A Guide to Small Business Accounting

!A Guide to Small Business Accountinghttps://checkstubmaker.com/wp-content/uploads/2019/11/small-business-accounting-300x200.jpg If you have owned a business...

Nov 03, 2019Ever wondered why you should always ask for a pay stub?

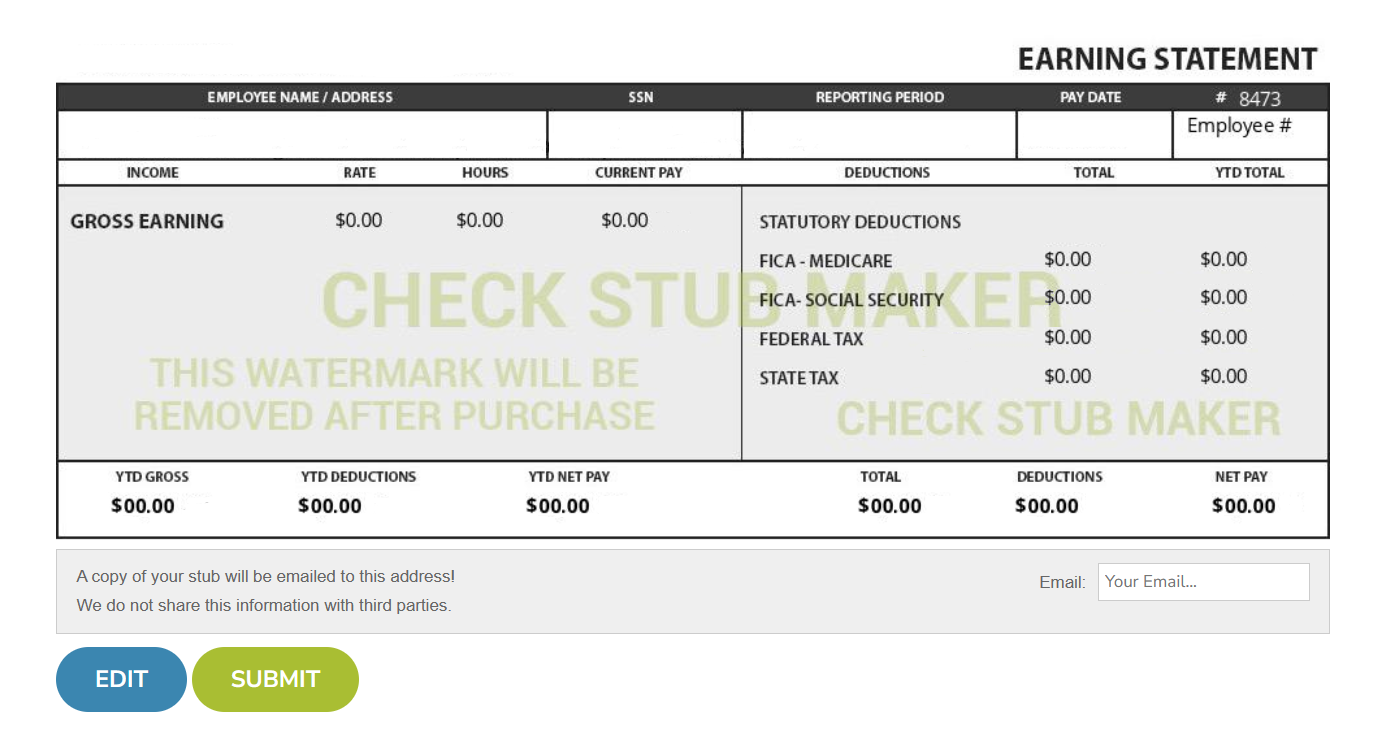

Ever wondered why you should always ask for a pay stub? It's simple! Pay stubs aren't just insignificant slips of paper; they're gateways to understanding your financial journey, offering a detailed snapshot of your earnings, deductions, and more. Whether you're an employer verifying a potential hire's salary or an employee proving your income, a pay stub is an indispensable tool. Enter Check Stub Maker, your trusted partner in the payroll process. With a rich history of simplifying payroll complexities, we can help you make paystubs that are accurate, professional, and specially tailored to your needs. Dive in with us, and let's explore the world of pay stubs together! What this article covers:

Our research indicates that many new employers request pay stubs for a variety of reasons. Whether it's to verify the information provided during the interview process or to understand an employee's financial background, pay stubs serve as a valuable tool in the world of finance and beyond. Here's a breakdown of the top reasons a new employer might ask you for a pay stub:

Ensuring that the stated salary during interviews aligns with actual pay is vital for employers to assess the honesty and reliability of potential hires. When discrepancies arise later on, it can potentially cast doubt on an employee's integrity. This is particularly significant during promotions or raises, where trust is critical. Inaccuracies in reported salaries can strain employer-employee relationships, potentially hindering career progression and workplace harmony.

Check stubs , particularly ones we generate at Check Stub Maker, act as proof of your employment with your previous or current company, thereby verifying your work history. For those who claim to have worked at certain establishments or held specific positions, a pay stub can confirm these details. This becomes particularly vital when an employer wont provide paystub access or if you need to know how to verify employment without checkstubs .

Understanding the deductions and benefits you were previously receiving can help in structuring a competitive offer for a new job. It gives a prospective employer insights into what you value in terms of benefits and what deductions were previously made. This can be particularly useful when determining packages that are both attractive to you and feasible for your new employer. It's also a reminder that direct deposit employers required to provide paystubs as a record.

While new employers can request to view your paycheck in order to offer you a competitive salary or assess your integrity and professional capabilities, this request needs to be done with the utmost care. Additionally, they should also consider industry salary standards and be mindful when sharing your confidential financial information. Let's look at some examples of when a potential employer may request to view your paycheck and what you can do to tactfully navigate these situations.

Our findings show that it's best to provide a salary range based on industry standards and your experience, should you need to include a salary requirement in a cover letter for a job application. It's always best to avoid giving a potential employer a fixed number, but instead offer a general salary range that you're comfortable with. This provides flexibility during negotiations, so you don't lowball yourself or overshoot your worth.

The initial salary offer isn't set in stone. There's still room for negotiation even after a potential employer makes you an offer. This is particularly true if the job duties expand or added perks are on the table. Recognizing that the first proposal is a starting point is key. We encourage open dialogue during this process; presenting valid reasons for a pay bump can sway the decision during the initial salary discussion. Occasionally, referencing an employment letter pay stub from your previous or current employer can provide valuable context, aiding in fruitful salary discussions.

Emphasizing your qualifications and industry standards is pivotal in securing a favorable compensation package. Many employers initially quote a conservative figure, foreseeing negotiation; that's why treading this path requires finesse on your part. While being too aggressive might deter potential employers, undervaluing your worth might lead to missed opportunities for better compensation. Balancing assertiveness with tact is the key to successful salary discussions.

After putting it to the test, pay stubs, like the ones we generate for you at Check Stub Maker , are essential documents that give you a detailed breakdown of your earnings and deductions for a specific period. Here's a closer look at the information typically contained in a pay stub:

Your gross wages are the total amount you earn before any deductions. This figure reflects the amount paid to you before taxes, contributions, and other deductions. For hourly employees, it lists the hourly rate and the number of hours worked. For salaried workers, the default rate is typically 40 hours a week.

Deductions are amounts taken out of your wages for taxes, insurance, and other obligations. They typically include taxes and contributions. In this instance, taxes encompass FICA tax deductions as well as federal and state income tax withholdings.

Contributions typically refer to amounts allocated towards benefits like retirement funds and health coverage, mirroring the perks an employer provides. For instance, a company with a robust health plan might have higher contributions so that employees can enjoy comprehensive benefits.

Net pay, often termed "take-home pay," is the final amount that lands in your pocket once all your financial obligations are met after paying taxes. We determined through our tests that you can calculate your net pay by deducting taxes, contributions, and other expenses from your gross income using our pay stub creator .

Court orders enforce garnishments, which are essentially legally required deductions from your earnings meant to resolve specific debts or obligations. Examples of this include child support or unpaid loans that come directly out of your paycheck. Our investigation demonstrated that garnishments are vital for prioritizing certain financial responsibilities, ensuring they're addressed before the pay reaches the employee.

Paid Time Off (PTO) encompasses the days you're allowed to take off with pay, including vacation, illness, or personal days, and generally speaking, employers legally have to show sick and vacation time on pay stub . It's a reflection of an employer's commitment to work-life balance while also showing transparency about their employees' leave entitlements and usage.

A pay period defines the specific interval at which you receive your earnings. It can vary, with some employees getting paid bi-weekly, while others might receive monthly salaries. This timeframe dictates when you can expect your paycheck and helps in tracking and managing your income and expenses over set durations.

A pay rate indicates the amount you earn for your work, either calculated hourly or as a fixed annual salary. For hourly workers, it's the sum earned per hour, while salaried employees have a predetermined yearly amount. This rate serves as the foundation for calculating gross earnings before any deductions or additions.

Should pay stubs have last 4 digits of SSN ? Your pay stubs usually contain the last four digits of your social security, as you'll notice when you use our pay stub generator for the first time. Additionally, your pay stub typically contains contact information with details pertaining to you (including your name, social security number, and address) and similar information about your employer.

In this FAQ section, we'll delve into the essentials of pay stubs, from understanding their structure and purpose to best practices in managing them. Additionally, we'll address common queries and provide our expert insights on the design of a pay stub, its varied uses, or the importance of retaining them.

A pay stub is a financial record showcasing an employee's income details for a set duration. It itemizes earnings alongside any deductions, such as taxes or benefits, providing an accurate depiction of your financial standing during that period. As per our expertise, pay stubs are an essential tool for both employers and employees to track and verify compensation details.

A pay stub's appearance can differ based on the issuer, but platforms like Check Stub Maker ensure a streamlined, user-friendly design that's 100% customizable to your specific company. When you make a checkstub , it reflects both your personal and professional financial details in an organized way, making it easy for you to understand your earnings, deductions, and other pertinent information at a glance.

Pay stubs serve multiple purposes. Primarily, they act as evidence of income, which is crucial for securing loans or verifying employment. Additionally, they're invaluable during tax preparations, helping you and accountants ensure accurate filings.

Accessing a pay stub (physical or digital) typically involves requesting it from your employer. If you're looking for a more streamlined solution, our paystub generator at Check Stub Maker offers a convenient way for businesses and employees to create, view, and manage these essential financial documents with ease.

Retaining old pay stubs is prudent because they serve as financial records, which aid in various future transactions or verifications. Should you ever encounter scenarios like a bankruptcy 7 lost pay stub , having a collection of past stubs can be a lifesaver so that you can prepare for any financial situation.

Through our trial and error, we discovered that you should keep your employee pay stubs for at least a year, but it's best to check with financial or tax advisors for additional clarity in this regard. For employers, the IRS expects you to do employment tax recordkeeping for at least four years after filing the fourth quarter of the year.

Navigating the financial landscape can be tricky, but understanding why you should always ask for a pay stub makes the journey smoother. Through our practical knowledge, these handy documents are reflections of your financial journey, offering clarity on your earnings, deductions, and more. Having a reliable pay stub not only ensures transparency but also empowers you in various financial dealings - from negotiating your salary at a new job to filing your taxes accurately. As we wrap up, remember that we at Check Stub Maker aren't just a service; we're your partner in financial clarity. If you're looking for detailed and accurate pay stubs tailored to your needs, give our innovative paystub creator a try today! If you want to learn more, why not check out these articles below:

!A Guide to Small Business Accountinghttps://checkstubmaker.com/wp-content/uploads/2019/11/small-business-accounting-300x200.jpg If you have owned a business...

Nov 03, 2019

Welcome to the ultimate guide on how to make a pay stub for a loan!

Mar 25, 2024

Online Paycheck StubsWhile employees are expected to fulfill their responsibilities to the companies that they work for, so in turn do employers meet the nee...

Feb 13, 2015