Do You Need Pay Stubs for Taxes?

Navigating the maze of tax season can be daunting, especially when you're faced with the burning question: "Do you need pay stubs for taxes?"

Oct 04, 2023Have you ever wondered, "What is MIP on my check stub?"

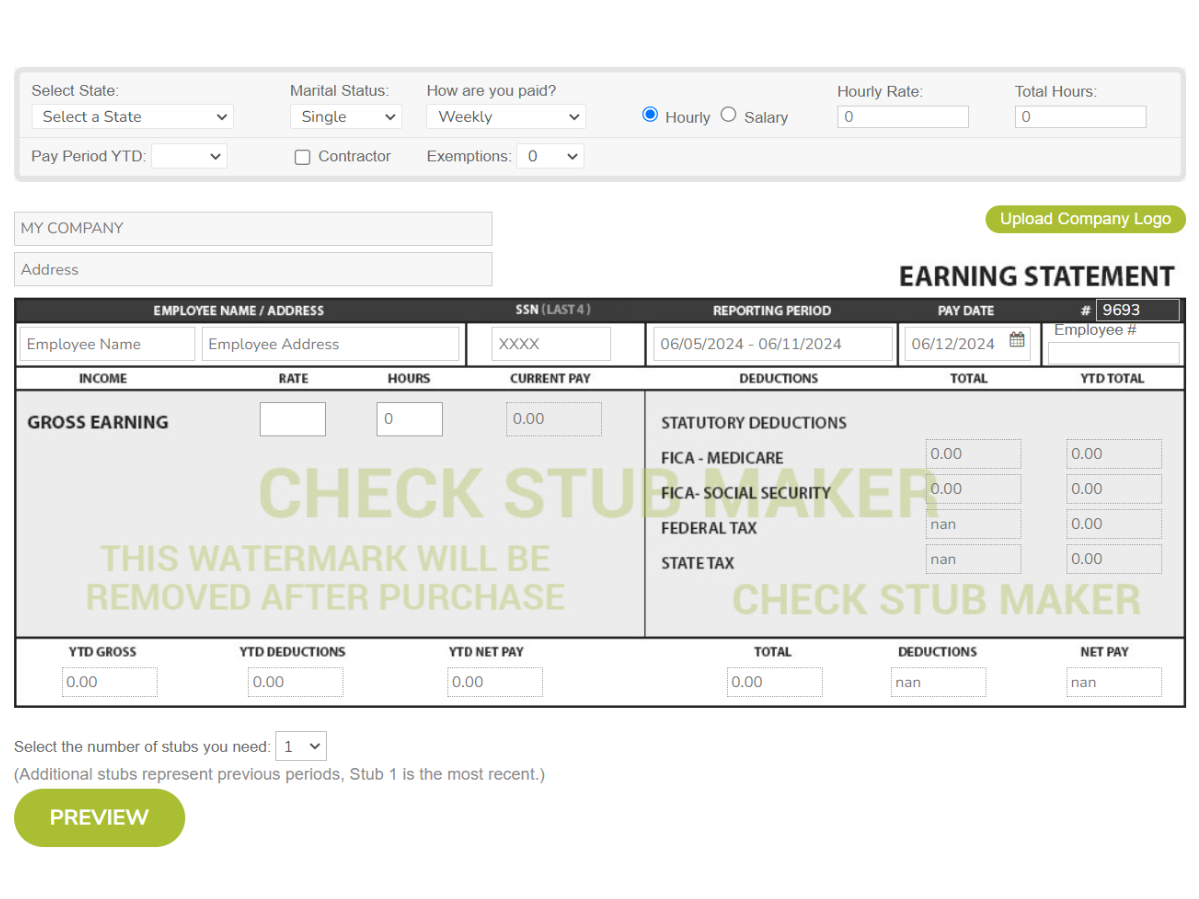

Have you ever wondered, "What is MIP on my check stub?" Essentially, ‘MIP' stands for ‘Member Investment Plan', a retirement savings plan that employers and employees often contribute to equally, which is reflected on pay stubs. As experts in the payroll process, we at Check Stub Maker are here to break down your MIP retirement benefits while viewing them on your paystubs . In this blog post, we'll explore what an MIP is, how it works, its various types, and vesting periods. Let's demystify this important aspect of your financial future!

A Member Investment Plan (MIP) is a type of retirement plan reflected on your check stub , designed to help you save for the future. It's a structured way for employees to set aside a portion of their income, often with the added advantage of employer contributions. Our investigation at Check Stub Maker demonstrated that MIPs offer employees a reliable way to save for retirement, while employers attract and retain talent through competitive benefits packages.

The Member Investment Plan was first introduced in the late 1980s as part of a broader initiative to encourage employee savings and monetary stability. MIPs are governed by specific laws and regulations that ensure transparency and protect participants' interests. The introduction of MIPs has marked a shift in how companies approach employee remuneration, moving beyond just salary. Now, they include the ability to maximize returns on investments as well as long-term financial planning.

In essence, employees contribute a portion of their earnings to an MIP, often through automatic deductions. Many employers sweeten the deal by offering to match employee contributions up to a certain percentage, effectively providing free money towards retirement annuities. Based on our observations at Check Stub Maker, we've noticed that MIPs typically come in a variety of investment options, such as:

The contributions grow tax-deferred, meaning you won't pay taxes on the earnings until you withdraw the funds when you retire. It's worth noting that some payroll paperwork may even show an RSU vest on paystub . This refers to Restricted Stock Units vested as part of your employer's compensation package when you invest in company stock.

MIPs are usually available to full-time employees who've been with a company for a certain amount of time. Some companies offer automatic enrollment, while others require employees to opt-in voluntarily. It's worth noting that part-time or temporary employees may not be eligible for MIP participation. However, this varies from company to company, and some progressive employers are extending retirement benefits to a wider range of workers. If you're unsure about your eligibility, it's always best to check with your HR department or payroll manager. They can also explain any other deductions or contributions you might see, such as an ESPP refund on pay stub , which relates to Employee Stock Purchase Plan refunds.

The most common MIPs found on check stubs are:

Our findings show that defined contribution plans in particular have become increasingly popular in recent years due to their flexibility and potential for higher returns.

Based on our first-hand experience at Check Stub Maker, vesting periods for MIPs generally range from 3 to 5 years. During the vesting period, employees gradually gain ownership of the employer contributions. For example, you might be 20% vested after one year, 40% after two years, and so on. Once your MIP is fully vested, you'll have complete ownership of all the funds in your account, including employer contributions, even if you leave the company.

Final Average Compensation (FAC) is a critical factor in determining MIP retirement perks, especially in defined benefit plans. FAC is typically calculated as the average of your highest salaries over a set number of years - usually the last few years of your career. The calculation method can significantly impact your pension amount with a higher FAC resulting in a larger retirement benefit. It's important to note that some MIPs may include:

Understanding how your plan calculates FAC can help you make informed decisions about your career and retirement planning. You might also see an EE purchase on pay stub , which refers to the Employee (EE) purchases or portion of contributions you've made to your specific MIP. With us at Check Stub Maker, you make paystubs and easily see the automatic breakdowns of compensation related to your MIP.

In this blog post, we explored what a Member Investment Plan means on your check stub, how it works, and why it's a valuable retirement savings tool that provides you with financial security and peace of mind. At Check Stub Maker , we're committed to helping you understand every aspect of your paycheck, including your retirement annuity. Ready to take control of your payroll process? Try our user-friendly pay stub generator today and make managing your money in your golden years a breeze! If you want to learn more, why not check out these articles below:

Navigating the maze of tax season can be daunting, especially when you're faced with the burning question: "Do you need pay stubs for taxes?"

Oct 04, 2023

The etymological meaning of the word “payroll” is a simple one: the prefix, “pay” meaning currency and the suffix, “roll” meaning to whom the payment goes to...

Aug 17, 2022

When it comes to managing financial records, a common question arises: "How long should you keep pay stubs before shredding them?"

Jan 30, 2024