What Would Cause a Wrong Year to Date Income on a Pay Stub?

Have you ever glanced at your pay stub and found the year to date (YTD) income figures puzzling and wondered, ‘What would cause a wrong year to date income on a pay stub?'

Dec 06, 2023Understanding paycheck processes can sometimes feel nuanced, especially when terms like “NCA offset” appear. So, ‘What is NCA offset on paystub'?

Understanding paycheck processes can sometimes feel nuanced, especially when terms like “NCA offset” appear. So, ‘What is NCA offset on paystub'? An NCA offset stands for a ‘Non-Cash Award' offset, which refers to the adjustment made on your paycheck when non-cash gifts or awards, such as airline miles or artwork, are taxable. When these non-cash items are considered taxable wages, applicable taxes like income withholding and FICA are subsequently deducted from your paycheck. In this blog post, we at Check Stub Maker will break down how an NCA offset works on a pay stub, what qualifies as a non-cash award, how to process it, and their tax implications on your earnings. Let's dive in! What this article covers:

When you receive a non-cash award from your employer, it's more than just a simple gift—it has significant tax implications. Our research at Check Stub Maker indicates that if the award is taxable, it will be included in your income, and taxes will be calculated based on its fair market value. The NCA offset on your paystub reflects these specific deductions on your paycheck. For instance, if you receive a non-cash award worth $500, and it's taxable, that amount is then added to your wages. From there, income tax and FICA ( Social Security and Medicare taxes ) are determined by that $500 NCA, and the offset ensures these taxes are taken from your paycheck and not from your employer's pocket. This adjustment helps maintain precise payroll records while meeting your tax obligations from start to finish.

A Non-Cash Award (NCA) is any perk, prize, or award given to an employee that isn't in the form of cash. Examples of NCAs include:

These awards are often used as incentives to boost employee morale or reward exceptional performance. However, the IRS views most non-cash awards as supplemental wages as well as taxable fringe benefits.  This means that the fair market value of these awards is added to your taxable income, which means you might owe taxes on them. Our investigation at Check Stub Maker demonstrated that the process of valuing and taxing these awards can vary depending on the type and value of the award, so it's important to check how your specific award is treated. If the award is below a certain value or falls under specific IRS exclusions, it may not be taxable. Nevertheless, if it doesn't meet these exemption criteria, it will be reflected as a taxable item on your check stub . From there, the NCA offset done by your employer will adjust for the necessary tax deductions.

This means that the fair market value of these awards is added to your taxable income, which means you might owe taxes on them. Our investigation at Check Stub Maker demonstrated that the process of valuing and taxing these awards can vary depending on the type and value of the award, so it's important to check how your specific award is treated. If the award is below a certain value or falls under specific IRS exclusions, it may not be taxable. Nevertheless, if it doesn't meet these exemption criteria, it will be reflected as a taxable item on your check stub . From there, the NCA offset done by your employer will adjust for the necessary tax deductions.

Processing a non-cash award involves several steps for correct tax reporting:

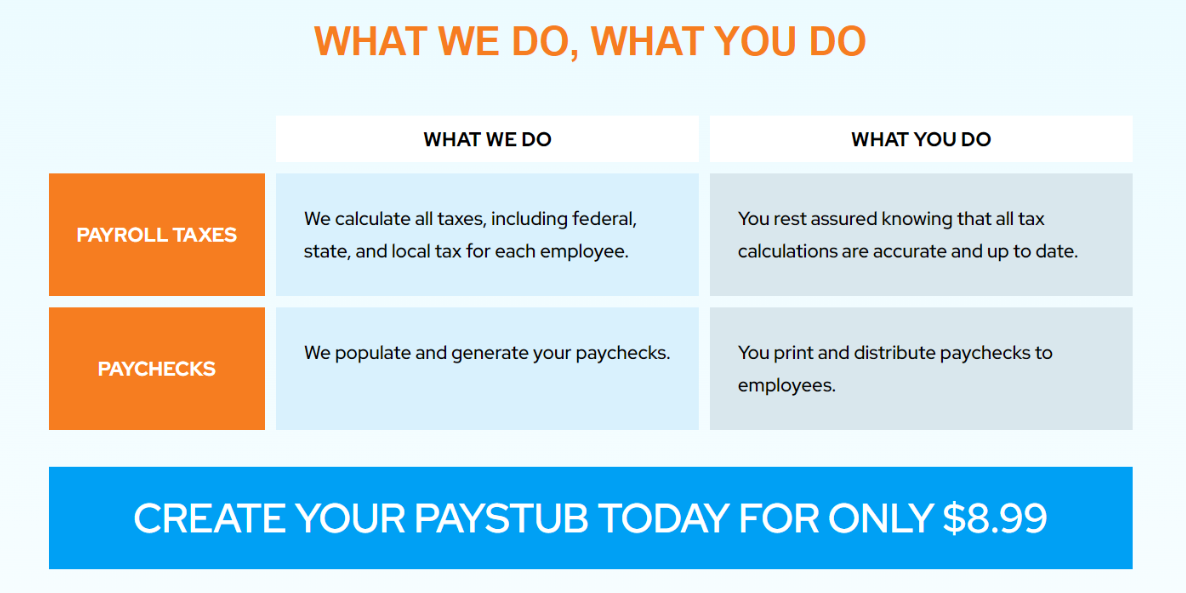

Drawing from our experience, we at Check Stub Maker recommend working closely with your payroll department or utilizing our user-friendly paystub creator to ensure that these awards are processed correctly. That way, you won't be overtaxed and your money-related records can remain consistently accurate.

Generally, non-cash awards that are considered “de minimis” (of minimal value) or classified as an “Employee Achievement Award” in recognition of exemplary work performance aren't taxable. However, awards that exceed the de minimis threshold (which is typically more than 0.25% of its face value after several years) or that aren't specifically excluded by IRS rules must be included in the employee's taxable earnings.

For example, a $50 gift card might be considered de minimis and not taxable. In contrast, a piece of art priced at $500 could be taxed, if either item meets the above requirements. If an NCA is taxable, then its taxable value is added to the employee's gross salary, and the necessary taxes are calculated and deducted via the NCA offset. Based on our observations at Check Stub Maker, it's crucial for both employers and employees to understand these tax rules to avoid unexpected liabilities or penalties from the IRS.

To avoid a federal offset due to underpaid taxes from NCAs, it's important to ensure that all taxable awards are reported correctly and that the appropriate taxes are withheld. One strategy is to increase your tax withholding throughout the year if you expect to receive significant non-cash awards. This way, you can avoid a large tax bill at the end of the year. Another approach is to consult with your payroll department to understand how non-cash awards are being handled and to plan accordingly. Regular communication with your payroll provider can help you stay on top of your tax obligations and prevent any surprises on your paystubs .

In this blog post, we revealed that understanding ‘What is NCA offset on paystub?' is crucial for controlling your earnings and tax obligations consistently and precisely. By staying informed and proactive, you can guarantee that your paycheck always reflects any non-cash awards and avoid unexpected tax issues. For a seamless and accurate payroll process, consider using our pay stub generator to manage all aspects of your company's perks efficiently. With our easy-to-use tools, our gift to you at Check Stub Maker is to ensure that your pay stubs are correct, compliant, and free from any errors related to non-cash awards. If you want to learn more, why not check out these articles below:

Have you ever glanced at your pay stub and found the year to date (YTD) income figures puzzling and wondered, ‘What would cause a wrong year to date income on a pay stub?'

Dec 06, 2023

If your pay period has ended and you need a record of your earnings, you might be wondering, ‘What if your employer doesn't give you a pay stub?'.

Dec 27, 2023

Are you ‘trying to get a loan but my paystubs are just to low’? Let us help!

Jun 06, 2024