What Does TPAF Contributory Insurance Mean on a Pay Stub?

What does TPAF contributory insurance mean on a pay stub? It's a question we've heard countless times. And today, we're on a mission to answer it for you.

Aug 31, 2023When you have an ‘employer asking for pay stub but I got paid in cash' scenario, it can create a unique challenge.

When you have an ‘employer asking for pay stub but I got paid in cash' scenario, it can create a unique challenge. This scenario is common for many workers, especially those in industries where cash payments are standard, like fast food restaurants or beauty parlors. In this blog post, we'll explore effective ways to demonstrate proof of income when you've been paid in cash and a check stub is not provided . Additionally, we'll discuss how to obtain pay stubs from us at Check Stub Maker in such situations, ensuring you're prepared for any financial verification your employer or other entities might require. Let's get started! What this article covers:

Luckily for you, we have ten excellent ways to show your proof of income, especially when you get paid in cash or cannot get w2 or last pay stub at all .

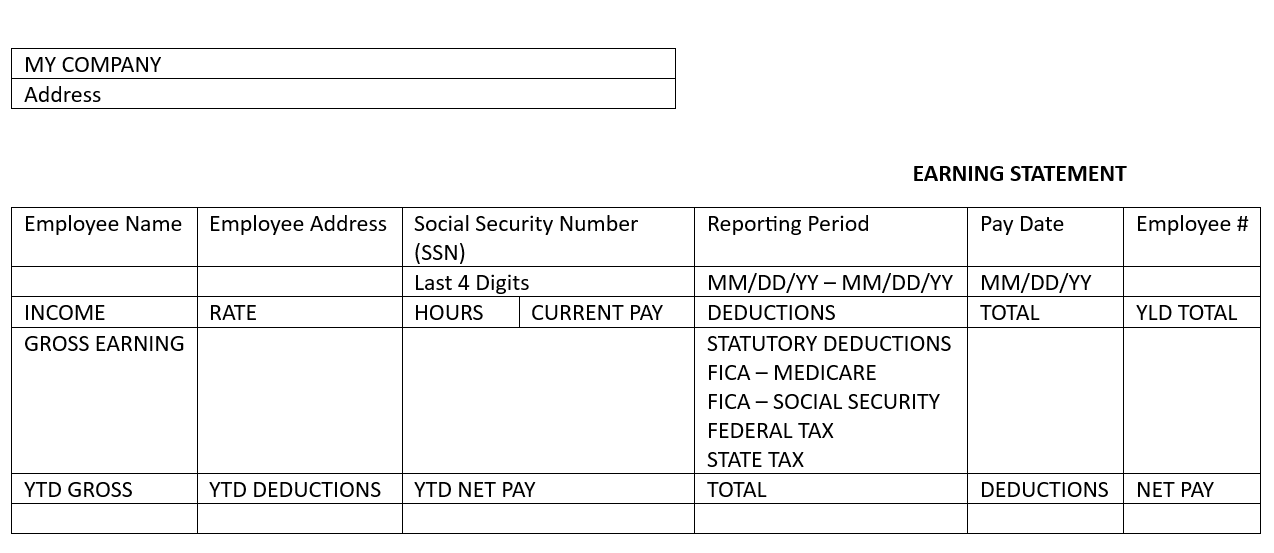

One practical solution is to create your own paystub. At Check Stub Maker, we have customizable templates that you can fill out and save each time you receive a payment. Based on our first hand experience, paystubs should include the following:

Keeping these documents organized and stored safely is crucial for future reference, especially during tax season.

Maintaining a digital record of your earnings through an updated spreadsheet is another effective method. This approach allows for easy tracking and searching for specific payments. However, we recommend keeping printed backups as a precaution against potential computer issues. This is easy to do when you make paystubs with us at Check Stub Maker; when you're done, just download and print them afterwards.

If you prefer a more automated solution, bookkeeping software can be invaluable. These programs not only make recordkeeping easier but are also extremely versatile. As indicated by our tests, they integrate well with tax filing and payroll software, like our paystub generator , making the process simpler when tax season comes around.

Regularly depositing your cash payments into a bank account and printing the bank statements can serve as an automatic record of your income. This method is straightforward and provides a clear financial trail.

A simple yet effective method is to document each transaction in writing. Based on our observations, having both parties sign this documentation can add a level of formality and verification to the process.

Using receipt books to record each payment received is another tangible way to track your cash income. To confirm the transactions, clients can also sign these receipts.

Your tax documents, especially if prepared with the help of an accountant, can act as official proof of income. These documents are detailed and verifiable, making them a reliable source for proof of income.

Several mobile apps are designed to help self-employed individuals and others who receive cash payments track their income. While it's convenient, it's still recommended to maintain backups in case of software issues.

An employment verification letter or proof of income letter can certify your cash payments. Drawing from our experience, this document should include details about the following:

If you're working for an employer who pays you in cash, an employment contract can be used as proof of income. This document should detail the payment terms and be notarized for added legitimacy. While being paid in cash might pose challenges to proving income, various methods, from creating paystubs to using bookkeeping software, can effectively address this issue. It's essential to maintain accurate records and understand the legal implications of cash payments. Additionally, understanding how to obtain pay stubs from direct deposit can be beneficial for those transitioning from cash to other forms of payment.

Next, we'll look at the most common questions we get asked here at Check Stub Maker about what to do when you don't have paystubs for your financial transactions.

If your employer refuses to provide you with pay stubs, it's important to understand your rights. Do employers have to give check stubs ? While the Fair Labor Standards Act (FLSA) stipulates that employers should keep records of wages and salaries , the provision of pay stubs varies by state. If you don't receive your pay stubs, you can request them in writing and, if necessary, file a complaint with the Wage and Hour Division to get department of labor paystubs . Our findings show that employers who fail to comply may face legal consequences.

As an independent contractor, obtaining pay stubs from a previous employer can be challenging. If they refuse to provide them, you can contact their accounting department, Human Resources, or seek legal assistance. Remember, you have a right to access these documents, but the process may involve some fees, especially if you request documentation from your previous employer or enter into legal proceedings against them.

When a company pays employees with personal checks without providing pay stubs, it may still be within legal bounds, depending on state laws. However, our research indicates that some states require employers to provide minimal information on pay stubs, such as mandatory deductions and gross pay. It's crucial to understand the specific regulations in your state to reduce the wait time on pay stub .

Navigating the complexities of an 'employer asking for pay stub but I got paid in cash' scenario can be challenging. This article has explored various ways to show proof of income when paid in cash and how to obtain pay stubs from your employer in these instances. Remember, each state has its own laws regarding pay stubs, and it's important to be aware of your rights and options as an employee. For those in need of reliable and efficient payroll services, we encourage you to try Check Stub Maker. Our user-friendly pay stub generator offers a hassle-free way to create and manage pay stubs, ensuring you're always prepared for any financial verification needs. So, what are you waiting for? Visit Check Stub Maker today and experience the ease of managing your payroll with us! If you want to learn more, why not check out these articles below:

What does TPAF contributory insurance mean on a pay stub? It's a question we've heard countless times. And today, we're on a mission to answer it for you.

Aug 31, 2023

!Deductions – What Are They and What’s Their Purpose?https://checkstubmaker.com/wp-content/uploads/2022/09/Deductions-300x201.jpg https://checkstubmaker.com/...

Jul 13, 2022

Facing the ‘how can employee correct the pay stub if the employer ran it wrong' conundrum can be a major headache.

Dec 27, 2023