Paystub Generator – Unlock This Game Changing Service for the Self-Employed

Paystubs are arguably one of the most important documents to any business, big or small. But if you’re self-employed, its importance is far greater. It is up...

Aug 23, 2022When it comes to payroll, a common question arises: "How quickly do employees have to get pay stubs after the pay date?"

When it comes to payroll, a common question arises: "How quickly do employees have to get pay stubs after the pay date?" Our findings show that employees can get pay stubs on the pay date itself in some states, while in other states, employees can receive their pay stubs on the first day of a new pay period. In this blog post, we will delve into the essentials of ensuring payroll compliance, understanding the nuances of pay period dates, the importance of employers providing their employees with timely pay stubs, and how we at Check Stub Maker can assist in this regard. Let's dive in! What this article covers:

Ensuring payroll compliance starts with understanding when paystubs are given to employees and what information is included on paystubs.

The timeline for receiving a pay stub post-pay date varies by state, which can occasionally lead to scenarios such as ‘ employee paid correctly but paystub shows incorrect pay period '. If you're not receiving pay stubs from employer , our research indicates that each state in the U.S. has its own set of laws governing the issuance of pay stubs.  For instance, some access states, like Alaska and North Dakota, require that pay stubs be provided on the pay date itself. Employers can achieve this by providing their employees with electronic paystubs like the ones we make here at Check Stub Maker. Alternatively, other access/print states like California and Texas may allow a certain grace period after the pay date, particularly if employers are issuing paper pay stubs to their employees. It's crucial for employers to familiarize themselves with their state's specific regulations to ensure compliance and avoid potential legal issues.

For instance, some access states, like Alaska and North Dakota, require that pay stubs be provided on the pay date itself. Employers can achieve this by providing their employees with electronic paystubs like the ones we make here at Check Stub Maker. Alternatively, other access/print states like California and Texas may allow a certain grace period after the pay date, particularly if employers are issuing paper pay stubs to their employees. It's crucial for employers to familiarize themselves with their state's specific regulations to ensure compliance and avoid potential legal issues.

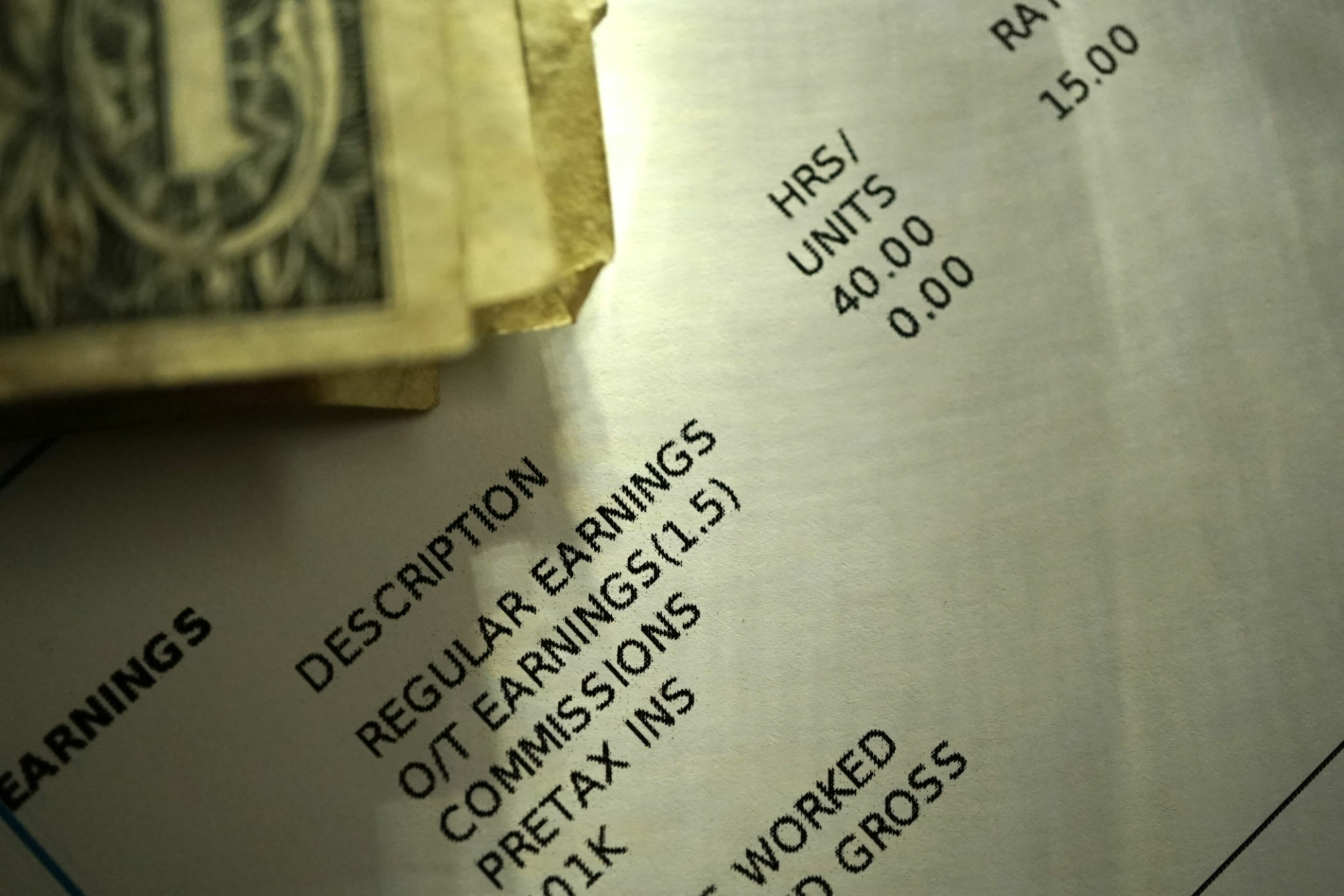

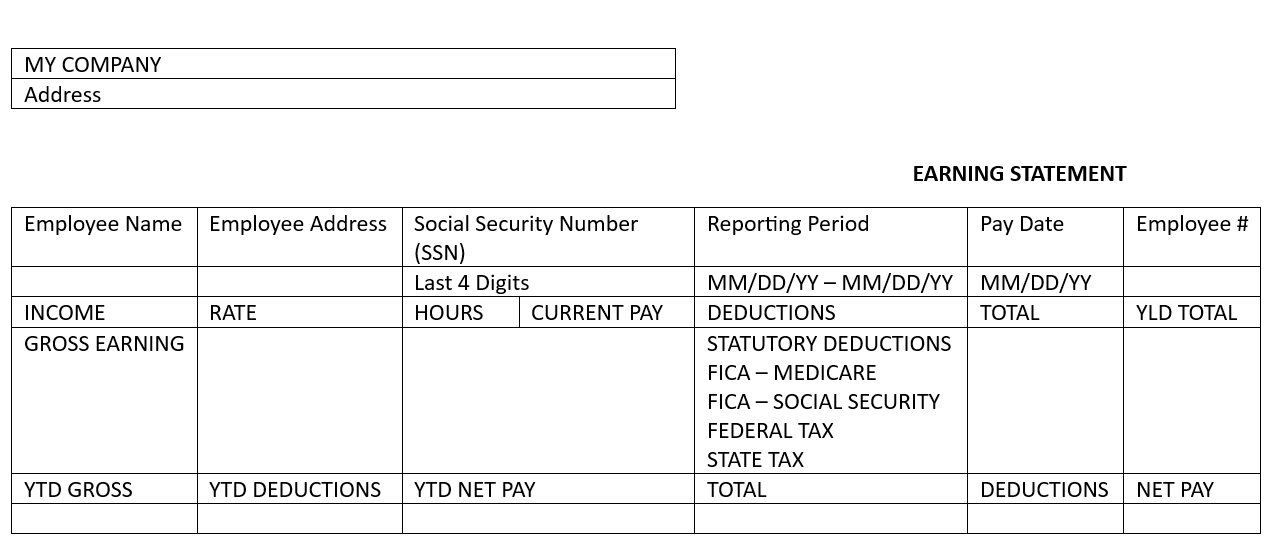

When you create pay stubs with us, they typically include vital information regarding an employee's earnings and deductions. Drawing from our payroll experience, this information generally encompasses the following information about employees:

This detailed breakdown is essential for employees to understand their compensation and for record-keeping purposes.

When you get paid depends on the start of your pay period, which is usually:

### Starting On The First Day Of A New Pay Period

### Starting On The First Day Of A New Pay Period

If an employee starts working on the first day of a new pay period, their first paycheck will usually be issued at the end of that pay period, following the company's regular pay schedule. Based on our first hand experience with payroll processes, this schedule depends on whether the company follows a weekly, bi-weekly, or monthly pay cycle.

For those starting in the middle of a pay period, the first paycheck might be prorated based on the number of days worked in that period. The subsequent paycheck will then align with the regular pay cycle of the employer. Understanding these nuances is crucial for employees to manage their financial expectations and for employers to maintain transparency and trust.

Employees typically receive their last paycheck on or before their regular payday for their last pay period, which is the case in states like Mississippi and Georgia. This paystub requirement varies across other states, though.

The final paycheck an employee receives should reflect all the hours worked until their last day, including any unused vacation or paid time off, if applicable. For instance, the Department of Industrial Relations in California mandates that employees must receive their final paycheck immediately upon termination or within 72 hours if the employee resigns without giving notice.  The following factors frequently determine the size of this paycheck and its timing (in accordance with a specific pay period):

The following factors frequently determine the size of this paycheck and its timing (in accordance with a specific pay period):

At Check Stub Maker, we understand the importance of adhering to these regulation. We offer solutions to help employers make paystubs that stay compliant while ensuring employees receive accurate and timely payment information.

Next, we'll look at frequently asked questions related to paystubs - from how to get them to what you should do with them in your various financial transactions.

Employers should provide pay stubs, as they're a critical record of an employee's earnings and deductions. Our investigation demonstrated that pay stubs serve as proof of income and employment, which is essential for employees when applying for loans, renting property, or filing taxes. Moreover, according to specific states, there are laws about providing a pay stub , ensuring transparency in the payroll process, and helping to avoid disputes over wages and deductions.

Obtaining pay stubs typically involves a few straightforward steps. Employers may distribute them physically or electronically. In the digital age, we at Check Stub Maker offer an intuitive online platform where employees can create paystubs , then download them securely. This method isn't just convenient but also environmentally friendly and cost-effective.

Drawing from our payroll experience, we recommend that you keep your pay stubs for at least a year. They're vital for verifying the accuracy of your W-2 form, preparing your tax returns, and resolving any discrepancies with your employer regarding pay. Additionally, they can be used as proof of income or employment when needed.

If you don't have pay stubs, the first step is to request them from your employer. In states where providing pay stubs is a legal requirement, employers are obligated to furnish them upon request. If your employer doesn't comply, you may need to contact your state labor department for assistance to provide you with department of labor paystubs .

If you lose a pay stub, you should contact your employer or the payroll department to request a replacement. Many companies can easily reissue a lost pay stub. It's also a good practice to keep digital copies of your pay stubs as a backup on platforms like ours at Check Stub Maker.

In this article, we've explored the critical question: "How quickly do employees have to get pay stubs after pay date?" This depends on a number of factors, including the employee's particular pay period, whether it's a standard paystub or the final paystub, and whether state laws govern paystub requirements. Whether you're an employer looking to streamline your payroll process or an employee needing to solutions with an ‘ employer didn't send w2 and don't have last check stub ' situation, we're here to help. So, visit us at Check Stub Maker today and discover how easy managing payroll can be with our customizable paystub maker . If you want to learn more, why not check out these articles below:

Paystubs are arguably one of the most important documents to any business, big or small. But if you’re self-employed, its importance is far greater. It is up...

Aug 23, 2022

If you're wondering how to get a paycheck stub if you work under the table, the answer is simple: there are several methods to obtain proof of income. This can be anything from using direct deposit to utilizing reputable payroll software.

Aug 28, 2024

Can you file your taxes with what you have off your pay stub? If you've been wondering how to file taxes with paystub, you've come to the right place.

Oct 04, 2023