In today's fast-paced work environment, the importance of transparency in payroll cannot be overstated. Within this particular professional space, there is a common yet critical issue many employees face: employers not giving pay stubs. What if your employer doesn't give you a pay stub ? Understanding your rights and the available resources is key to ensuring you are fairly compensated and informed about your earnings. In this article, we'll explore the legal obligations of employers regarding pay stubs, the steps you can take if you find yourself without pay stubs, and how we at Check Stub Maker can assist in these scenarios with our handy pay stub generator . Let's get started! What this article covers:

Do Employers Have to Provide Pay Stubs?

Does an employer have to provide a pay stub ? The laws governing pay stubs differ across the United States, with some states mandating that employers must provide a physical or electronic pay stub, while others do not have these requirements.

What If My Employer Doesn't Give Me A Pay Stub?

If you find yourself without a pay stub, it's crucial to first understand the specific laws in your state related to your employer's legal responsibilities in this respect. If you discover that your employer has failed to provide you with pay stubs and is legally obligated to do so, we recommend contacting your state's labor department so they can assist you with the next steps. In some cases, employees are allowed to take legal action against employers who fail to give them their pay stubs in a practical format (paper or electronic) or within a reasonable time frame. For instance, in California, employers can be fined up to $4,000 for failing to provide employees with pay stubs.

What If My Salary Is Direct Deposited And I Don't Get A Pay Stub?

Even if you receive your salary through direct deposit, you're still entitled to a pay stub in certain states. For instance, in California and Alaska, our findings show that employees are entitled to receive pay stubs from their employers that are in paper or electronic form.

Can A Previous Employer Refuse To Provide Past Pay Stubs?

Your right to access past pay stubs depends on specific state laws. Some states require employers to retain payroll records for up to three years, according to provisions in the Fair Labor Standards Act (FLSA) . In these scenarios, you may have the right to request access to these records from your previous employer.

What Are Some Reasons That Employers Don't Give Their Employees Pay Stubs?

There are various reasons why an employer might not provide their employees with pay stubs. These can range from a lack of understanding of legal requirements to attempts at obscuring actual hours worked or wages paid. In some cases, it's simply an oversight or a result of inadequate payroll systems.

What Are The Consequences Of Breaking Pay Stub Requirements?

Employers who fail to comply with state laws regarding pay stubs can face significant legal consequences. Our research indicates that this can include:

- penalties

- fines

- legal action from employees in some cases

Employers need to understand their legal obligations to avoid these payroll-related repercussions.

Can I Sue My Employer For Not Giving Me Pay Stubs?

The possibility of suing an employer for not providing pay stubs also depends on particular state laws. In some states, employees have the right to sue their employer for damages if they don't comply with pay stub requirements. However, it's advisable to seek legal counsel to understand your rights and the best course of action in your specific situation. As an employee, it's crucial to be aware of your rights and the laws in your region. For instance, in New York, employees can claim damages up to $5,000 from employers who fail to provide them with pay stubs. For employers, understanding and adhering to these laws isn't just a legal obligation but also a step towards maintaining transparency and trust with their employees. At Check Stub Maker, we understand the importance of accurate and accessible pay stubs and offer solutions to ensure both employers and employees. We easily manage and understand your payroll information with our user-friendly paystub maker .

My Job Doesn't Give Me Check Stubs FAQs

In this section, we'll offer our expert insights at Check Stub Maker to common questions related to why certain employers don't give their employees check stubs. We'll also discuss what to do when employer doesn't give w2 or access to paystubs .

Is It Illegal For Your Employer To Not Give You A Pay Stub?

The legality of not providing pay stubs varies by state. In some states, such as Access/Print states like Massachusetts, it is indeed illegal for employers not to provide paper pay stubs or digital access to pay stubs. That's why it's important to understand your state's specific laws, which are crucial in determining the legality of your employer's actions regarding your pay stubs.

Can A Previous Employer Refuse To Send Me Pay Stubs If I Was An Independent Contractor?

Generally, employers aren't required to provide pay stubs to independent contractors. If you're an independent contractor, we recommend keeping track of your invoices and payments with the help of our pay stub creator . After trying out this product, we found that it's easily customizable, and you can preview and download your pay stubs in minutes!

Is It Legal For A Potential Employer To Ask For A Pay Stub?

It depends on the specific state in which the potential employer operates their business. Since January 2023, numerous states (and Puerto Rico) have implemented salary history ban legislation according to the Equal Pay Act of 1963 (EPA) . This is a way of protecting employees and their privacy. This has also been done to prevent discrimination against employees by potential employers based on their gender, age, ethnicity, or socioeconomic circumstances to ensure fair wage distribution across the board. These are the states that currently have salary history ban legislation, either state-wide or in some of their major cities:

- Alabama

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Georgia

- Hawaii

- Illinois

- Kentucky

- Lousiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- New York

- New Jersey

- Nevada

- North Carolina

- Ohio

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Utah

- Vermont

- Virginia

- Washington

- Wisconsin

A potential employer may ask for a pay stub in non-salary-history-ban states, but it's important to always understand your rights in this situation as an employee.

What Happens When A Company Pays Employees With A Personal Check Without A Pay Stub Every Pay Period?

Paying employees with a personal check without a pay stub can lead to several issues, especially if it's against state law. Based on our observations, this practice can result in a lack of transparency in wage calculations and potential legal consequences for the employer. That's why it's important to always follow state laws regarding pay stubs to avoid these complications.

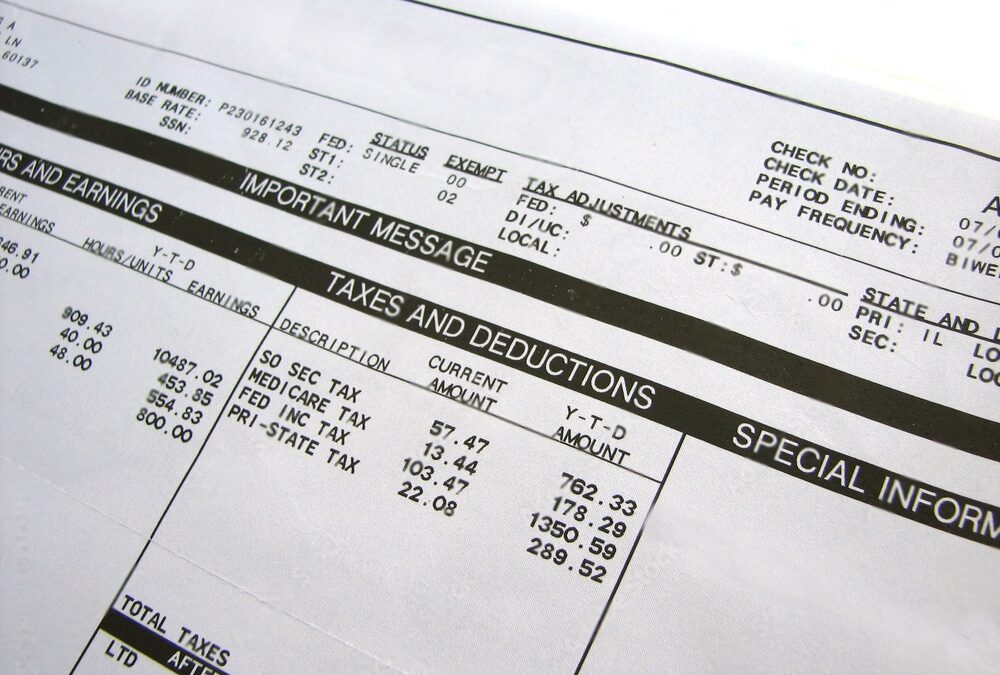

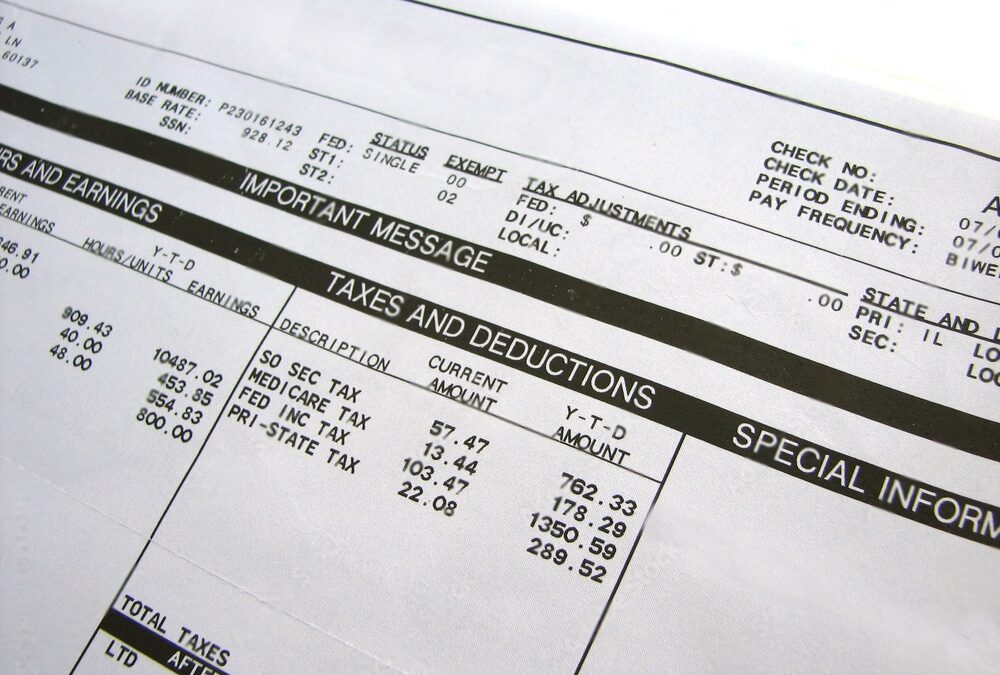

If I Am Required To Provide A Pay Stub, What Needs To Be On It?

Pay stubs, like the ones we create here at Check Stub Maker , include several key pieces of information. It is worth noting that the specific requirements can vary by state. Pay stubs should include the following:

- earnings

- deductions

- taxes withheld

- net pay

The above information is essential for a comprehensive and compliant pay stub, regardless of the pay date and pay period.

Conclusion

Understanding what to do about an employer not giving pay stubs is crucial for both employees and employers. This article has explored the legalities, rights, and responsibilities of employers surrounding pay stubs. At Check Stub Maker, we recognize the importance of accurate and accessible pay documentation. We encourage you to explore our user-friendly paystub generator , which is designed to ensure compliance and clarity in financial transactions. Whether you're an employer seeking to streamline your payroll system or an employee needing to generate accurate pay stubs, we're here to guarantee you a hassle-free experience in your financial journey. So, choose Check Stub Maker now and make paystubs that simplify your payroll processes! If you want to learn more, why not check out these articles below: