If your pay period has ended and you need a record of your earnings, you might be wondering, ‘What if your employer doesn’t give you a pay stub?’.

The legality of not providing pay stubs differs from state to state. With that said, you still have the right to obtain comprehensive information about your wages and find out why ‘my company will not give me a pay stub’ as an employee.

In this article, we at Check Stub Maker will explore the reasons behind not receiving pay stubs, the legalities surrounding this, and the practical steps you can take if you find yourself without this crucial payroll document.

Let’s dive in!

What this article covers:

- What Are Some Reasons That Employers Don’t Give Their Employees Pay Stubs?

- What to Do If Your Employer Doesn’t Give You a Pay Stub

- My Boss Stopped Giving Me Pay Stubs FAQs

What Are Some Reasons That Employers Don’t Give Their Employees Pay Stubs?

There are a number of reasons why employers might not give their employees pay stubs, and they’re not always a cause for concern.

Administrative Oversights

Sometimes, the absence of a pay stub or pay stubs are incorrect can be due to simple administrative errors or oversights.

Based on our observations, employers might forget to send them, or there could be a glitch in the payroll system. This is often the case in smaller companies that don’t have a dedicated HR department.

Cost-Saving Measures

In an effort to cut costs, some employers might choose not to issue physical pay stubs, especially if they pay salaries via direct deposit.

While this might be seen as a cost-effective measure, it can leave employees without a tangible record of their earnings and deductions.

Lack Of Legal Requirement

In certain states, like Arkansas and South Dakota, there is no strict legal requirement for employers to provide pay stubs to their employees.

This can lead to situations where employers opt not to issue them, either due to ignorance of the law or a deliberate choice to withhold this information.

What to Do If Your Employer Doesn’t Give You a Pay Stub

Our investigation demonstrated that there are three steps you can take to get pay stubs from your employer.

1. Determine Where You Can Find Your Pay Stubs

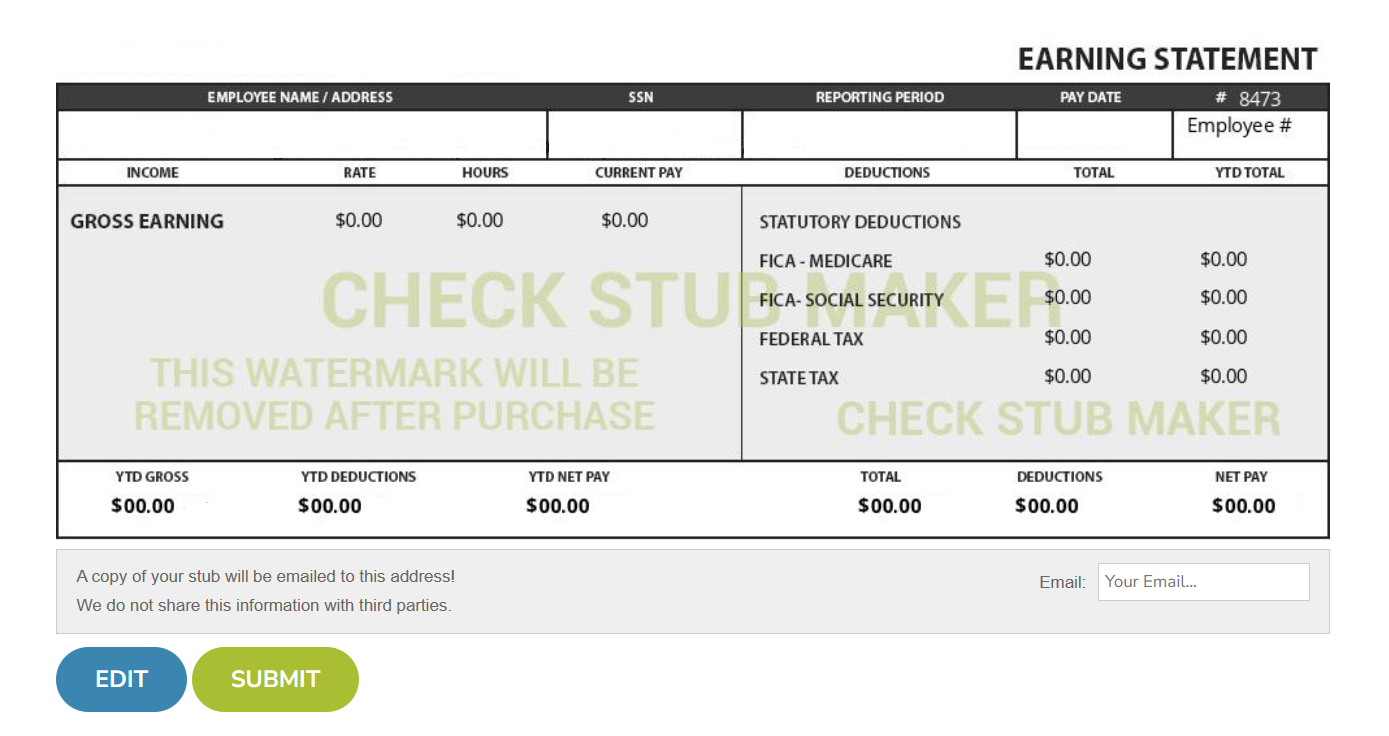

First, check if your employer has an online system where pay stubs are uploaded. Many businesses now use digital platforms for payroll data, like Check Stub Maker, which employees can access whenever they want.

2. Ask For Copies Of Your Pay Stubs

If you can’t find your pay stubs online, the next step is to directly request them from your employer. It’s best to make this request in writing and keep a record of your communication.

3. Allow Time For Their Retrieval

After making your request, give your employer a reasonable amount of time to respond. If they fail to provide the pay stubs within this period, you may need to take further action, such as contacting your state’s labor department.

Not receiving a pay stub from your employer can be a source of significant concern. However, by understanding the possible reasons behind this and knowing the steps to take, you can effectively address the issue.

At CheckStub Maker, we’re committed to helping you navigate these challenges and ensure you have the information you need regarding your earnings and deductions.

My Boss Stopped Giving Me Pay Stubs FAQs

In this section, we’ll address frequently asked questions related to the legality of not supplying employees with paystubs.

Instead, you can use excellent paystub alternatives like our paystub generator if you find yourself in a particularly problematic payroll scenario.

Is It Illegal For Your Employer To Not Give You A Pay Stub?

According to the Fair Labor Standards Act (FLSA), there is no federal mandate requiring employers to provide pay stubs.

However, the FLSA stipulates that employers must keep accurate records of hours worked and wages paid.

In many states, there are specific laws requiring employers to provide access to pay stubs, whether a paper copy of pay stub vs emailed copy

For instance, states like California, Colorado, and Connecticut require employers to provide a pay stub that is printed or written; conversely, other states allow for electronic versions, like our paystubs at Check Stub Maker.

Is It Legal For A Potential Employer To Ask For A Pay Stub?

Under the Equal Pay Act of 1963 (EPA), certain states have implemented salary history bans that make it illegal for potential employers to ask for your pay stubs.

Our findings show that this has been done to protect employees against potential discrimination based on age, gender, ethnicity, or religion with staffing company asking for paystubs.

With that said, only some states currently have salary history bans, which makes it perfectly legal for potential employers operating in other states with non-salary-history-bans to request pay stubs of employees to verify their previous employment and salary history.

While you’re not obligated to provide this information, it’s a common practice during the hiring process. If you’re uncomfortable sharing your pay stubs with a potential employer, you have the right to decline, but this may impact their hiring decision.

What Happens When A Company Pays Employees With A Personal Check Without A Pay Stub Every Pay Period?

When a company pays employees with a personal check without providing a pay stub, it can create challenges for employees in understanding their financial transactions.

While this practice isn’t illegal in states that don’t require pay stubs, it can lead to confusion and potential disputes over wages and deductions.

As an employee, you have the right to request detailed information about your earnings. If your employer doesn’t give you pay stubs, you can ask for an itemized statement of your wages and deductions for your records.

Are There Any Pay Stub Alternatives?

If your employer doesn’t provide you with pay stubs because your paystubs required, paid under the table, you can use other documents to verify your income and employment.

These alternatives include:

- Form W-2 or 1099: These tax forms provide detailed information about your earnings and taxes paid if you can’t find paystubs IRS.

- Bank Statements: Through our practical knowledge, bank statements can serve as proof of income if your salary is deposited directly into your bank account.

- Letters from Employer: A letter from your employer stating your employment status and earnings can also be used.

- Self-Created Pay Stubs: For independent contractors or freelancers, creating your own pay stubs using our online services at Check Stub Maker can be a practical solution. Our user-friendly paystub maker calculates your employee information and earnings accurately to help you avoid legal and tax-related issues in the long run.

Conclusion

Understanding your rights and options regarding pay stubs is crucial.

While the legality of not issuing pay stubs varies by state, you still have the right to access detailed information about your earnings as an employee and guard yourself against an error in check and check stub.

If you’re facing challenges with obtaining pay stubs, consider using alternatives like tax forms, bank statements, or our self-created pay stubs at Check Stub Maker.

Whether you’re an employer looking to streamline your payroll process or an employee needing to create accurate pay stubs, we’re here to make obtaining paystubs a breeze.

So, try out our pay stub creator at Check Stub Maker today for a hassle-free payroll experience!

If you want to learn more, why not check out these articles below:

- Pay Stub Pay Period Is Not Right

- My Pay Stub Show I Have Sick Time But My Company Doesn’t Want to Pay Me

- What You Can Do If You Work Wont Give You Your Paystubs

- If My Pay Stub Says Vacation Time Do They Have to Give It to Me?

- How to Access Pay Stubs If Your Not a Best Buy Employee Anymore

- Letter From Employer Verifying No Pay Stub for Work Week

- Why You Should Always Ask for a Pay Stub

- How Do I Get My Pay Stub If My Company Went Bankrupt?

- Do You Need Pay Stubs for Taxes?

- Can I Use My Last Paycheck Stub to Get a Estimate on My Tax Return?

- Is There an Online Source to Figure Taxes with a Check Stub?

- Can You File Taxes If You Have All of Your Pay Stubs?

- Can I Use My Paystubs to File Taxes?

- What Important Information Is Available on a Pay Stub?

- What Is a Pay Stub?