Are you currently thinking of becoming a homeowner? A common question we encounter is "How many pay stubs for mortgage are needed”? Drawing from our experience, lenders typically require the last two to three months of pay stubs to verify your income. This is done to ensure you have sufficient funds to make regular loan payments. In this article, we at Check Stub Maker will delve into why pay stubs are the gold standard for proof of your earnings, highlighting their pivotal role in securing a mortgage for your dream house. What this article covers:

How Many Pay Stubs Do I Need for a Mortgage?

Through our practical knowledge, it typically ranges from your most recent two to three months worth of pay stubs. These property check stubs serve as a reliable proof of your income, showcasing your financial ability to meet mortgage payments.

How Many Pay Stubs Do I Need For A Personal Loan?

Generally, lenders may ask for one to three pay stubs, particularly with a W-2 or paystub for loan application . However, this can depend on the:

- lender's criteria

- size of the loan

The principle remains the same: your wages need to be verified as a guarantee that you can make repayments. When we tried this product, we found that our paystub maker can supply you with reliable documentation. For instance, lenders can assess your net pay after taxes that's recorded on pay stubs and required for mortgage pre-approval and loan processes as a confirmation of your wages.

Why Are Pay Stubs Important as Proof of Income?

When it comes to a ‘pay stub for apartment' or a house, they're important because they:

- demonstrate your earnings

- provide a detailed record of your employment history and financial stability

Based on our first-hand experience, this makes creating pay stubs an indispensable tool that lenders trust in the journey to homeownership.

What If You Are Self-Employed?

If you're self-employed and don't have pay stubs, detailed financial records, including bank statements and tax returns, can serve as alternative forms of proof of income. At Check Stub Maker, we help self-employed individuals generate pay stubs that accurately reflect their earnings. This ensures that they too can navigate the mortgage application process with confidence.

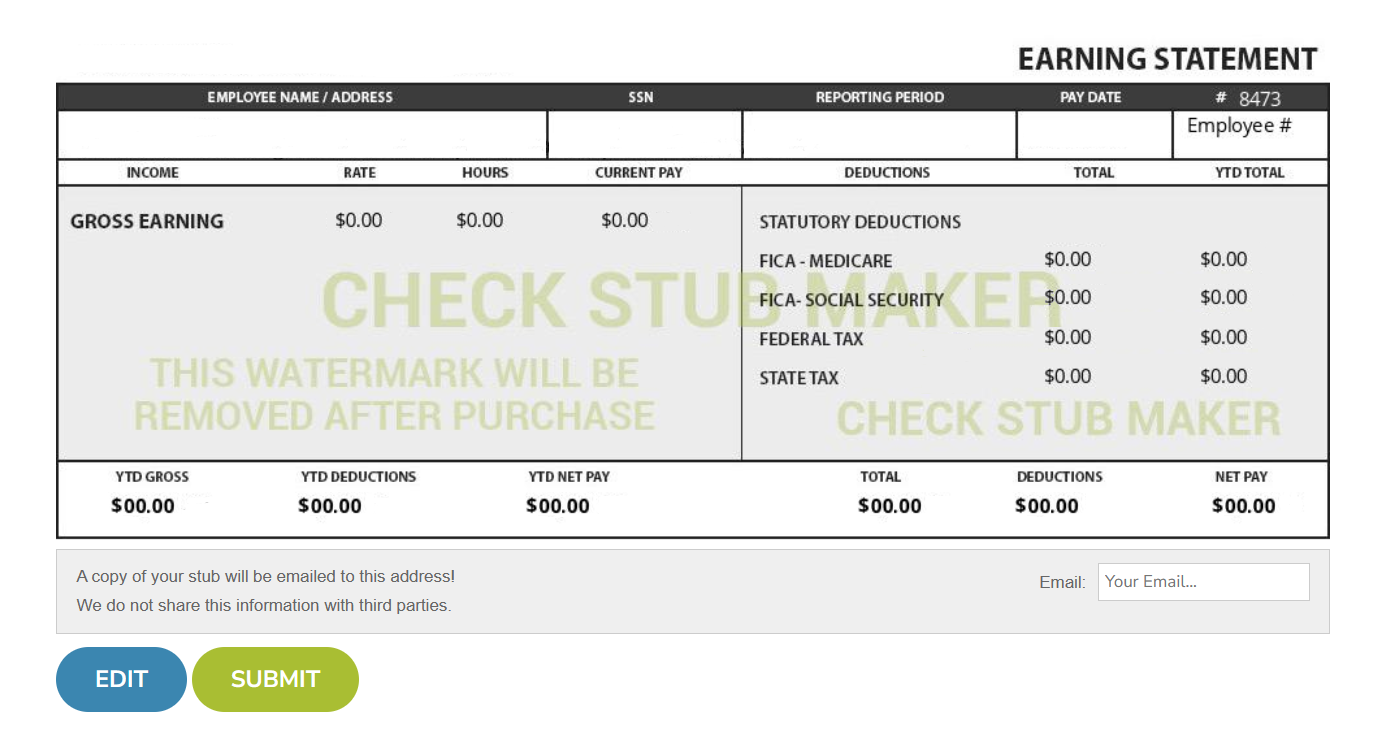

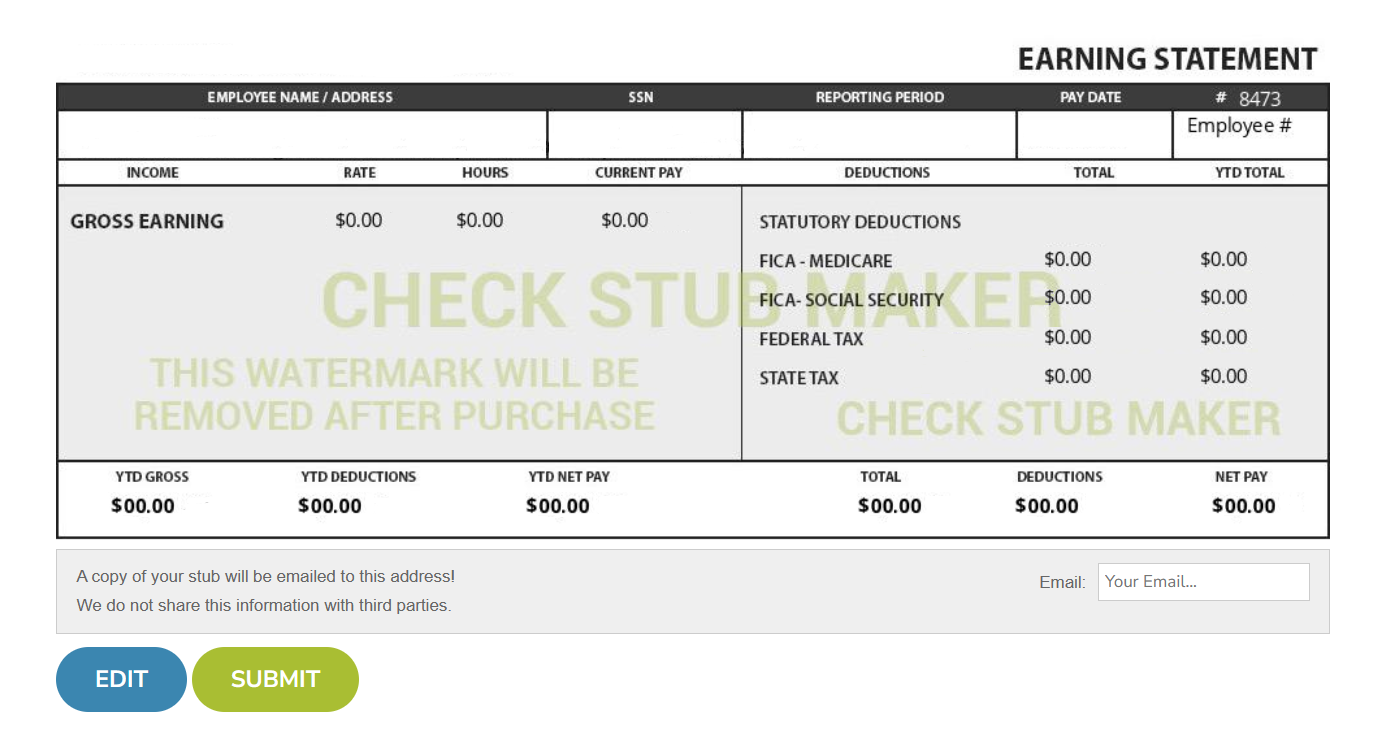

How to Get Pay Stubs for a Mortgage Application

You can access your pay stubs via your employer's payroll portal or by contacting the HR or Payroll Departments. If you're a freelancer or contractor, our paystub generator is a simple solution. After trying out this product, you start by inputting your wage details. From there, our user-friendly interface will do all the necessary calculations for you. All that's left to do is review the information you've entered to ensure it's correct, then click ‘Submit' and download your new pay stubs.

Other Documents You Need to Buy a House

Here's a comprehensive guide to other essential paperwork you'll need for getting a home loan with no paystub . Table: Other Documents You Need To Buy A House

Document TypePurposeDetailsTax Returns- To verify income and employment history over the past two years.

- Provides a comprehensive view of financial health

- Especially important for self-employed people

Letter From Employer- Confirms employment status, job security, and wage stability.

- Should include position, salary, and employment duration

Bank Statement- Proves the availability of funds for down payment, closing costs, and cash reserves.

- Lending agents usually request the last 2-3 months of statements

Photo ID- Verifies the identity of the applicant.

- Government-issued ID

- Driver's license

- Passport

Credit History- Assesses borrower's reliability and financial management.

- A good credit history and score can influence loan approval and interest rates

Tax Returns

Lenders use your tax returns to verify your income and employment history over the past two years, offering a broader picture of your financial health. This is particularly crucial for freelancers and contractors, as it provides a more detailed insight into their earnings stability and business success. With us at Check Stub Maker, you can create check stubs that accurately reflect your tax deductions and returns for ample proof of wages.

Letter From Employer

Our research indicates that a letter from your employer can serve as a testament to your job security and income stability. It reassures lending agents of your ongoing employment and, consequently, your ability to maintain mortgage payments. This document should include your:

- position

- salary

- length of your employment

Bank Statement

Your bank statements are pivotal in proving you have the funds for all costs related to the purchase of a house. Like with paystubs , our findings show that lending agents typically request up to three months worth of bank statements as well. This is an essential way of checking that you have the financial means to take on a mortgage without defaulting.

Photo ID

A government-issued photo ID, such as a driver's license or passport, is required to verify your identity. This step is crucial in the mortgage application process to confirm that the applicant is indeed the person they claim to be and prevent fraud.

Credit History

Your credit history is a critical component of your mortgage application. Lenders will typically examine your credit report and score to assess your reliability as a borrower. A good credit history indicates a pattern of timely payments and responsible credit management. Our investigation demonstrated that this can significantly influence your lending approval and interest rates. With us at Check Stub Maker, you have all the tools and information needed to present yourself as a credible buyer and secure a loan in this instance.

Conclusion

By considering the question, "How many pay stubs for mortgage are necessary?” and exploring the landscape of income verification, we've discovered that pay stubs play a pivotal role in securing a loan. Now, it's your turn to take the next step. Why not ease your path with us at Check Stub Maker ? Our user-friendly payroll services are just a click away. Dive in and discover how we can help illuminate your way to homeownership. Give our pay stub generator a try, and let's make buying a house a breeze! If you want to learn more, why not check out these articles below: