What Does TPAF Contributory Insurance Mean on a Pay Stub?

What does TPAF contributory insurance mean on a pay stub? It's a question we've heard countless times. And today, we're on a mission to answer it for you.

Aug 31, 2023If you're new to payroll processes, you may be thinking about check stubs meaning and wondering, “What do check stubs look like?” This is a common question for many employees and employers alike.

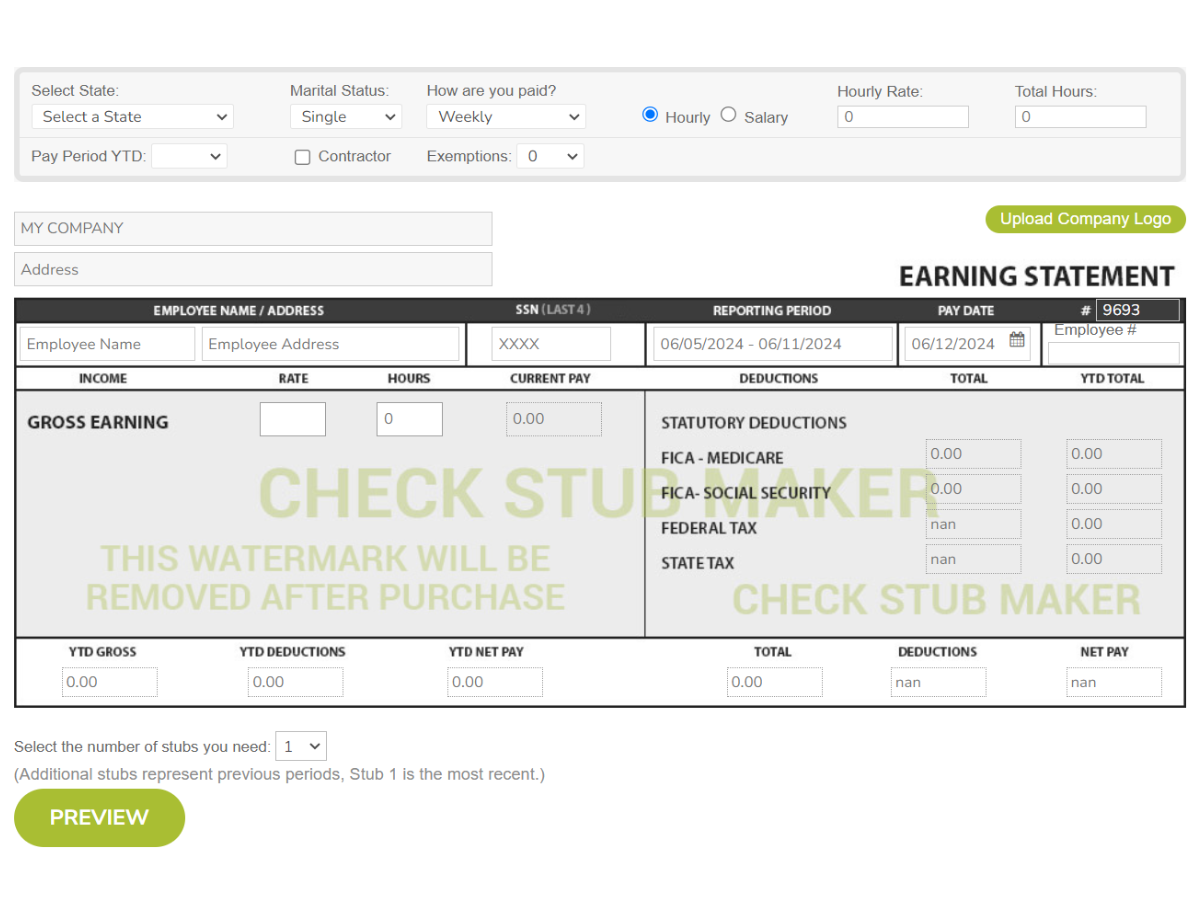

If you're new to payroll processes, you may be thinking about check stubs meaning and wondering, “What do check stubs look like?” This is a common question for many employees and employers alike. A check stub, also known as a pay stub, typically contains three main sections: employee and employer information, earnings, and deductions. At Check Stub Maker , we understand the importance of clear and accurate pay stubs in financial processes. With the aid of our pay stub creator , we can guide you through the intricacies of pay stub components and creation. In this article, we'll explore the anatomy of a check stub, including employer and employee details, gross wages, taxes and deductions, back pay, and net income. We'll also show you how to create your own check stubs with our user-friendly tools. What this article covers:

Based on our first-hand experience, we've found that a typical check stub, or paystub v. pay stub in layman terms, contains several key elements.

The top section of a check stub usually displays essential details about both the employer and the employee, such as:

This information serves as a record of employment and helps with proper identification for tax purposes.

Our findings show that the gross income section is a crucial part of any pay stub. It outlines the total amount earned before any deductions are made, including:

Understanding your gross wages is essential for budgeting and financial planning. That's where we at Check Stub Maker come in when you make paystubs with us.

This section of the pay stub details all the taxes, deductions, and contributions taken from your gross pay, including:

Each deduction is typically listed separately with the corresponding amount withheld on your pay stubs.

Back pay refers to compensation owed to an employee for previous work that wasn't properly paid at the time. While not present on all paystubs , your ‘back pay' may appear on them if your employer owes you for any past work completed on your part. Back pay often arises due to:

If employers fail to compensate employees for all hours worked, including overtime or bonuses, they may be liable for back pay. This payment is often mandated by labor laws such as the Fair Labor Standards Act (FLSA). In some cases, employers are required to issue back pay; employees may need to file claims to recover these wages within a period of two years when the violation first occurred.

The net income section of a check stub shows the final amount an employee takes home after all deductions are made, including:

This figure, also known as ‘take-home pay', reflects the actual amount deposited into the employee's account via paycheck or direct deposit at the end of a specific pay period. It's calculated by subtracting all deductions from the gross pay. This ensures employees know how much money they can spend or save after mandatory tax withholdings.

At Check Stub Maker, we offer a simple and efficient solution for helping you generate pay stubs. With our online pay stub generator , you can:

Our analysis of this product revealed that you can ensure your financial paperwork contains all the necessary info included on pay stub while maintaining compliance with payroll regulations in your state.

In this article, we revealed that check stubs detail everything from employer and employee information to gross income, taxes, deductions, and net pay. We also touched on the importance of accurate pay stubs and how to create them with our user-friendly digital tools. That's exactly why we're committed to simplifying financial processes for businesses of all sizes and self-employed individuals. Ready to streamline your payroll? Try our paystub creator at Check Stub Maker today and experience the difference it can make for your business! Did our blog meet your needs? You might also find our other guides helpful:

What does TPAF contributory insurance mean on a pay stub? It's a question we've heard countless times. And today, we're on a mission to answer it for you.

Aug 31, 2023

Investors and business owners alike care a lot about retained earnings.But what are they?In this article, we’ll explain what retained earnings are, what a st...

Jul 15, 2021

Have you ever wondered, "What does WA SPAA on pay stub stand for?” Well, you're not alone.

Aug 28, 2024