What Is Hospit on My Paystub?

Have you ever wondered, "What is Hospit on my paystub?" Many employees encounter this term and find themselves puzzled.

Aug 28, 2024Understanding ‘Why is it important to review the information on a paycheck stub?' is crucial for financial management and accuracy in earnings.

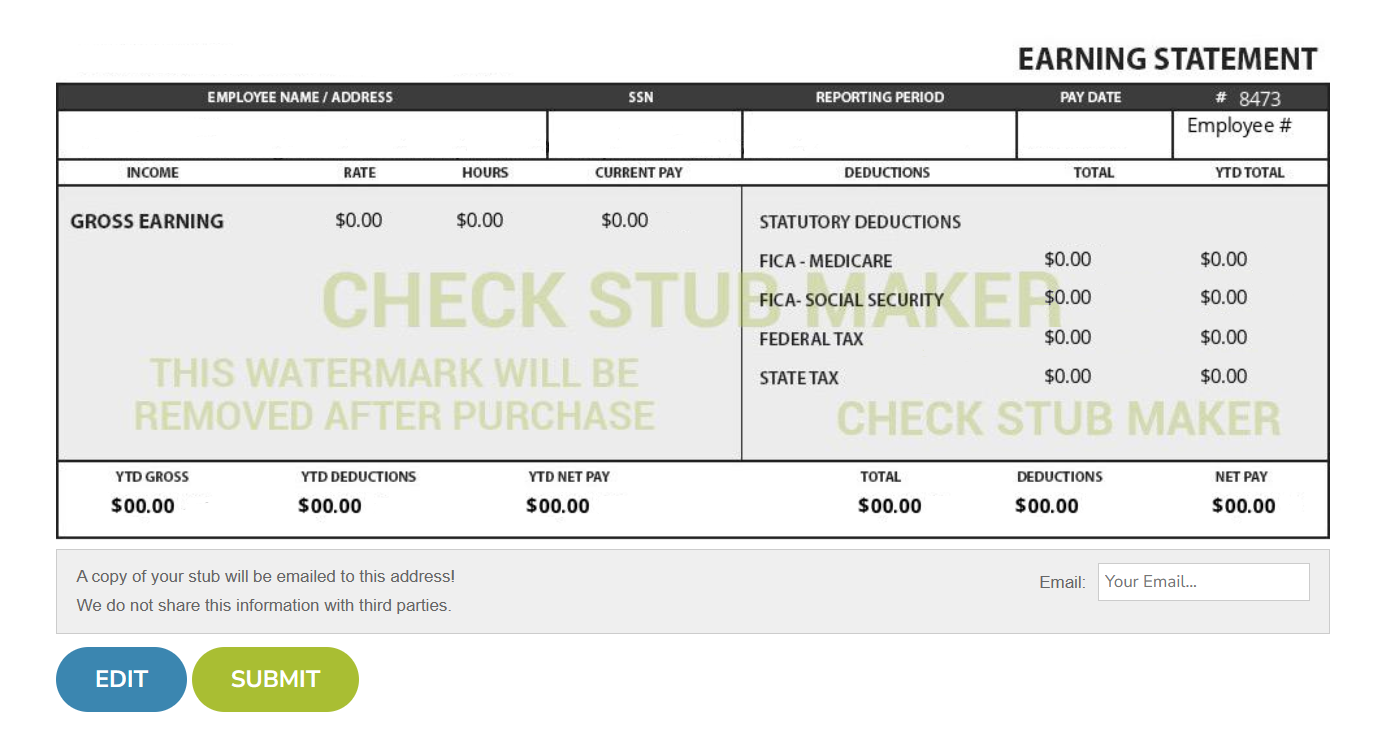

Understanding ‘Why is it important to review the information on a paycheck stub?' is crucial for financial management and accuracy in earnings. It's not just about being able to see your pay stubs online and verify how much you've earned; it's also about ensuring everything from your taxes to benefits is properly accounted for too. In this blog post, we at Check Stub Maker will explore important reasons to review the information in your paycheck stubs - from correct withholding during tax season to monthly budgeting. Let's dive in!

There are a number of reasons why you should always check your pay stub or pay check .

Reviewing your paycheck stub allows you to tailor your taxes effectively. Through our practical knowledge, understanding your tax withholdings and ensuring they're accurate can prevent unexpected tax bills or hefty refunds. At Check Stub Maker, we can help you with identifying these details easily, ensuring your taxes are precisely what they should be when you create pay stubs with us.

Correct withholding is essential for financial stability, helping you ensure that the right amount is being withheld for taxes. This not only helps in avoiding surprises at tax time but also aids in better financial planning throughout the year.

Inaccuracies in paycheck stubs aren't uncommon, particularly in the employer verification pay stubs process. Our findings show that reviewing your pay stub regularly can help catch errors in:

This vigilance helps in ensuring you're paid exactly what you're owed according to your pay stub hours per week . With Check Stub Maker, we do all the heavy lifting and calculations for you, ensuring that your paycheck stubs accurately reflect your financial information.

Understanding your total tax load is vital for financial planning. This means being aware of how much is taken out for federal, state, and local taxes. With our pay stub creator , you can easily pinpoint your tax load on your check stubs , helping you plan your finances more effectively each year.

Keeping track of your working hours and paid time off is essential. Our investigation demonstrated that reviewing your pay stub can verify that you're being compensated for all the hours you've worked, including any overtime. Additionally, it can also ensure that your paid time off is correctly recorded.

Benefits deductions, such as health insurance, retirement contributions and employee medicare on pay stub , are a significant part of your paycheck. Always verify these deductions to ensure they're correct and not higher than they're supposed to be. This way, you can avoid negatively impacting your financial planning and budgeting.

Drawing from our experience, effective budgeting starts with having a clear understanding of your paycheck. Knowing exactly how much you earn after deductions plays a crucial role in managing your finances. With our detailed paystubs at Check Stub Maker, we make it easier for you to plan and budget your earnings accordingly.

If you're juggling multiple jobs, it's important to review each pay stub to ensure accuracy across all your employment sources. This is why employers should mail paystubs to employees in instances like this. Alternatively, our services allow you to manage records of multiple income streams effortlessly with our highly accurate online paystub maker .

In this article, we've answered the question, ‘Why is it important to review the information on a paycheck stub?' As per our expertise, regularly reviewing your paycheck stub is essential for financial accuracy and planning, ultimately ensuring that your records are always current. We invite you to try our expert payroll services at Check Stub Maker for a clear and hassle-free experience in managing your earnings. Keep your finances in check with our reliable and user-friendly pay stub creator today! If you want to learn more, why not check out these articles below:

Have you ever wondered, "What is Hospit on my paystub?" Many employees encounter this term and find themselves puzzled.

Aug 28, 2024

!Top-Rated Check Stub Creatorhttps://checkstubmaker.com/wp-content/uploads/2018/12/top-checkstubmaker-1-300x200.jpg Business owners, business managers, and o...

Dec 24, 2018

Talk of digital transformation seems to be everywhere these days, but what does it mean to go digital? When you want to watch a movie, you can do it online. ...

Jun 20, 2017