What Is STD on Paystub?

Ever wondered "What is STD on paystub"?

Aug 01, 2024In the modern digital landscape, a dependable self employed paystub generator is indispensable. Whether you're an independent contractor or run your own business, the ability to swiftly and accurately generate a paystub is invaluable.

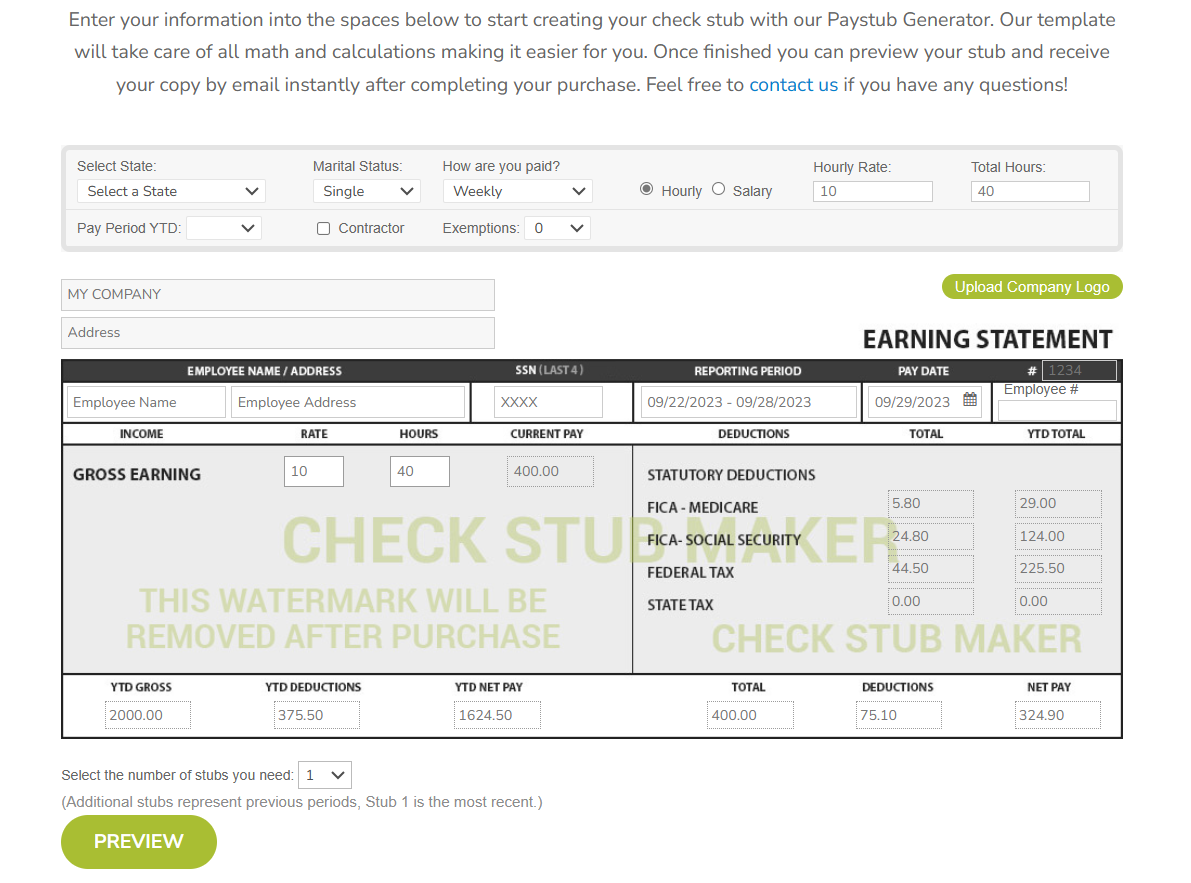

In the modern digital landscape, a dependable self employed paystub generator is indispensable. Whether you're an independent contractor or run your own business, the ability to swiftly and accurately generate a paystub is invaluable. If you're self-employed and need pay stubs , these tools not only save time but also eliminate the risk of manual errors. But what's involved in creating a paystub for the self-employed? Essentially, it's a digital record of your earnings, deductions, and net pay. One of the leading solutions in this domain is Check Stub Maker. Our paystub generator is customizable and easy to use, helping you create accurate paystubs for your business in minutes. Read on for our expert insights into the intricacies of creating paystubs using a self employed paystub generator like ours. What this article covers:

Navigating the world of paystubs is an intricate process, especially for the self-employed. In this section, we'll give you a step-by-step guide for creating accurate and professional paystubs. From inputting precise company details to understanding gross earnings and deductions, we'll outline the essentials of crafting impeccable paystubs in today's digital age with our expert insights.

The accuracy of a paystub hinges on the details. It's crucial to provide exact company information, especially if you're crafting payroll check stubs for independent contractors . After putting it to the test, platforms like Check Stub Maker make this process straightforward. Every piece of data you input lays the groundwork for subsequent calculations, from taxes to other deductions.

Your gross wages represent your total earnings before any deductions. It's the foundation for making your check stubs . Once you've entered the requisite details, our system automatically computes your gross wages, ensuring precision and eliminating the need for manual calculations.

Understanding the correlation between hours worked and pay rate is pivotal. It's not merely about entering numbers; it's about grasping their implications. The product of the hours you've worked and your pay rate yields your gross wages. That's why our intuitive pay stub creator guides you through this, ensuring accurate input and sidestepping common errors every step of the way in the payroll process.

A comprehensive paystub must account for tax deductions, be they federal, state, or local. Given the complexities self-employed individuals often face regarding tax deductions, we help you stay updated with the latest tax brackets and regulations to accurately calculate these reductions.

Apart from taxes, there are other deductions, such as health insurance and retirement contributions. These can differ based on personal preferences and company policies. Digital paystub generators like ours provide insights into prevalent benefits and their corresponding deductions.

Unemployment taxes, though sometimes neglected, are integral to a paystub, especially for the self-employed. A modern paystub generator ensures that these taxes are correctly computed and incorporated into your paystub.

After accounting for all deductions, the remaining amount is your net pay. This figure is vital as it signifies your actual earnings. That means you're spared from intricate calculations, as the payroll system you're using handles the computation to guarantee accuracy.

What's great about a self employed paystub generator is the ability to preview your paystub before finalizing it so that all your details and computations align with your expectations. If any adjustments are needed, our platform facilitates easy modifications with an ‘Edit' option before you click ‘Submit' on final changes in your paystub.

In our digital era, immediacy is paramount. Once your paystub is crafted, we promptly deliver your brand new paystub to your email within minutes of submission. Whether for record-keeping, loan applications, or other needs, your document is readily accessible going forward.

Navigating the world of paystubs can be daunting, especially for the self-employed. With various components and calculations, it's essential to understand the basics. This FAQ section aims to address common questions and provide clarity on the subject.

A pay stub is a document that details an employee's earnings for a specific period, breaking down gross wages, deductions, and net pay. Drawing from our experience at Check Stub Maker , a pay stub serves as a record of payment, ensuring transparency between employers and employees, making it a vital tool for financial planning and verification.

There are three groups of people who need paystubs: employees, the self-employed, and independent contractors and subcontractors.

For salaried employees, pay stubs are more than just a piece of paper; they detail earnings your, deductions, and net pay, offering transparency between you and your employer. By dissecting your compensation, you, the employee, can better manage your finances and verify that you're receiving the correct remuneration from your company.

If you're self-employed and need freelance pay stubs, these financial documents are crucial. They act as proof of income, especially when applying for loans or leases. As per our expertise, paystubs for the self-employed look a little different from typical paystubs for full-time employees at companies. In other words, it's a way for self-employed individuals like yourself to show proof of income, especially when required for financial verifications.

Finally, paystubs for independent contractors act as vital financial records. They not only track earnings and payments but also validate timely compensation. Moreover, pay stubs streamline tax filings, providing a clear record of income, which is essential for accurate tax assessments and future financial planning on your part.

Mistakes happen, and it's essential to have the flexibility to correct them. That's why platforms like Check Stub Maker help you edit paystubs both before and after previewing. If you spot any inaccuracies while in ‘Preview' mode, they can be easily rectified by clicking the ‘Edit' button, ensuring your final document is error-free before you hit ‘Submit'.

Absolutely! Based on our first hand experience, personalizing your pay stub can make it more aligned with your brand or preferences. For instance, with Check Stub Maker, you can choose from a variety of professional templates and add your company logo at the top to make it unique to your business needs. A personalized pay stub not only looks professional but also resonates better with the recipient.

In the realm of payroll and financial documentation, having a reliable self-employed paystub generator is invaluable. Whether you're an employer, an independent contractor, or someone getting paid check stubs from your own LLC , understanding the intricacies of pay stubs is crucial. At Check Stub Maker , we're committed to simplifying the payroll process for both B2Bs and B2Cs. With our expertise and user-friendly platform, creating accurate and professional pay stubs when self employed has never been easier. So, why wait? Dive into the world of digital pay stubs with Check Stub Maker and experience the difference! Did you find the blog helpful? If so, consider checking out other guides:

Ever wondered "What is STD on paystub"?

Aug 01, 2024

Paycheck stub making 15/hr is a straightforward process that can be completed quickly and easily using an online pay stub generator.

Oct 04, 2024

What is FTD on teacher paystub? That is a valid and common question in the education sector. FTD stands for Federal Tax Deposits, which your employer pays to...

Aug 31, 2023