What Is LTD on Paystub?

When you first read your pay stub, you might find several abbreviations that can be confusing, like ‘LTD'. So, ‘What is LTD on paystub' precisely?

Aug 01, 2024If your pay period has ended and you need a record of your earnings, you might be wondering, ‘What if your employer doesn't give you a pay stub?'.

If your pay period has ended and you need a record of your earnings, you might be wondering, ‘ What if your employer doesn't give you a pay stub ?'. The legality of not providing pay stubs differs from state to state. With that said, you still have the right to obtain comprehensive information about your wages and find out why ‘my company will not give me a pay stub' as an employee. In this article, we at Check Stub Maker will explore the reasons behind not receiving pay stubs, the legalities surrounding this, and the practical steps you can take if you find yourself without this crucial payroll document. Let's dive in! What this article covers:

There are a number of reasons why employers might not give their employees pay stubs, and they're not always a cause for concern.

Sometimes, the absence of a pay stub or pay stubs are incorrect can be due to simple administrative errors or oversights. Based on our observations, employers might forget to send them, or there could be a glitch in the payroll system. This is often the case in smaller companies that don't have a dedicated HR department.

In an effort to cut costs, some employers might choose not to issue physical pay stubs, especially if they pay salaries via direct deposit. While this might be seen as a cost-effective measure, it can leave employees without a tangible record of their earnings and deductions.

In certain states, like Arkansas and South Dakota, there is no strict legal requirement for employers to provide pay stubs to their employees. This can lead to situations where employers opt not to issue them, either due to ignorance of the law or a deliberate choice to withhold this information.

Our investigation demonstrated that there are three steps you can take to get pay stubs from your employer.

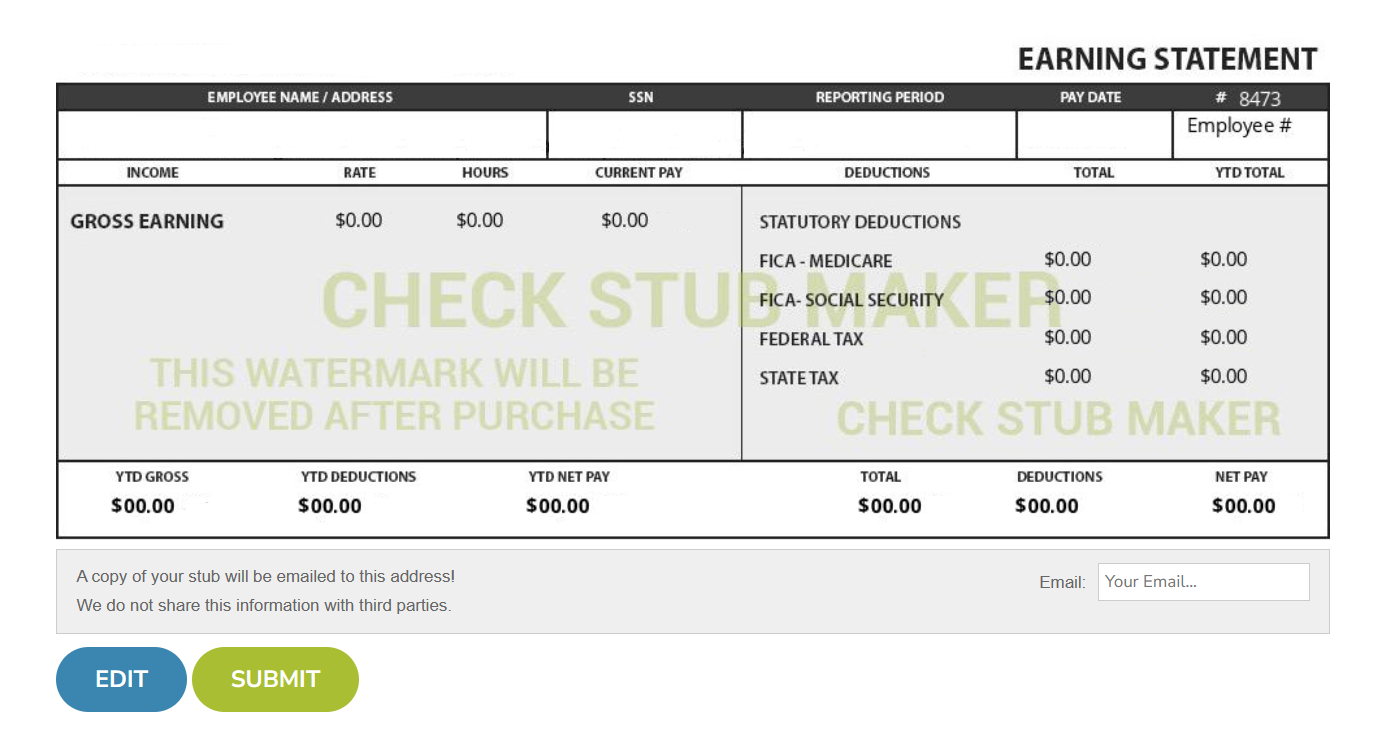

First, check if your employer has an online system where pay stubs are uploaded. Many businesses now use digital platforms for payroll data, like Check Stub Maker, which employees can access whenever they want.

If you can't find your pay stubs online, the next step is to directly request them from your employer. It's best to make this request in writing and keep a record of your communication.

After making your request, give your employer a reasonable amount of time to respond. If they fail to provide the pay stubs within this period, you may need to take further action, such as contacting your state's labor department. Not receiving a pay stub from your employer can be a source of significant concern. However, by understanding the possible reasons behind this and knowing the steps to take, you can effectively address the issue. At CheckStub Maker, we're committed to helping you navigate these challenges and ensure you have the information you need regarding your earnings and deductions.

In this section, we'll address frequently asked questions related to the legality of not supplying employees with paystubs. Instead, you can use excellent paystub alternatives like our paystub generator if you find yourself in a particularly problematic payroll scenario.

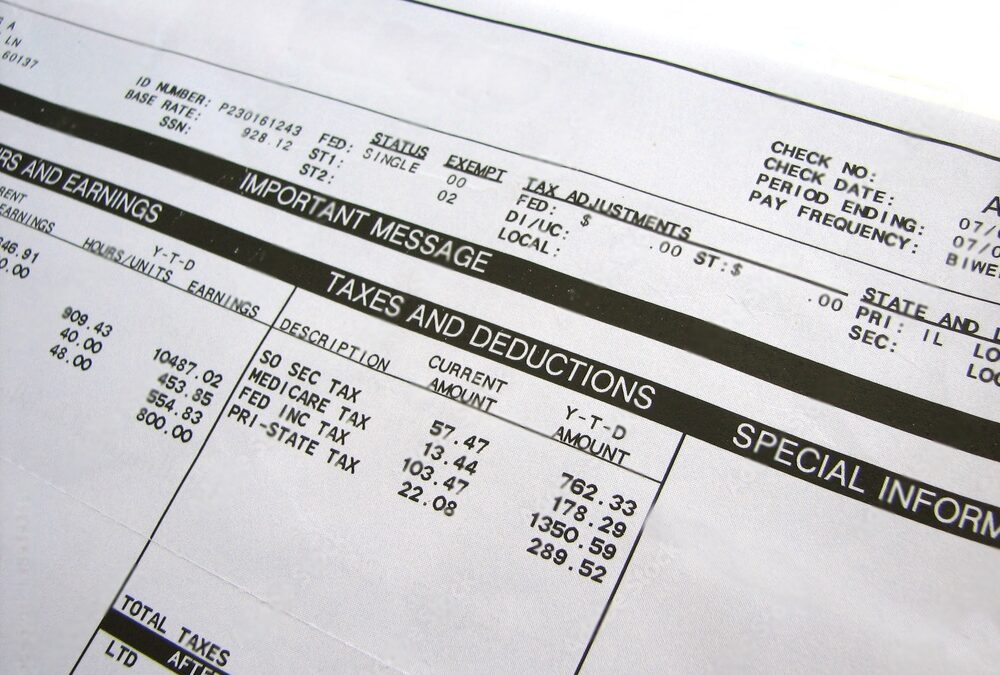

According to the Fair Labor Standards Act (FLSA), there is no federal mandate requiring employers to provide pay stubs. However, the FLSA stipulates that employers must keep accurate records of hours worked and wages paid . In many states, there are specific laws requiring employers to provide access to pay stubs, whether a paper copy of pay stub vs emailed copy For instance, states like California, Colorado, and Connecticut require employers to provide a pay stub that is printed or written; conversely, other states allow for electronic versions, like our paystubs at Check Stub Maker.

Under the Equal Pay Act of 1963 (EPA) , certain states have implemented salary history bans that make it illegal for potential employers to ask for your pay stubs. Our findings show that this has been done to protect employees against potential discrimination based on age, gender, ethnicity, or religion with staffing company asking for paystubs . With that said, only some states currently have salary history bans, which makes it perfectly legal for potential employers operating in other states with non-salary-history-bans to request pay stubs of employees to verify their previous employment and salary history. While you're not obligated to provide this information, it's a common practice during the hiring process. If you're uncomfortable sharing your pay stubs with a potential employer, you have the right to decline, but this may impact their hiring decision.

When a company pays employees with a personal check without providing a pay stub, it can create challenges for employees in understanding their financial transactions. While this practice isn't illegal in states that don't require pay stubs, it can lead to confusion and potential disputes over wages and deductions. As an employee, you have the right to request detailed information about your earnings. If your employer doesn't give you pay stubs, you can ask for an itemized statement of your wages and deductions for your records.

If your employer doesn't provide you with pay stubs because your paystubs required, paid under the table , you can use other documents to verify your income and employment. These alternatives include:

Understanding your rights and options regarding pay stubs is crucial. While the legality of not issuing pay stubs varies by state, you still have the right to access detailed information about your earnings as an employee and guard yourself against an error in check and check stub . If you're facing challenges with obtaining pay stubs, consider using alternatives like tax forms, bank statements, or our self-created pay stubs at Check Stub Maker. Whether you're an employer looking to streamline your payroll process or an employee needing to create accurate pay stubs, we're here to make obtaining paystubs a breeze. So, try out our pay stub creator at Check Stub Maker today for a hassle-free payroll experience! If you want to learn more, why not check out these articles below:

When you first read your pay stub, you might find several abbreviations that can be confusing, like ‘LTD'. So, ‘What is LTD on paystub' precisely?

Aug 01, 2024

Many factors influence the success of any business, but productivity is arguably the most important one. How your employees perform can be directly correlate...

Jan 23, 2023

Are you wondering 'How do landlords verify pay stubs'? Understanding the verification of pay stubs to ensure that they're not fake is crucial for landlords during the lease agreement process.

Apr 24, 2024