Monthly Pay Stubs

In today's fast-paced world, understanding and managing financial documents is crucial for both employers and employees. A key component in this financial landscape are your monthly pay stubs.

Dec 06, 2023Ever pondered the question, "If I own a business do I get pay stubs?" The process is simpler than you might think.

Ever pondered the question, "If I own a business do I get pay stubs?" The process is simpler than you might think. Independent contractors and business owners often grapple with the intricacies of creating pay stubs. After all, when you're the boss, who hands out your pay stub? One of the primary challenges as an independent contractor and business owner is maintaining accurate records of your income, especially when it comes to submitting tax returns to the Internal Revenue Service (IRS). One way to address this unique challenge is through the generation of pay stubs. In this blog post, we'll explain the paystub generation process for independent contractors and business owners and help you make paystubs with Check Stub Maker. Let's jump in! What this article covers:

Independent contractors, unlike traditional employees, don't receive pay stubs from an employer. Instead, you often face the question: "If I'm self-employed, can I make my own pay stub to prove income ?" The answer is yes, and it's often necessary. As an independent contractor, you need to create your own to serve as proof of income, especially when applying for loans, renting properties, or just navigating your way through tax season. Let's delve into the process behind understanding and creating specialized pay stubs for independent contractors.

A pay stub is a record of a person's compensation, detailing earnings and deductions for a specific period. Through our practical knowledge, a typical pay stub includes:

Are pay stubs required for independent contractors ? Absolutely! For an independent contractor, the most crucial elements of your paystub reflect your earnings and any deductions:

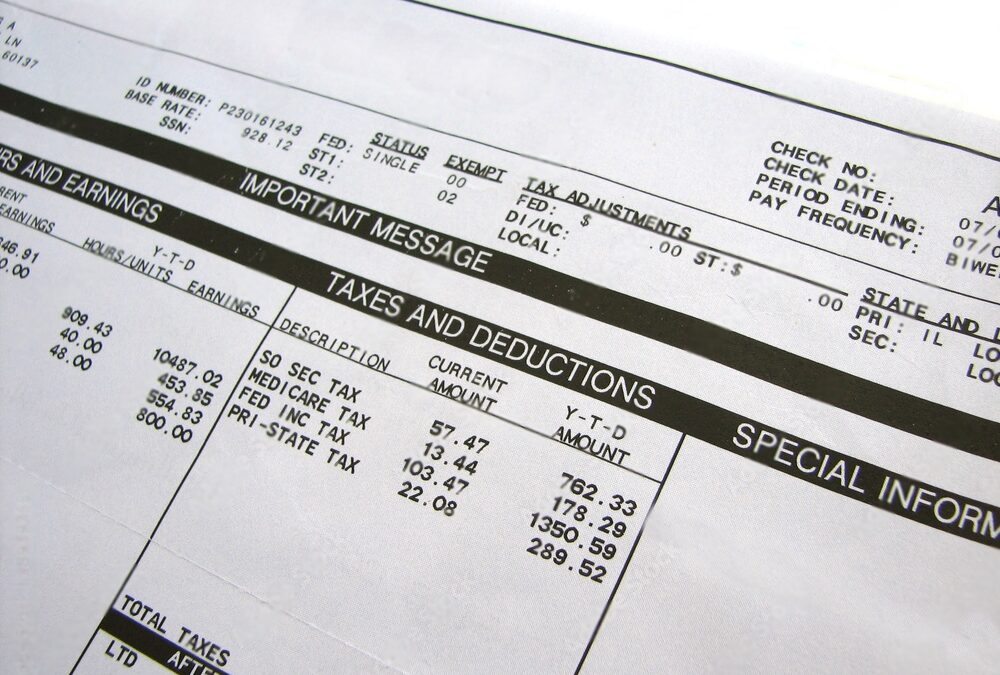

This figure showcases the complete earnings before subtracting any expenses or taxes. The calculation can hinge on various factors, like:

It's essentially your gross income before any financial obligations are addressed.

After subtracting all necessary deductions like taxes, insurance, and other contributions from the gross earnings, what remains is the net pay. This figure is the genuine amount you pocket, reflecting the actual income you can spend or save which impacts your daily financial decisions.

For the self-employed, deductions include any amounts taken out of your gross pay, which can include:

### Pay Stub Software

### Pay Stub Software

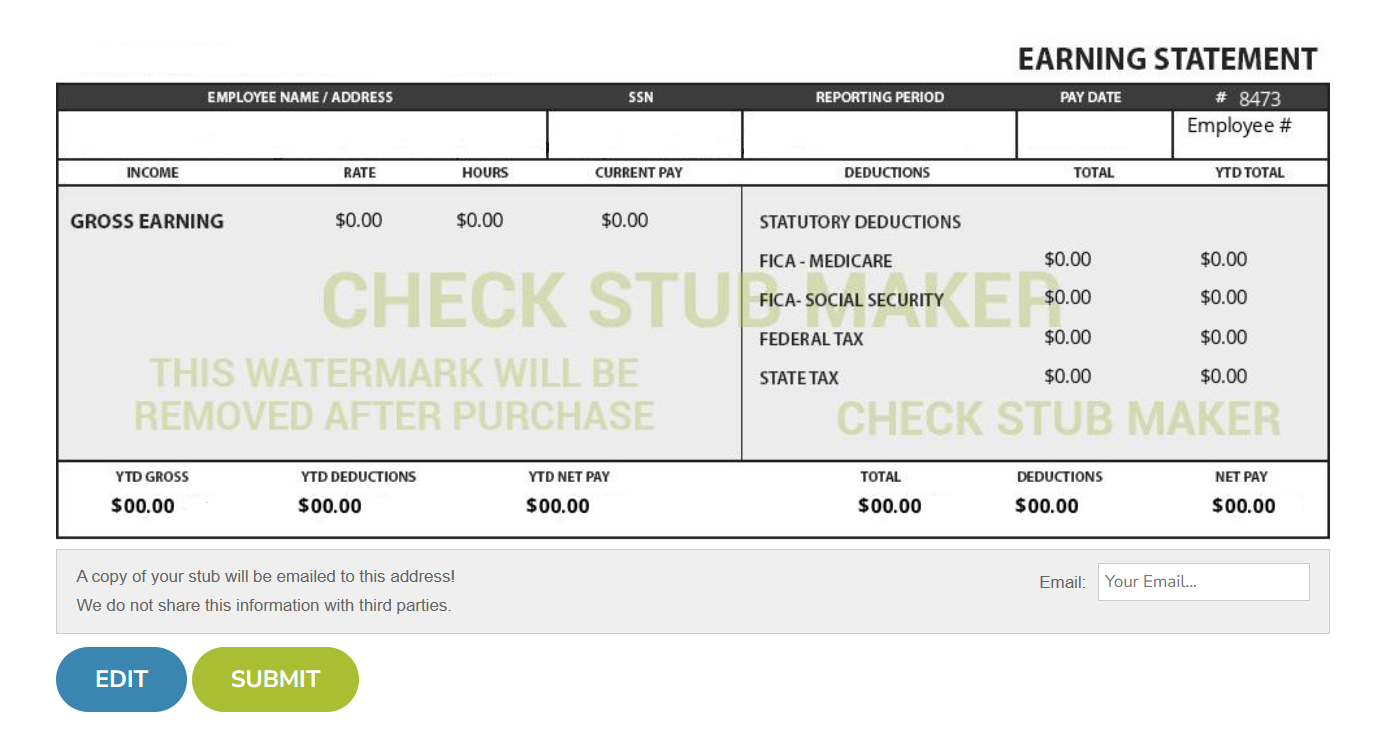

Based on our observations, pay stub software often takes the form of an online self employed paystub generator that allows you to input your earnings, deductions, and other relevant information to generate a professional-looking pay stub. For instance, pay stub software like Check Stub Maker offers user-friendly solutions to help you create pay stubs that are professional within minutes.

Creating a pay stub as an independent contractor involves inputting personal details, specifying payment periods and dates, outlining deductions, and calculating net pay. With this kind of paystub equivalent contractor , it's crucial to ensure the accuracy of all information to avoid discrepancies during tax filing.

Based on our first hand experience, proof of income for independent contractors is essential for various financial transactions and commitments, such as:

Navigating the world of independent contracting and creating your own paystubs? From understanding the essence of contractor pay stubs to the perks of using pay stub makers, our "Paystubs As An Owner" FAQ section will answer all of your burning questions. If you want to learn about making a pay stub when you're self employed or just seeking the best tools for the job, get ready for a crash course in mastering your financial records!

Contractor pay stubs are detailed financial statements for freelancers. They itemize earnings, list deductions like taxes, and cover a set timeframe, validating an independent contractor's income for that period.

As per our expertise, tracking pay stubs is crucial for:

We have found from using this product that when you select a pay stub generator, you should always consider factors like:

Lucky for you, Check Stub Maker checks all these boxes with our comprehensive payroll solution. You have full control over the paystub process from start to finish with our innovative paystub creator . Pay stub makers like ours offer a quick, efficient, and accurate way to generate pay stubs for you and your business. We can help you:

And if you make a mistake while entering your business info, not to worry. You can still edit and preview your paystubs; once you're happy, simply click the ‘Submit' button, and we'll email your brand new paystub to you in a matter of minutes!

We've journeyed through the world of independent contractor paystubs, shedding light on their intricacies and the undeniable need for proof of income in the realm of ‘If I own a business do I get pay stubs?'. Crafting your own pay stub might seem like uncharted territory, but with the right guidance, it's a cinch with Check Stub Maker, your trusted partner in the payroll industry. Our dedication to streamlining payroll for B2Bs, B2Cs, and independent contractors is unmatched. So, as you embark on your entrepreneurial adventure, why not use Check Stub Maker's dynamic paystub generator today? We're here to make payroll simple and stress-free for you, one paystub at a time! Did you find the blog helpful? If so, consider checking out other guides:

In today's fast-paced world, understanding and managing financial documents is crucial for both employers and employees. A key component in this financial landscape are your monthly pay stubs.

Dec 06, 2023

An employee pay stub is a document that accompanies a paycheck, detailing the specifics of an employee's earnings.

Jan 30, 2024

Can you file your taxes with what you have off your pay stub? If you've been wondering how to file taxes with paystub, you've come to the right place.

Oct 04, 2023