Stub Maker.

A pay stub acts as a testament to your income and is indispensable for several financial undertakings. Be it loan applications, rental agreements, or employment letter pay stub verifications, a pay stub is a vital document. It underscores why do you need your paystub by detailing your earnings and deductions.

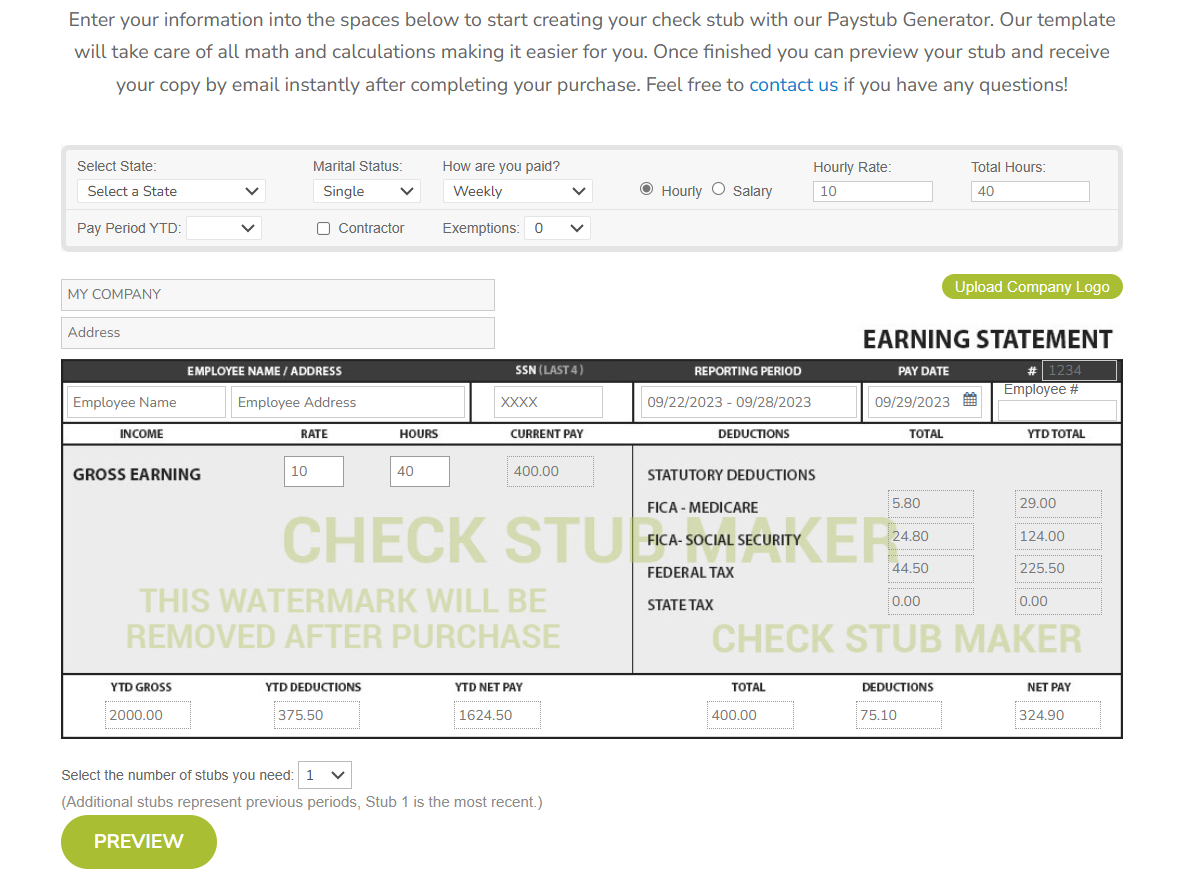

Based on our first hand experience, the format of your check stub is pivotal. When configuring printed paychecks, customization options are available for the placement of check stub details. By default, your full Social Security number won't be displayed on the check stub, but only the last four digits instead, while using our pay stub creator . Is it legal to include bank account number on paystub?' The general consensus is no, primarily due to data privacy concerns. However, the layout is adjustable, allowing for the inclusion of details like your business address or company specifics.

Employers are legally bound to furnish pay stubs to their workforce. While there's no federal mandate in this regard, state-specific requirements exist, making wage payment transparency extremely important and something to be encouraged across the board. Employer requirements and obligations in relation to paystubs can differ from one state to another, making it essential for businesses operating across state lines to be well-versed in the diverse rules and pay stub laws that apply to them.

Our investigation demonstrated that the retention duration of employee information can fluctuate based on state regulations and the nature of the record, thereby affecting how to look up a check stub from many years ago . However, as a general guideline, we recommend that companies retain payroll records for a minimum of three years to align with federal standards and aid in addressing potential disputes or audits.

The Fair Labor Standards Act (FLSA) impacts nearly all employers and their employees in the U.S. It sets the standard for minimum wage, overtime pay, and youth employment . Grasping the nuances of the FLSA is crucial, as it has direct implications for your pay stubs and wage computations.

Employees typically should obtain their pay stubs on or before their payday. The distribution frequency can differ based on the employer's payroll schedule, be it weekly, bi-weekly, or monthly.

As per our expertise, both paper and electronic paystubs have their merits. While paper pay stubs offer a tangible record, electronic versions are eco-friendly and facilitate easy storage and retrieval. The final choice often hinges on employer preferences and specific state regulations. We highly recommend utilizing electronic paystubs like ours overall for their convenience, easy storage, and eco-sustainability.

If you're in the unfortunate predicament where your ‘ employer wont give me a pay stub ', it might contravene state laws. Consider consulting a labor attorney or reaching out to your state's labor department for advice.

Grasping the intricacies of what information is encapsulated in a pay stub, especially concerning a pay stub with social security number, is indispensable for both employers and employees. While pay stub obligations for employers and pay stub laws might differ across states, the core essence remains consistent: ensuring transparency and adherence to regulations for smoother payroll processes. At Check Stub Maker , we take immense pride in demystifying the payroll process with our state-of-the-art pay stub generator. Whether you're a burgeoning business or an entrepreneur, our expertise is at your disposal. If you're keen on optimizing your payroll process, try our unparalleled paystub maker today! If you want to learn more, why not check out these articles below:

Wondering how to get paystubs from a job if you get paper checks?

Aug 28, 2024

Curious about ‘How can I get pay stubs as a retired federal employee'?

Jul 02, 2024

Wondering how to find annual income on paystub? All you have to do is check the 'summary' section of your paystubs to see a breakdown of your annual income, including earnings and deductions.

Aug 28, 2024